- United States

- /

- Residential REITs

- /

- NYSE:IRT

Independence Realty Trust (IRT): Exploring Valuation Following Strong Returns From Recent Property Upgrades

Reviewed by Simply Wall St

Independence Realty Trust (IRT) has accelerated its long-term strategy by investing in kitchen, bath, and common area upgrades across multiple properties. These completed projects are already delivering strong returns and reinforcing the company’s approach.

See our latest analysis for Independence Realty Trust.

Independence Realty Trust’s share price has bounced by 4.2% over the past month, suggesting some renewed optimism after a slower patch earlier in the year. Despite a 1-year total shareholder return of -19.2%, long-term holders have still seen solid gains, with shares up nearly 55% over five years. This shows that momentum tends to ebb and flow with broader sector shifts and the company’s latest execution on strategy.

If you’re watching how recent upgrade projects are affecting sentiment, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership.

With recent upgrades generating robust returns and the share price still trading below analyst targets, investors now face a pivotal question: Is Independence Realty Trust undervalued at these levels, or has the market already accounted for future growth in the current price?

Most Popular Narrative: 19.5% Undervalued

The most widely followed narrative suggests Independence Realty Trust’s fair value sits well above the recent close. This sets the stage for a deeper look at what drives this view.

Ongoing capital recycling, selling older, higher CapEx assets to acquire newer, lower CapEx communities with higher growth profiles in high-demand regions, allows IRT to enhance portfolio quality, capture operating synergies, and improve overall net margins and earnings growth potential.

Want to see what major numbers are fueling this valuation? The narrative hinges on an aggressive outlook for both revenue and margin expansion, backed by strategic repositioning. Find out which surprising projections analysts believe will unlock significant future upside.

Result: Fair Value of $21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing apartment oversupply and aggressive concessions from new developments could limit rent growth and put pressure on earnings if conditions persist.

Find out about the key risks to this Independence Realty Trust narrative.

Another View: What Do Market Multiples Say?

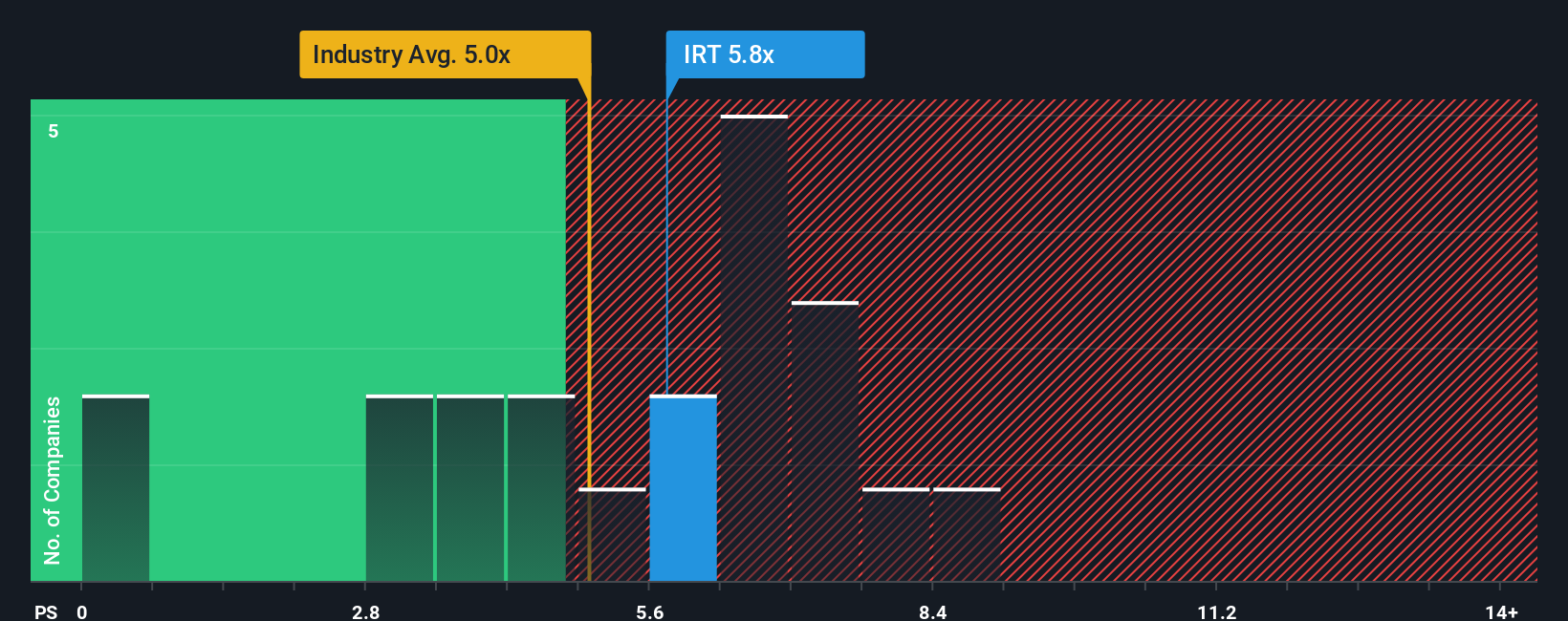

Looking through the lens of price-to-sales ratios, Independence Realty Trust trades at 6.1x, which is not only higher than the North American Residential REITs industry average of 5.1x, but also above its own fair ratio of 4.4x. While there is some agreement with industry peers at an average of 6.2x, this raises questions of how much optimism is already reflected in today’s price and what that means if growth falters. Could the stock be pricing in more good news than is certain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independence Realty Trust Narrative

If you see the story differently or want to dig into the details yourself, building a personal take takes just a few minutes. Why not Do it your way?

A great starting point for your Independence Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the curve by tapping into unique opportunities set to shape tomorrow’s market. Don’t let your next great investment slip away.

- Start building passive income streams by checking out these 15 dividend stocks with yields > 3% and discover stocks delivering attractive yields above 3%.

- Ride the wave of AI advancements with these 26 AI penny stocks, revealing innovative companies reshaping every corner of the economy.

- Uncover undervalued gems by browsing these 927 undervalued stocks based on cash flows, where smart capital seeks strong upside based on proven cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRT

Independence Realty Trust

Independence Realty Trust, Inc. (NYSE: IRT), an S&P 400 MidCap Company, is a real estate investment trust (“REIT”) that owns and operates multifamily communities, across non-gateway U.S.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success