- United States

- /

- Office REITs

- /

- NYSE:KRC

Should Investors Revisit Kilroy Realty After Positive Leasing Momentum in 2025?

Reviewed by Bailey Pemberton

Wondering whether to add, hold, or walk away from Kilroy Realty? You are not alone. The company's stock has been on something of a rollercoaster, falling 2.7% over the past week, but still up 2.9% for the month and impressively up 18.6% over the last year. Year-to-date performance also sits in positive territory at 5.8%. However, when you zoom out to five years, it is basically flat.

What is behind these moves? Like most office-focused real estate companies, Kilroy has had to weather changing investor sentiment as work trends shift and interest rates move. While no single event has driven a sudden change, the general thaw in commercial real estate pessimism and hints of improved leasing demand have helped boost confidence in the sector. This optimism has kept Kilroy's long-term gains healthy despite near-term volatility.

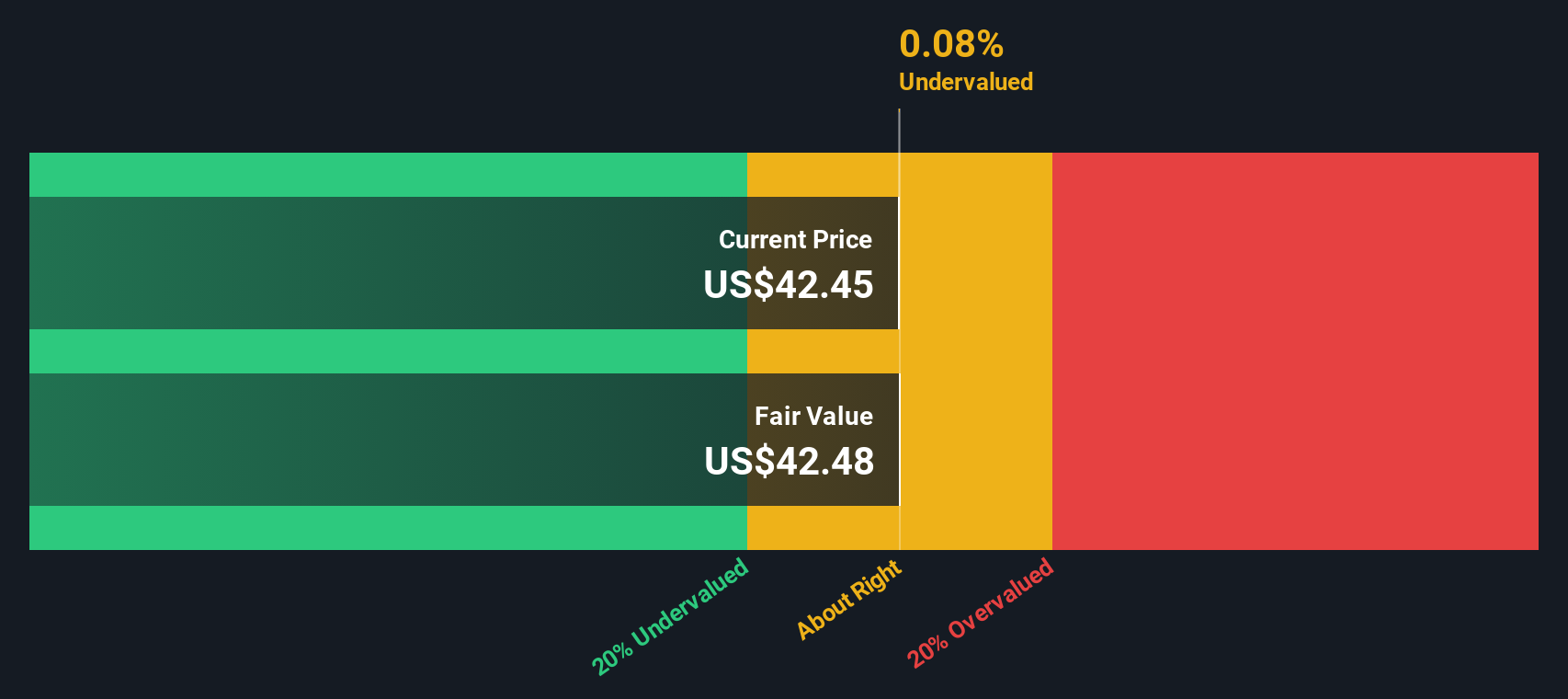

So is Kilroy Realty undervalued right now? Based on a blend of key valuation metrics, the company scores a 2 on a 6-point value scale, signaling that it appears undervalued in only two areas. That suggests there might still be some caution in the market's pricing, or perhaps an opportunity for the right investor.

Let us break down the numbers and look at which valuation approaches reveal hidden value, which wave red flags, and at the very end, explore a fresh perspective on how to truly judge if Kilroy Realty is a bargain today.

Kilroy Realty scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kilroy Realty Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model attempts to estimate the intrinsic value of a company by projecting its future adjusted funds from operations and then discounting those future cash flows back to today's value. For Kilroy Realty, this method relies on its ability to generate free cash flow (FCF) over time, providing a forward-looking approach to valuation.

Currently, Kilroy Realty's Free Cash Flow stands at $468 million. Analyst consensus offers projections for the next five years, with FCF estimates ranging from $306 million to $321 million annually. This reflects the company's stable cash-generating capabilities. Beyond five years, projections are extrapolated and suggest moderate growth, reaching approximately $350 million by 2035. All these values are in United States dollars and are well below the billion-dollar mark, keeping predictions realistic for the office real estate sector.

Based on these estimates, the DCF model yields an intrinsic value of $42.36 per share. This figure is just 0.5% above the current share price, so the stock is basically in line with what its future cash flows justify.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Kilroy Realty's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Kilroy Realty Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric when analyzing profitable companies, as it relates a company's share price to the earnings it generates per share. For companies like Kilroy Realty, which have steady profits, the PE ratio is especially useful for assessing if the market is paying a reasonable amount for each dollar of earnings.

It is important to remember that what counts as a "normal" or "fair" PE ratio depends on factors like future earnings growth and the perceived riskiness of the business. Faster-growing companies or those in less risky environments often command higher PE ratios, since investors expect stronger future profits and are willing to pay up for that growth potential.

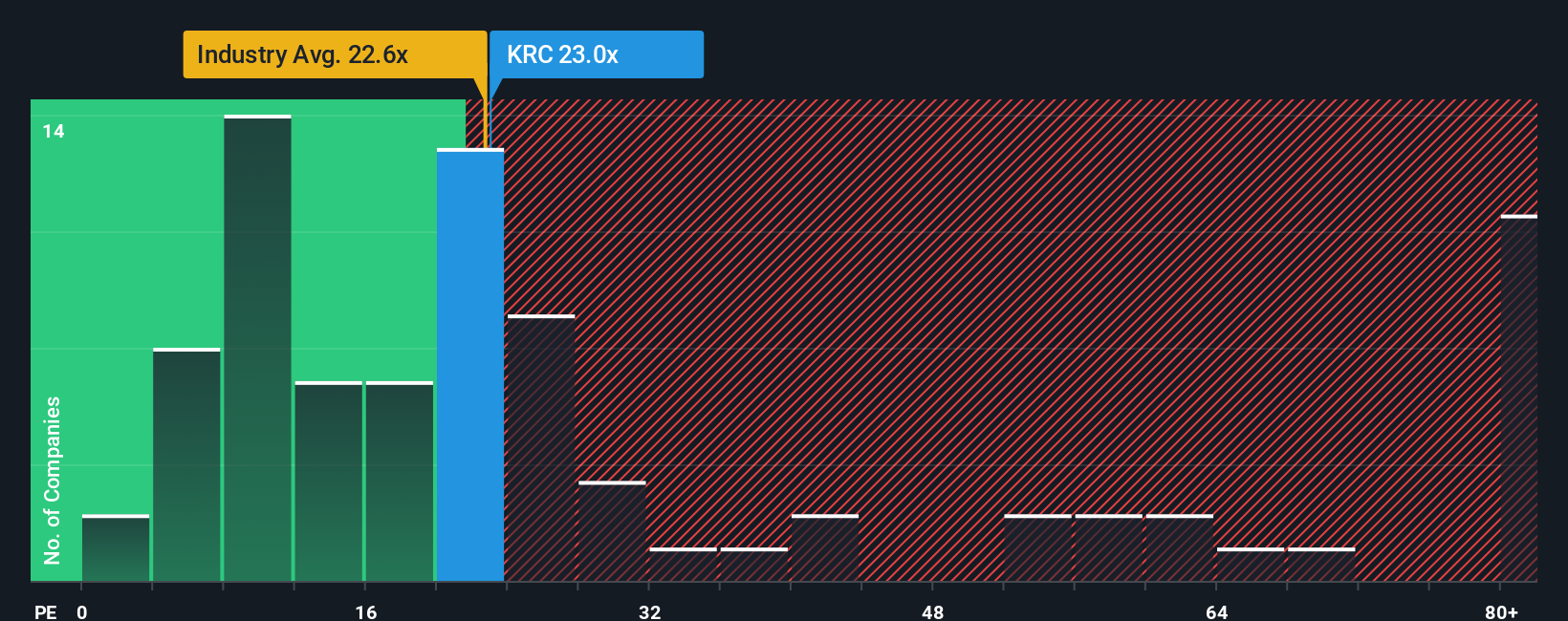

Kilroy Realty currently trades at a PE of 22.8x. This sits slightly above the 22.5x average for Office REITs and well below the peer group average of 35.0x. To go a step further, Simply Wall St’s proprietary "Fair Ratio" for Kilroy is 19.9x, which considers not just industry norms, but also Kilroy’s own earnings growth, profit margins, size, and risk profile. Fair Ratio is more insightful than a simple comparison to peers or the broader sector, because it reflects expectations built around the company’s unique financial and business conditions.

Right now, Kilroy’s PE is just a notch above its Fair Ratio, close enough that the stock’s valuation by earnings appears balanced.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kilroy Realty Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company; it is how you connect your view of its business prospects, industry trends, and management quality to assumptions about its future revenue, earnings, and margins. These then flow into your estimate of fair value.

Unlike static models, Narratives let you link Kilroy Realty’s story to a living financial forecast and a dynamically calculated fair value, all explained in plain language. On Simply Wall St’s Community page, used by millions of investors, you can easily create and update your Narrative, compare it to others, and instantly see if the story you believe in suggests Kilroy is a buy, hold, or sell when matched against the latest share price.

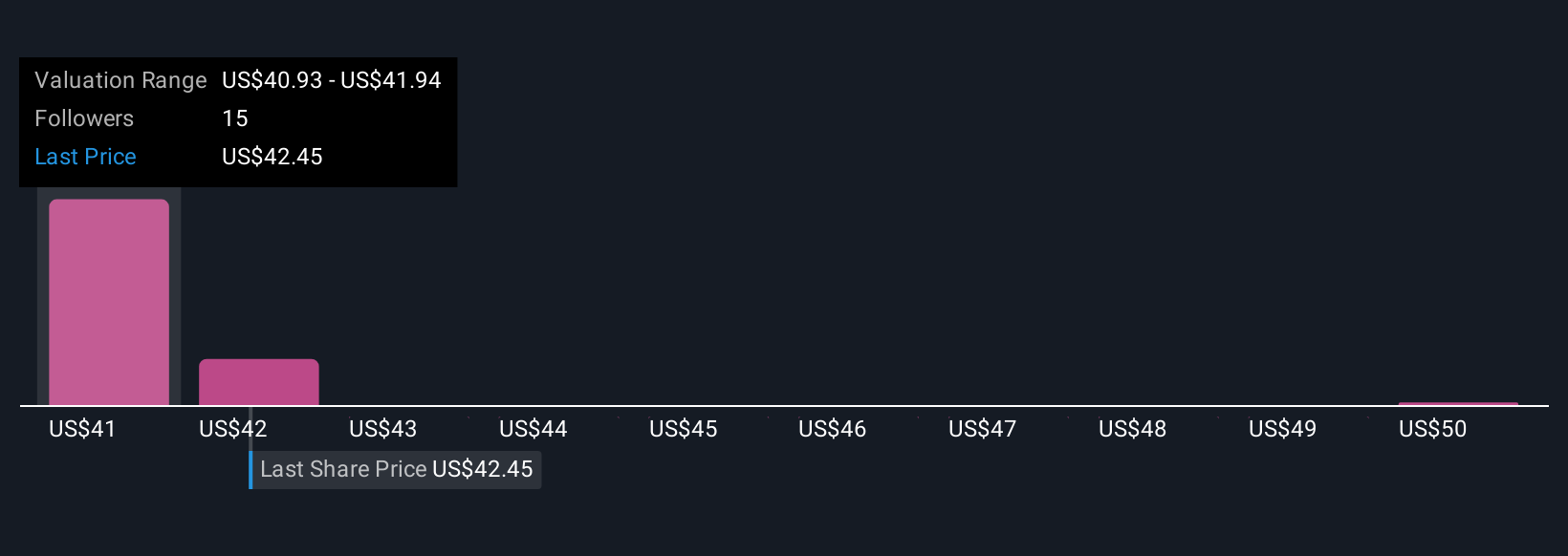

Narratives help you make decisions with confidence because your forecast and fair value automatically update as news breaks or new earnings are released, keeping your view relevant. For example, right now the most optimistic Narrative forecasts a fair value of $55 for Kilroy Realty, while the most cautious expects $33, highlighting just how much perspectives can differ depending on what story you believe.

Do you think there's more to the story for Kilroy Realty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kilroy Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRC

Kilroy Realty

Kilroy is a leading U.S. landlord and developer, with operations in San Diego, Los Angeles, the San Francisco Bay Area, Seattle, and Austin.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives