- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Assessing LTC Properties After New Lease Deals and a 3.9% Monthly Share Decline

Reviewed by Bailey Pemberton

If you’ve been eyeing LTC Properties lately, you’re not alone. The stock has caught quite a few investors’ attention. With shares recently closing at $35.19, the company is showing a steady hand even while the real estate sector rides a wave of uncertainty. After a modest 0.3% gain in the past week, it’s true the stock is down 3.9% for the month, but that hardly tells the whole story. In fact, LTC’s longer-term performance holds up nicely, with nearly 39% gains over five years and a 12.2% return for the past three years, outpacing many peers.

Much of this stability can be traced back to LTC’s focus on seniors housing and health care properties, two segments that continue to generate headlines amid shifts in national policy and evolving demographic trends. Most recently, the company made news by further diversifying its operator portfolio and locking in new lease agreements. These moves have been generally viewed as signaling lower risk and the potential for more consistent cash flows down the line. It is no surprise the market seems to be reassessing its risk-reward profile in real time.

But headline moves are not the only thing investors care about. Is the stock actually undervalued? According to recent analysis, LTC Properties passes 5 out of 6 major value checks, landing it an impressive valuation score of 5. That’s not a number you see every day. So, how do these valuation approaches stack up, and what might matter even more when you’re weighing your next move? Let’s dig into the methods analysts use to value LTC, and keep our eyes out for a smarter way to size up the company’s true worth by the end of this article.

Why LTC Properties is lagging behind its peers

Approach 1: LTC Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash generation, specifically here its adjusted funds from operations, and discounts those future cash flows back to today to estimate how much the business is intrinsically worth right now.

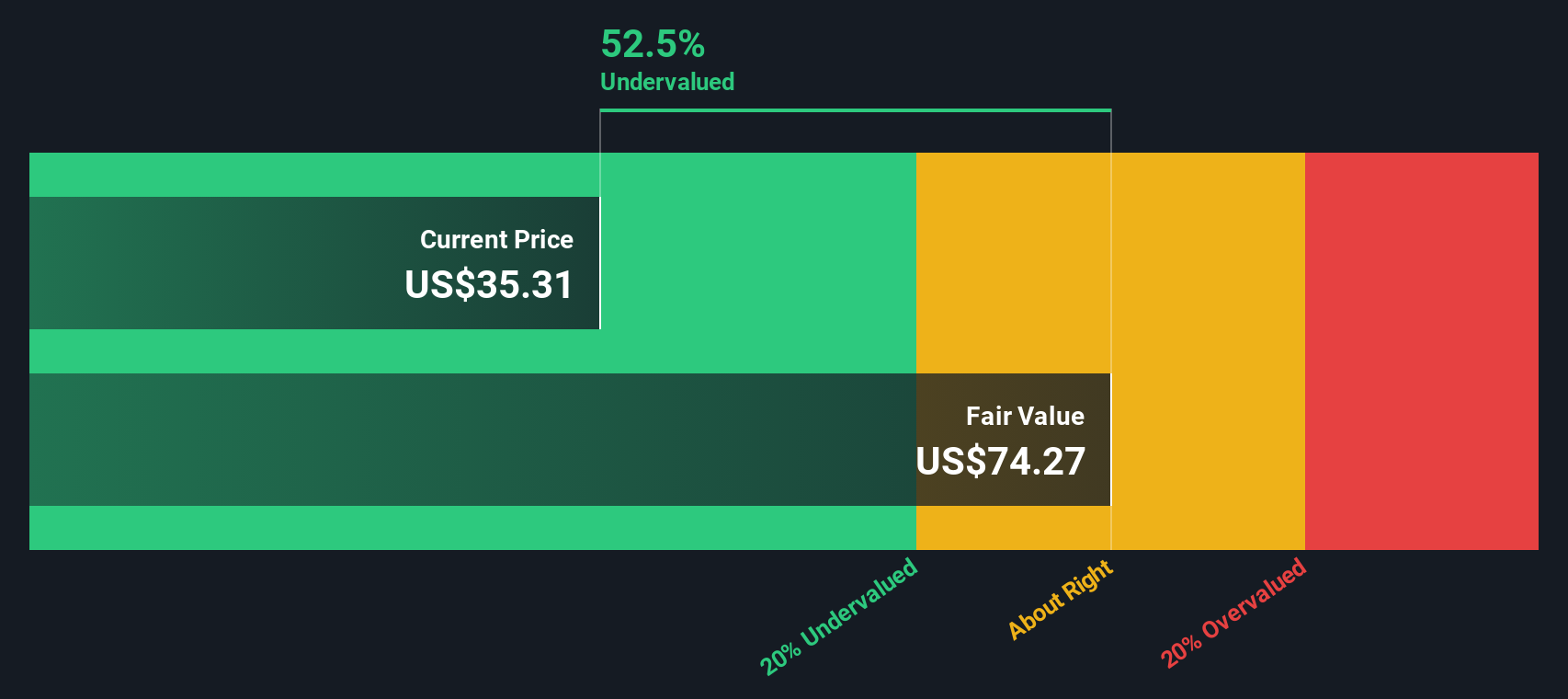

For LTC Properties, the DCF analysis starts with its latest Free Cash Flow figure, coming in at $123.43 million. Analyst estimates suggest a steady climb, with free cash flow projected to reach around $230.10 million by 2035. Notably, while analysts typically provide about five years of forecasts, the further-out growth rates beyond 2027 are extrapolated by Simply Wall St, building a fuller long-term view.

Running these projections through the DCF model results in an intrinsic value of $81.36 per share. Compared to LTC’s recent closing price of $35.19, that signals the stock is trading at a 56.7% discount to its calculated fair value, which may indicate substantial undervaluation at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LTC Properties is undervalued by 56.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: LTC Properties Price vs Earnings

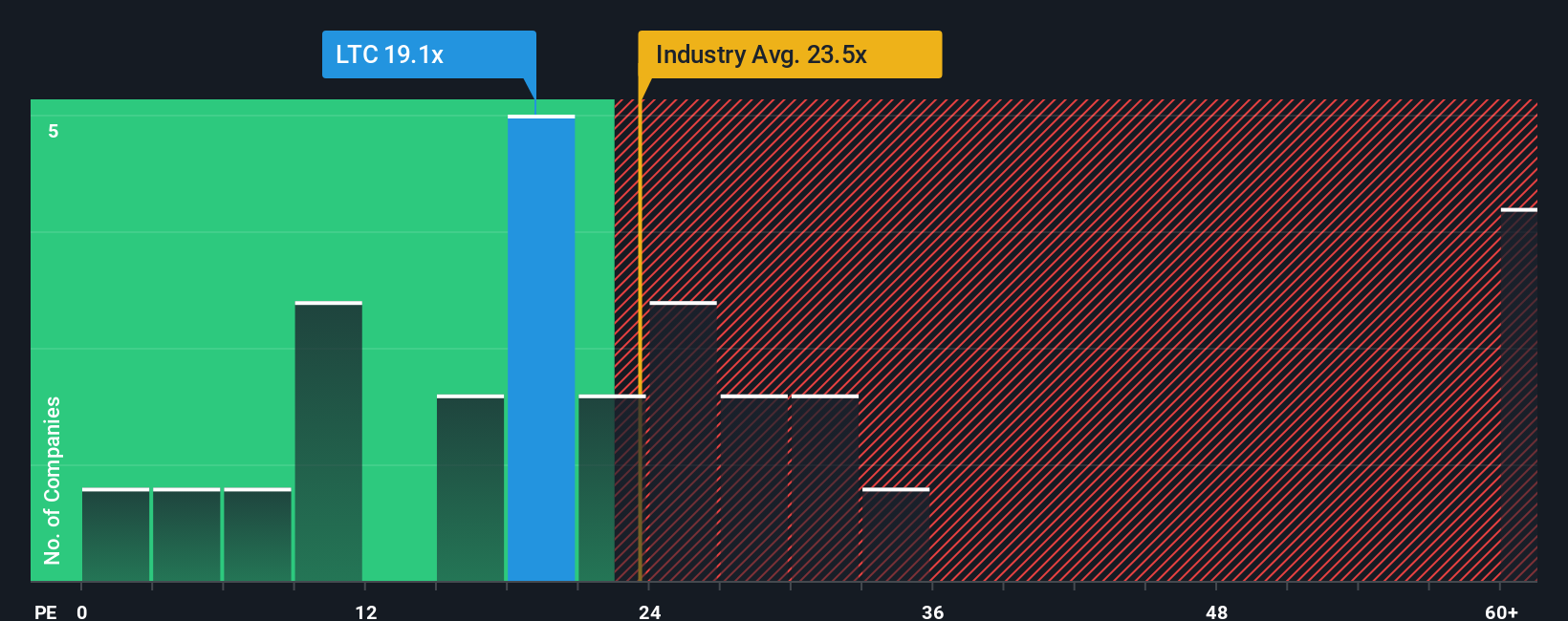

For companies like LTC Properties that reliably generate profits, the Price-to-Earnings (PE) ratio is a popular metric to gauge valuation. It offers a quick snapshot of how much investors are willing to pay for each dollar of current earnings, making it especially useful for comparing companies within the same industry.

What counts as a "fair" PE ratio can vary considerably depending on expectations for future growth and the level of risk investors perceive. Faster-growing companies or those with stable earnings streams typically command higher multiples. Companies facing headwinds or greater uncertainty might trade at a discount.

Currently, LTC Properties sports a PE ratio of 19.6x. To put this in perspective, the average PE for its Health Care REIT industry peers is about 24.0x, and the broader peer group averages 26.6x. This places LTC's valuation below these common industry reference points, hinting at a discount to its sector.

Simply Wall St’s proprietary “Fair Ratio” provides a more tailored benchmark, adjusting for LTC’s specific profile by including factors like earnings growth, business risks, and market cap to arrive at a value of 33.4x. Unlike simple industry or peer averages, the Fair Ratio reflects nuances that can significantly impact what the company is truly worth on an earnings basis.

Comparing the Fair Ratio of 33.4x to LTC’s actual PE of 19.6x suggests the stock is undervalued by this method and reinforces the idea that it may be trading at a meaningful discount to its fair value today.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LTC Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful and approachable tool that let you tell the story behind a company's numbers, by bringing together your outlook for future revenue, earnings, margins, and your personal fair value estimate, all in a single, dynamic investment thesis.

With Narratives, you bridge the gap between what’s happening in LTC Properties’ business and your own financial expectations, translating the company’s story directly into a forecast and fair value. Narratives are easily accessible on Simply Wall St’s platform, where millions of investors craft and share their perspectives in the Community page. This means you do not have to be a professional analyst to build or understand one.

This makes it easier than ever to decide when to buy or sell, as Narratives visually compare your Fair Value to the current share price and update live when new news or earnings drop, ensuring your investment view is always relevant. For example, some investors see LTC Properties’ expansion into modern senior housing as a growth engine worth a $43 price target, while others remain more cautious given industry risks, suggesting fair value just above $34. Your Narrative empowers you to make that call based on your own research and beliefs.

Do you think there's more to the story for LTC Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives