- United States

- /

- Residential REITs

- /

- NYSE:INVH

Are Recent Price Drops Creating Opportunity for Invitation Homes in 2025?

Reviewed by Bailey Pemberton

If you have found yourself eyeing Invitation Homes lately and wondering whether now is the right time to make a move, you are definitely not alone. The stock has seen its fair share of swings this year. Over the past week, shares have dipped by 1.7%, and if you zoom out to the past month, they are down 3.4%. Year-to-date, the drop is even steeper at 10.3%, while the stock is 12% lower than it was twelve months ago. That might be enough to give any investor pause, but the five-year performance, up 16.7%, tells a different story. This points to a company that has shown staying power even in choppy markets.

One of the reasons for the recent bumpy ride is a series of headlines that have put the spotlight on the single-family rental market. Discussions about shifting housing affordability and changing tenant preferences have shaped market sentiment, sometimes amplifying both optimism and skepticism among investors. While these factors can lead to nervous trading, they have also helped reset expectations for how much risk or growth is really in the price.

With a value score of 4 out of 6 on our valuation check, Invitation Homes is currently undervalued in several key metrics. So, what does that actually mean for you as a current or potential shareholder? To answer that, let’s dig into how the stock measures up across the most common valuation tests. Be sure to stick around, because we will finish with one approach to valuation that is surprisingly overlooked and might just offer the clearest answer of all.

Approach 1: Invitation Homes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its adjusted funds from operations far into the future and discounting those back to today’s dollars. For Invitation Homes, this process begins with its trailing twelve-month free cash flow of $986 Million, a strong base that represents the cash generated by the business after necessary capital expenditures.

Analysts expect Invitation Homes’ free cash flow to grow steadily over the next five years, with projections reaching $1.20 Billion in 2029. Notably, while analyst estimates cover about five years, longer-term numbers are extrapolated beyond that to capture what value might materialize for shareholders over an extended period.

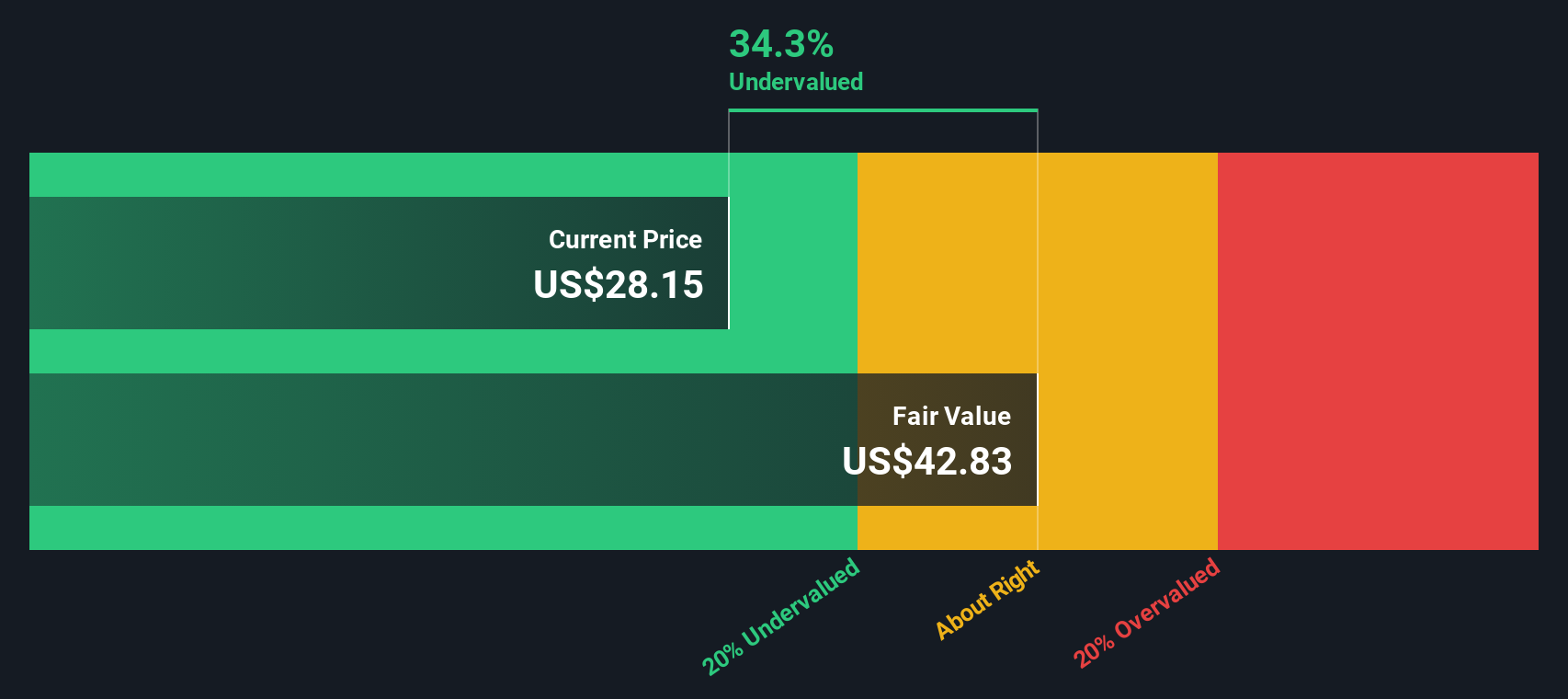

After modeling these cash flows in dollars, the DCF calculation arrives at an estimated fair value of $42.79 per share. With the current share price trading about 34.1% below that intrinsic value, Invitation Homes appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Invitation Homes is undervalued by 34.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Invitation Homes Price vs Earnings

Price-to-earnings (PE) is a widely used valuation metric for companies like Invitation Homes that consistently generate profits. It provides a clear window into how the market is pricing every dollar of earnings, making it especially useful for stable, profitable businesses in mature industries.

The PE ratio is shaped by factors like growth expectations, profit margins, and risk. Companies with higher anticipated earnings growth or lower risks typically command a higher PE, while those facing headwinds often see their multiples compressed. Finding the right benchmark is crucial. Comparing with the Residential REITs industry average or close peers helps, but each company’s profile is unique.

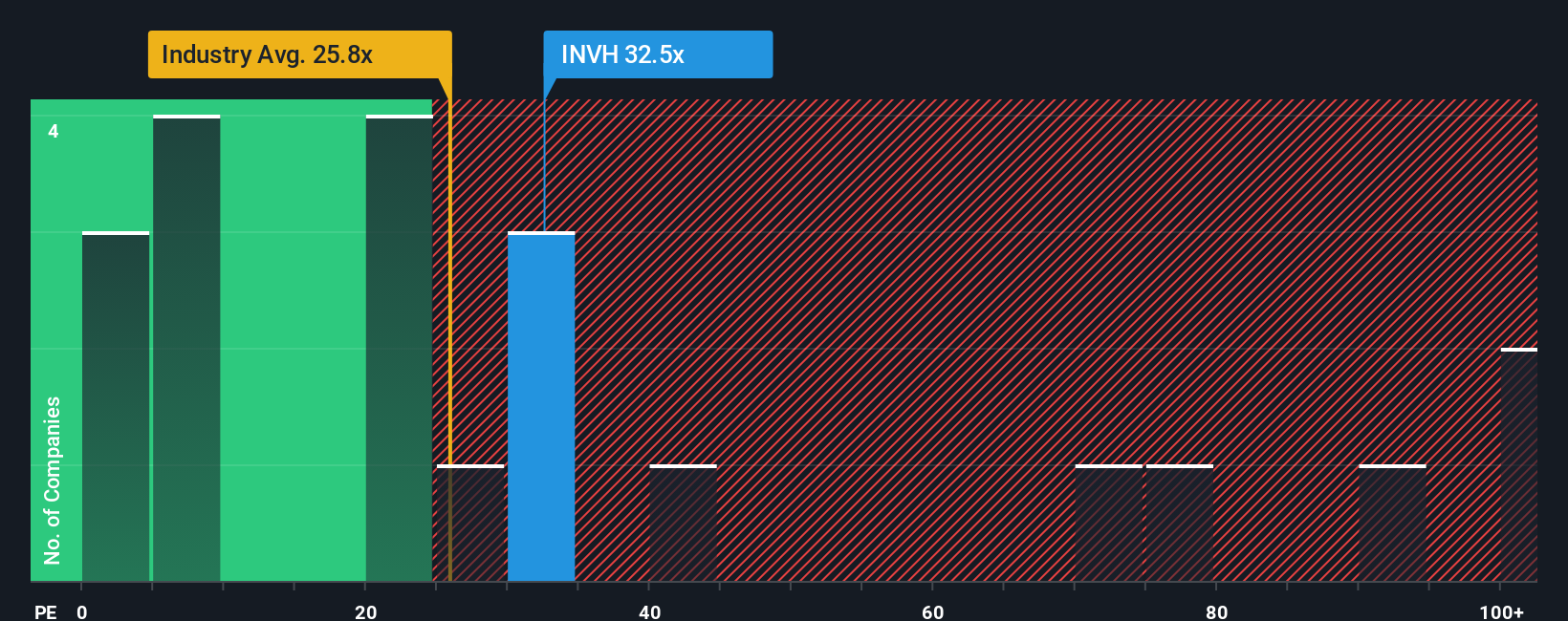

Currently, Invitation Homes trades at a PE ratio of 31.75x. That is notably higher than the Residential REITs industry average of 20.43x, and below the peer group average of 49.55x. However, Simply Wall St’s “Fair Ratio” offers a more tailored insight, suggesting that Invitation Homes deserves a PE of 30.96x, factoring in its earnings growth, profit margin, size, and industry risk. Unlike simple averages, the Fair Ratio adapts to all the moving parts that shape true fair value for a specific company.

With Invitation Homes’ actual PE just a fraction above the Fair Ratio, its valuation looks well-aligned with expectations based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Invitation Homes Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story you build around a company, combining your unique perspective on its future prospects with the numbers that matter, such as projected revenues, profit margins, and growth rates. This ultimately links a company’s journey to its fair value.

With Narratives, available on the Simply Wall St Community page used by millions of investors, you can easily frame your investment thesis, translate your outlook into specific forecasts, and see how your fair value stacks up against the current share price. This makes it straightforward to spot opportunities or risks and decide when to act. Narratives are updated automatically as new information or earnings arrive, providing a dynamic, up-to-date view of your investment case without extra effort.

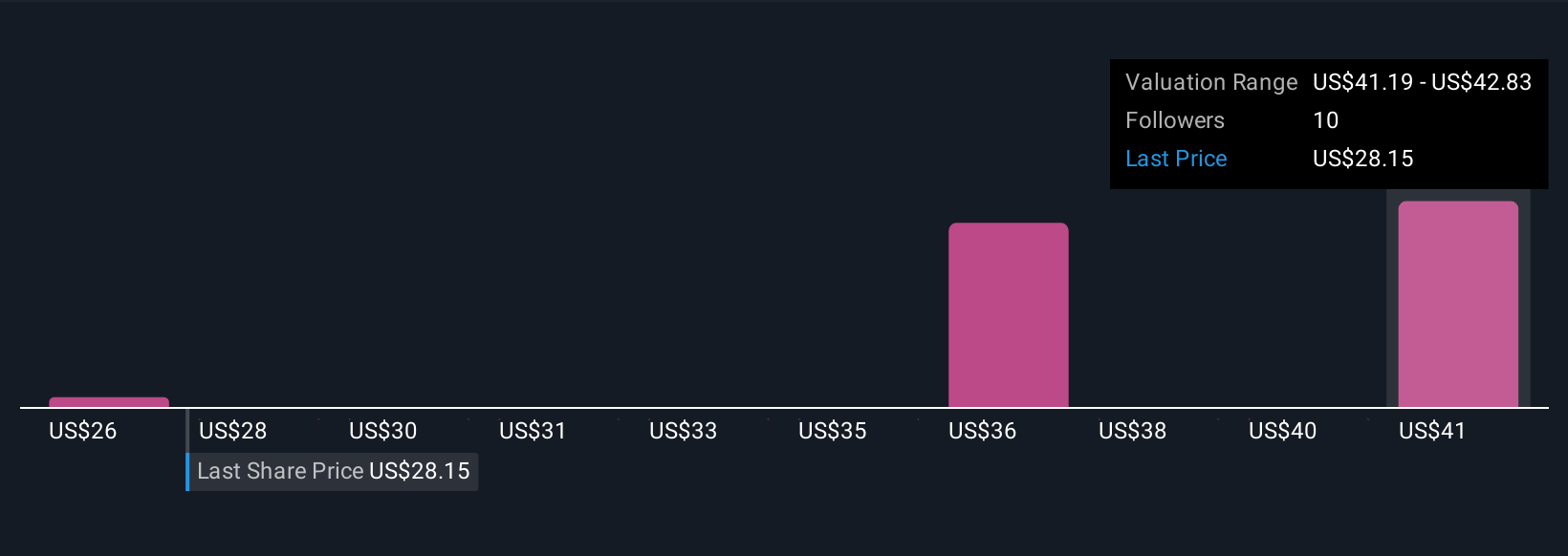

For example, when it comes to Invitation Homes, some investors see strong long-term rental demand driving future earnings towards $633 million and a price target near $41, while others anticipate more conservative results, projecting earnings closer to $441 million and a price target as low as $32. This demonstrates that Narratives allow you to make sense of, and act on, your own beliefs as market conditions shift.

Do you think there's more to the story for Invitation Homes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVH

Invitation Homes

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality homes with valued features such as close proximity to jobs and access to good schools.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives