- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

Florida Medical Cannabis Legal Battle Might Change The Case For Investing In Innovative Industrial Properties (IIPR)

Reviewed by Sasha Jovanovic

- Earlier this month, analysts reiterated strong confidence in Innovative Industrial Properties thanks to its robust financial position and double-digit yield, despite near-term risks such as tenant defaults and possible dividend reductions.

- At the same time, a legal battle began on October 20 regarding access to Florida's regulated medical cannabis market, which could create new opportunities for companies following IIPR's specialized real estate model.

- We'll explore how growing optimism about regulatory expansion in Florida could influence the company's outlook and broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

Innovative Industrial Properties Investment Narrative Recap

To be a shareholder in Innovative Industrial Properties (IIPR), belief in the resilience and long-term growth of regulated cannabis real estate is crucial, despite recent revenue softness and ongoing tenant distress. The recent legal battle in Florida may ultimately play a role in unlocking new leasing opportunities for IIPR's model, but it does not materially change the most immediate catalyst, addressing tenant defaults, or lessen the biggest risk: further near-term rent collection or dividend pressure. The underlying fundamentals remain unchanged for now.

Of IIPR’s recent announcements, the acquisition of a 145,000-square-foot property in Ocala, Florida stands out in light of the legal debate over expanding medical cannabis access in the state. This purchase highlights IIPR’s continued focus on strategic markets with growth potential and its willingness to deploy capital into assets positioned for regulatory change. While the news may bring long-term tailwinds, the company's near-term performance will still rely on stabilizing collections and occupancy.

Yet even with new growth avenues potentially opening, investors should keep an eye on…

Read the full narrative on Innovative Industrial Properties (it's free!)

Innovative Industrial Properties' narrative projects $257.0 million revenue and $105.7 million earnings by 2028. This requires a 3.7% annual revenue decline and a $26.2 million decrease in earnings from $131.9 million currently.

Uncover how Innovative Industrial Properties' forecasts yield a $57.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

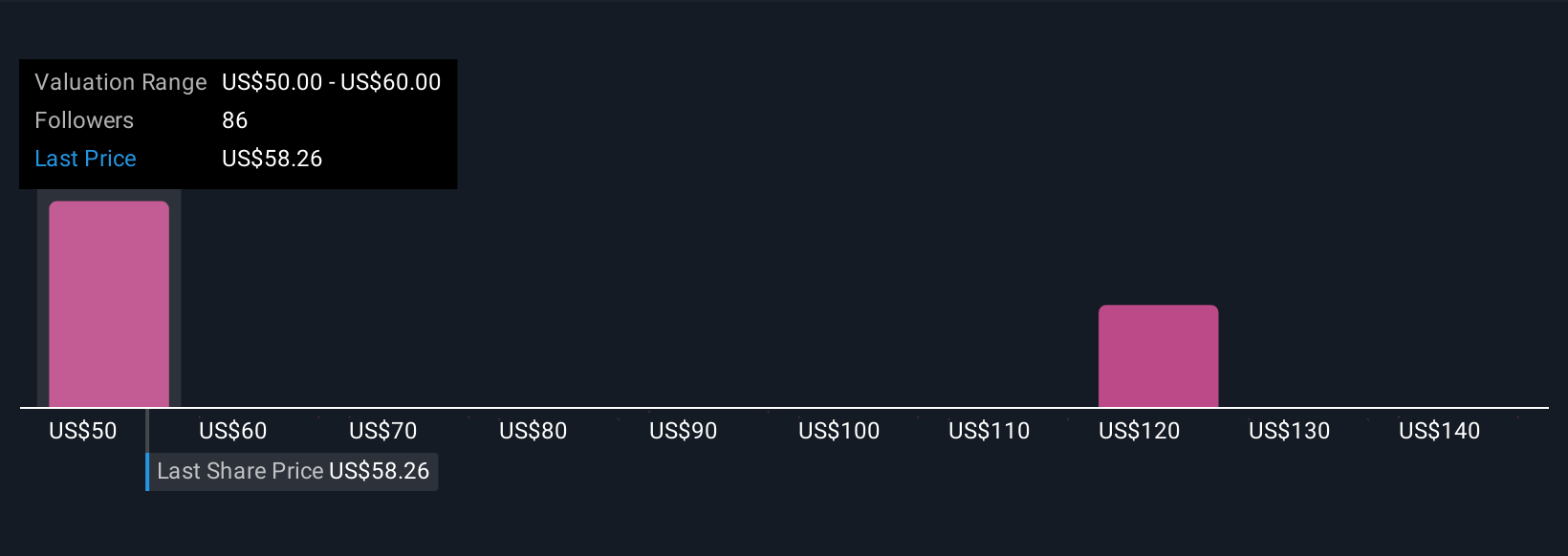

Ten individual fair value estimates from the Simply Wall St Community range from US$50 to US$121, a wide spectrum of opinion. While expectations vary, uncertainties over tenant stability remain a core consideration and could significantly shape future company results.

Explore 10 other fair value estimates on Innovative Industrial Properties - why the stock might be worth 6% less than the current price!

Build Your Own Innovative Industrial Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovative Industrial Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innovative Industrial Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovative Industrial Properties' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IIPR

Innovative Industrial Properties

A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated cannabis facilities.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives