- United States

- /

- Residential REITs

- /

- NYSE:IRT

Independence Realty Trust (IRT): Revisiting Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Independence Realty Trust.

After a subdued few months, Independence Realty Trust’s share price has started to show signs of life with a 3.3% gain over the last 30 days, even as the year-to-date share price return remains in the red. Looking over the longer horizon, the stock’s five-year total shareholder return of 50.3% suggests that patience has generally paid off. Momentum, however, is just beginning to rebuild.

If you’re curious about what else is gathering momentum beyond real estate, this could be the ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and recent growth in net income, the big question is whether the stock remains undervalued or if the market has already priced in the next phase of growth.

Most Popular Narrative: 21.3% Undervalued

Compared to the latest closing price, the most widely followed narrative assigns Independence Realty Trust a notably higher fair value. This suggests there is deeper market optimism beneath recent share performance.

Ongoing capital recycling, selling older, higher CapEx assets to acquire newer, lower CapEx communities with higher growth profiles in high-demand regions, allows IRT to enhance portfolio quality, capture operating synergies, and improve overall net margins and earnings growth potential.

What’s fueling those lofty projections? Audacious assumptions lie at the heart of this story, such as future-proof operational strategies and ambitious margin expansion. If you’re curious about which financial levers pull this narrative higher, you’ll want to see the full reasoning behind the headline value.

Result: Fair Value of $21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply surges in key Sun Belt cities or aggressive leasing incentives from new developments could challenge IRT’s optimistic earnings and rent growth outlook.

Find out about the key risks to this Independence Realty Trust narrative.

Another View: High Sales Ratio Poses Questions

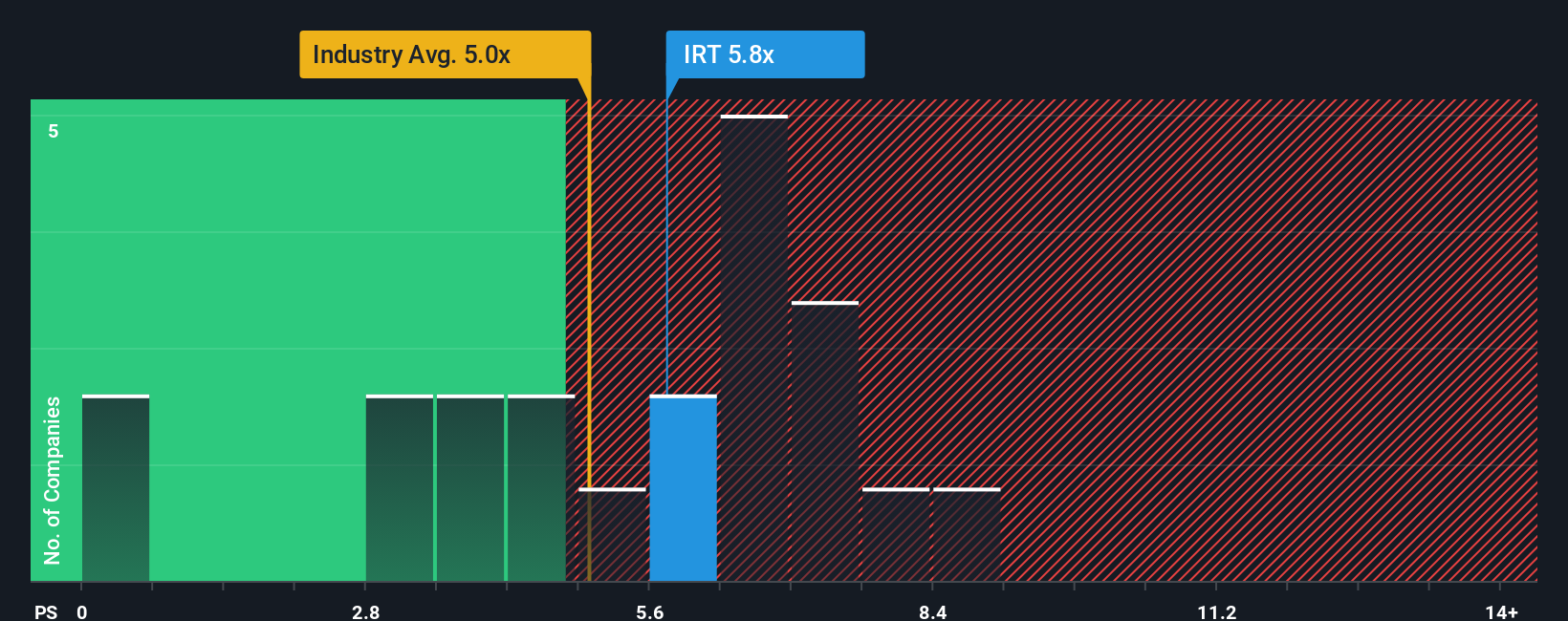

Shifting to a different lens, the company’s price-to-sales ratio stands at 6x, which is above both the North American Residential REITs industry average of 5x and the fair ratio of 4.3x. This suggests the market is putting a premium on Independence Realty Trust, raising the stakes if future growth stumbles. Could this premium hold up if growth expectations disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independence Realty Trust Narrative

If you have a different perspective, or want to dive deeper into the numbers yourself, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your Independence Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart moves start with staying ahead of the crowd. Uncover opportunities you may have missed and get instant access to unique strategies tailored to different investing goals below.

- Unlock the potential for long-term wealth by checking out these 16 dividend stocks with yields > 3%, which offers stable yields over 3% from companies with robust payout histories.

- Tap into tomorrow’s biggest trends by searching these 25 AI penny stocks, where advances in artificial intelligence are creating new market leaders.

- Seize value now by exploring these 886 undervalued stocks based on cash flows, featuring quality stocks currently trading below their estimated cash flow-based worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRT

Independence Realty Trust

Independence Realty Trust, Inc. (NYSE: IRT), an S&P 400 MidCap Company, is a real estate investment trust (“REIT”) that owns and operates multifamily communities, across non-gateway U.S.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives