- United States

- /

- Residential REITs

- /

- NYSE:INVH

Assessing Invitation Homes (INVH) Valuation as Shares Slide 7% Over the Past Month

Reviewed by Kshitija Bhandaru

See our latest analysis for Invitation Homes.

Invitation Homes’ share price has backtracked in 2024, with a 30-day share price return of -6.9% and a year-to-date drop of 11.1%. Recent events have not reversed the broader cooling trend, as total shareholder return over the past year sits at -14.2% and long-term gains are now modest, signaling that momentum is currently fading.

If you’re scanning for other potential movers outside of real estate, now could be a smart moment to discover fast growing stocks with high insider ownership

But after months in retreat, is the current price an undervalued entry point for patient investors? Or is the market simply accounting for softer fundamentals and moderate long-term growth expectations?

Most Popular Narrative: 24.3% Undervalued

Invitation Homes is attracting attention as its most popular narrative argues for substantial upside, with a consensus fair value well above the latest closing price of $27.94. The narrative claims the gap is justified by strong rental demand, expansion in key markets, and efficiency gains.

The company's concentrated investments and expansion in high-growth Sun Belt and suburban markets align with population migration trends. This creates opportunities for above-average rental rate increases and boosted property appreciation, directly supporting both revenue and asset value growth.

Curious what bold financial assumptions fuel such a bullish outlook? The narrative is built on ambitious forecasts for revenues, margins, and future profit multiples. The projections may surprise you. Uncover the specifics behind this valuation story and see why analysts think this gap could close.

Result: Fair Value of $36.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent expense growth and a surge in new rental supply could quickly dampen revenue momentum and challenge the current bullish thesis.

Find out about the key risks to this Invitation Homes narrative.

Another View: Market Multiples Tell a Different Story

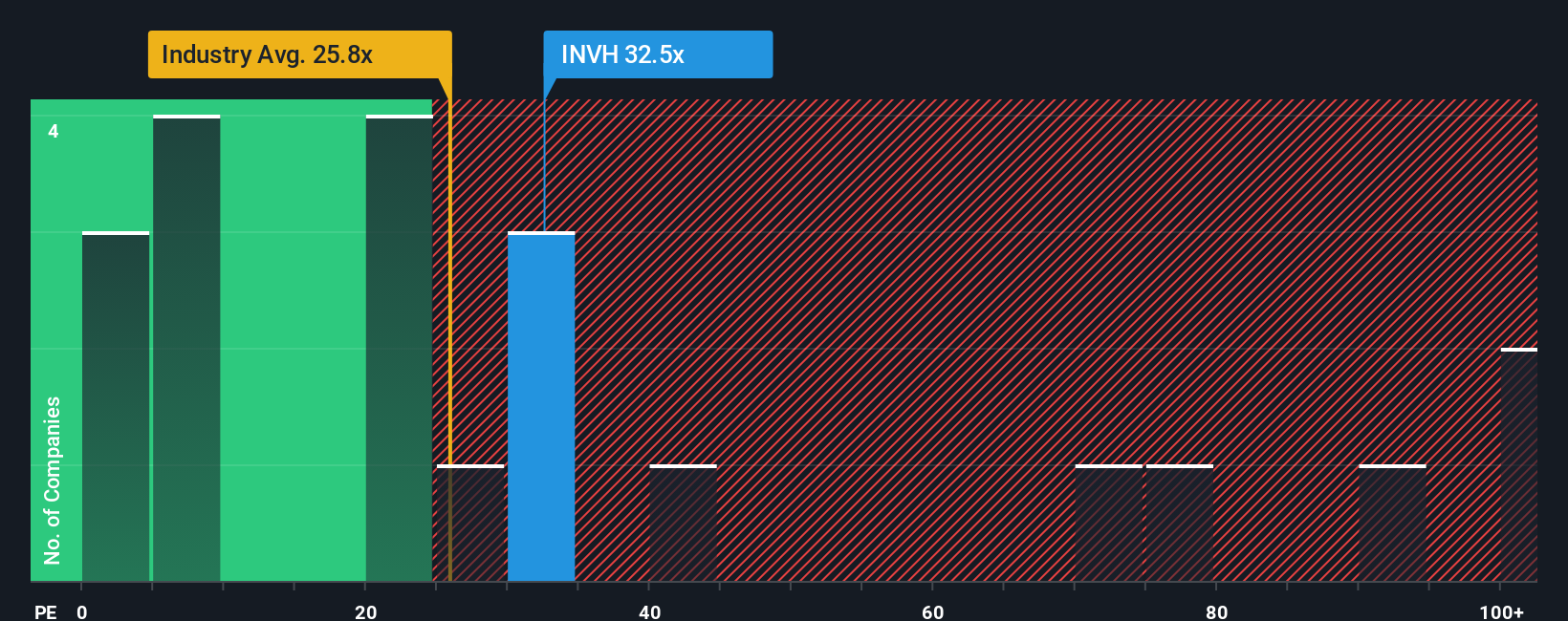

Looking at a price-to-earnings ratio instead, Invitation Homes appears expensive at 31.5 times earnings. This is slightly above its fair ratio of 31.2 and much higher than the global residential REITs average of 19.9. This suggests the market has priced in more optimism here than for its peers. Are investors overlooking valuation risks, or is there unseen potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invitation Homes Narrative

If you’re not on board with these viewpoints or want a hands-on approach, you can analyze the numbers and shape your own narrative in just a few minutes: Do it your way

A great starting point for your Invitation Homes research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Expand your reach and capitalize on unique market trends using these exclusive stock lists, only on Simply Wall Street:

- Secure your portfolio with steady income by targeting these 19 dividend stocks with yields > 3% that offer attractive yields above 3% and strong fundamentals.

- Catalyze your gains by tapping into these 24 AI penny stocks at the forefront of artificial intelligence innovation, transforming industries and unlocking new growth frontiers.

- Leap ahead of the crowd as you uncover these 3582 penny stocks with strong financials with robust financials, giving you a shot at the next breakout winner.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVH

Invitation Homes

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality homes with valued features such as close proximity to jobs and access to good schools.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives