- United States

- /

- Residential REITs

- /

- NYSE:INVH

Invitation Homes (INVH): Exploring Valuation After Analyst Target Cuts and Cautious Housing Market Updates

Reviewed by Simply Wall St

Invitation Homes (INVH) held its Analyst and Investor Day at a time when several analysts pulled back on their outlook, keeping ratings steady but lowering expectations. The event provided updates on strategy and operations, but persistent housing market headwinds still cloud the near-term view.

See our latest analysis for Invitation Homes.

Invitation Homes' latest share price sits at $28.39. While the stock has shown a bumpy ride this year, pressure from the broader housing market has weighed on sentiment. The total shareholder return over the last 12 months is down 13.8%, erasing the more modest medium-term gains that the company built over the past five years. Recent company updates and analyst reactions suggest momentum is fading for now as investors await clearer signs of recovery or renewed growth potential.

If recent real estate volatility has you rethinking your watchlist, it could be the right time to explore new opportunities with fast growing stocks with high insider ownership

With analyst targets drifting lower and valuations still elevated compared to sector peers, investors are left to consider whether Invitation Homes is truly undervalued or if the market already reflects tempered growth expectations. This could leave limited upside from here.

Most Popular Narrative: 20.2% Undervalued

With the most widely followed narrative putting fair value at $35.57, Invitation Homes' last close of $28.39 signals a meaningful gap to watch. This sets up a deep dive into how long-term rental demand could drive recovery and share price momentum, even as near-term sentiment remains cautious.

The company's concentrated investments and expansion in high-growth Sun Belt and suburban markets align with population migration trends, creating opportunities for above-average rental rate increases and boosted property appreciation. This directly supports both revenue and asset value growth.

Curious what financial forecasts could possibly justify that ambitious fair value? The narrative is built on a tight set of key growth assumptions, revenue projections, and margin trends. The full breakdown reveals which bold numbers underpin the valuation and why some analysts still see significant upside.

Result: Fair Value of $35.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as increased new housing supply and rising property expenses could undermine the growth narrative and put pressure on margins going forward.

Find out about the key risks to this Invitation Homes narrative.

Another View: Market Ratios Tell a Different Story

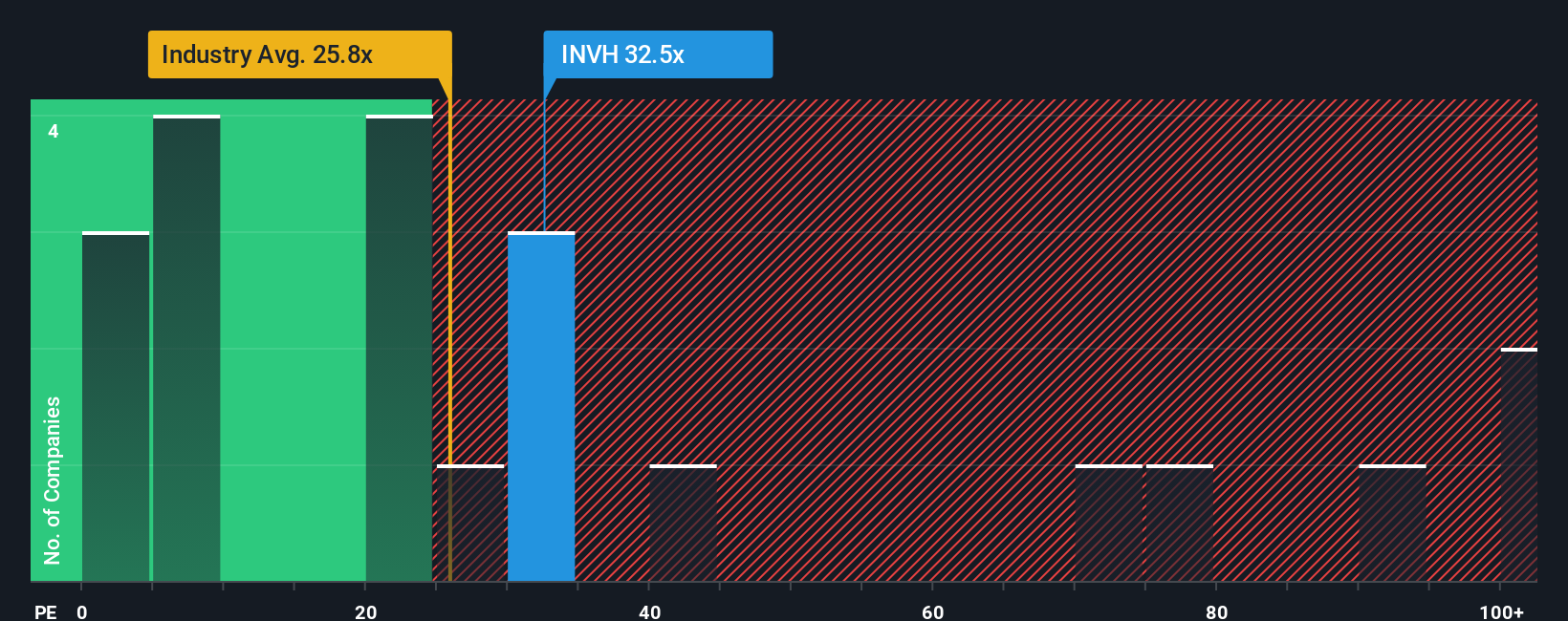

While the narrative points to undervaluation, a look at market-based valuation ratios gives pause. Invitation Homes trades at a price-to-earnings ratio of 29.7x, making it more expensive than both the industry average (27.2x) and the fair ratio of 28.9x. Compared to a peer average of 69x, this gap could mean reduced valuation risk, but it might also signal limited upside if the market’s optimism fades. Will the market push the share price higher, or is the bar already set?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invitation Homes Narrative

If you see things differently or want to dig into the numbers yourself, you can easily craft your own story in just a few minutes with Do it your way.

A great starting point for your Invitation Homes research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't limit your portfolio to one opportunity when fresh investment ideas are right at your fingertips. Make your next move by considering these compelling stock types:

- Unlock the potential of big yields as you chase steady returns by checking out these 16 dividend stocks with yields > 3% with above-average payouts.

- Tap into rapid innovation and future-defining themes by selecting these 25 AI penny stocks focused on artificial intelligence breakthroughs and advanced data analytics.

- Cement your edge by targeting overlooked value with these 897 undervalued stocks based on cash flows, where cash flow signals suggest these stocks might be trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVH

Invitation Homes

Invitation Homes, an S&P 500 company, is the nation’s premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality homes with valued features such as close proximity to jobs and access to good schools.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives