- United States

- /

- Health Care REITs

- /

- NYSE:HR

How Attractive Is Healthcare Realty Trust After Its Recent Quarterly Results in 2025?

Reviewed by Bailey Pemberton

If you're considering what to do with your Healthcare Realty Trust shares, or perhaps thinking about making a move, you're not alone. The stock has been making waves, sometimes subtle, sometimes more noticeable. Over just the past week, there was a minimal dip of -0.1%, and the past month has seen a slightly larger decline of -1.8%. Yet, zooming out, things look far sunnier: Healthcare Realty Trust is up 7.7% so far this year and a solid 9.5% over the last twelve months. Of course, anyone who held on for the past five years has felt the sting of a -21.8% drop, though that longer-term slide is not unusual among healthcare real estate investment trusts navigating an evolving market and interest rate shifts.

Investor sentiment seems to be gradually warming. Some of that shift is likely due to broader market stabilization and ongoing sector developments. But the big question remains: are shares of Healthcare Realty Trust undervalued, or do recent moves reflect a fair price?

As we dive into the numbers, it’s worth knowing the company carries a valuation score of 3 out of 6 on key checks for undervaluation. That means it passes about half the tests that flag a bargain buy. But before you rush to judgment, let’s walk through the different approaches analysts use when sizing up valuation. Stick around, because we’ll cover a nuanced way of understanding what “value” means for Healthcare Realty Trust in the final section.

Why Healthcare Realty Trust is lagging behind its peers

Approach 1: Healthcare Realty Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that calculates what a company is worth today by forecasting its expected future adjusted funds from operations and discounting those cash flows back to the present. For Healthcare Realty Trust, this model uses key company data including the most recent Free Cash Flow, future projections, and discounting techniques that reflect both analyst expectations and systematic estimates.

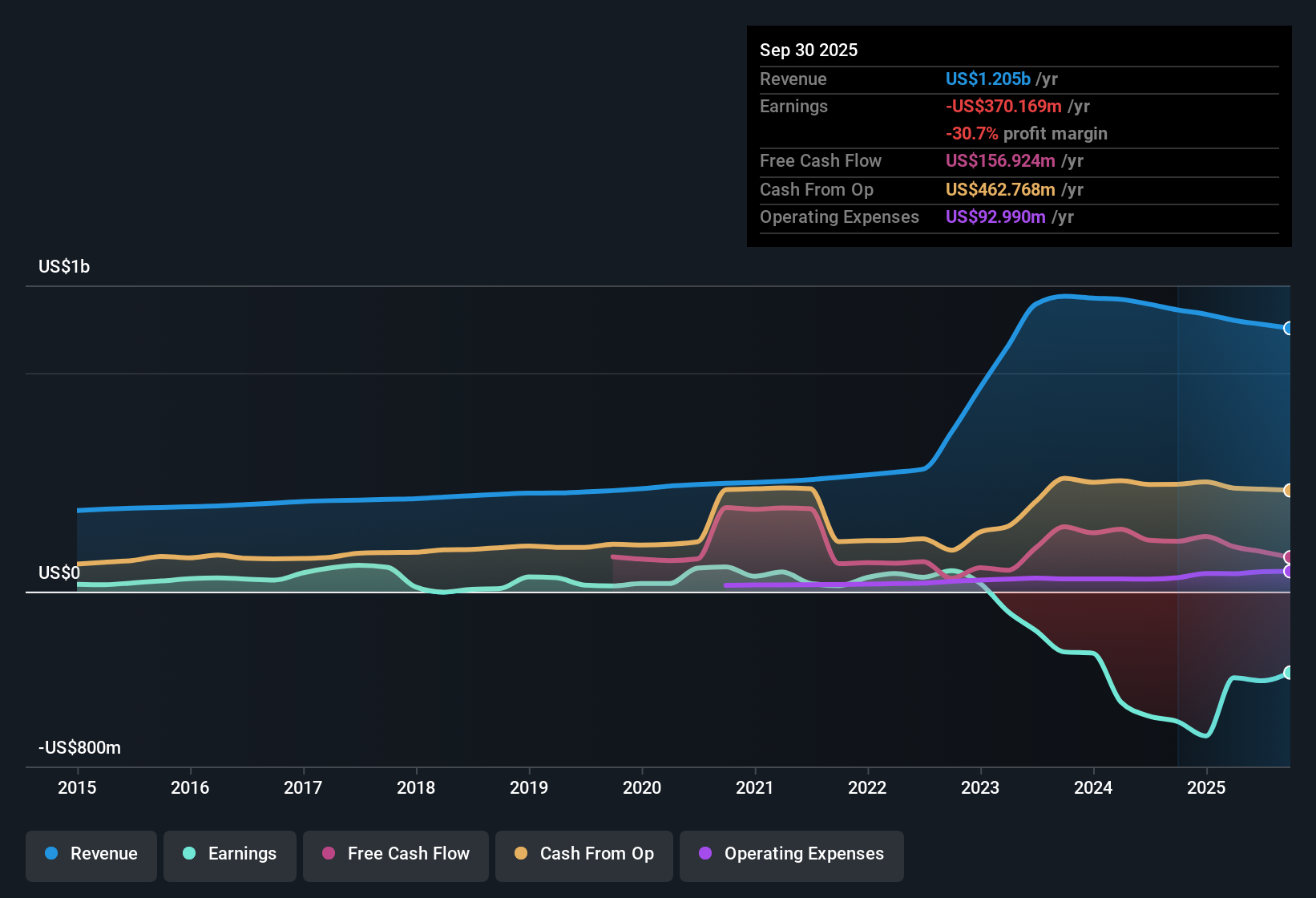

Healthcare Realty Trust’s latest reported Free Cash Flow sits at approximately $50.6 million. Analyst coverage directly extends up to 2028, projecting Free Cash Flow to increase to around $464.2 million, with further increases extrapolated for the following years. This model, operated in USD, indicates a steady but not spectacular annual growth rate in funds generated by the trust.

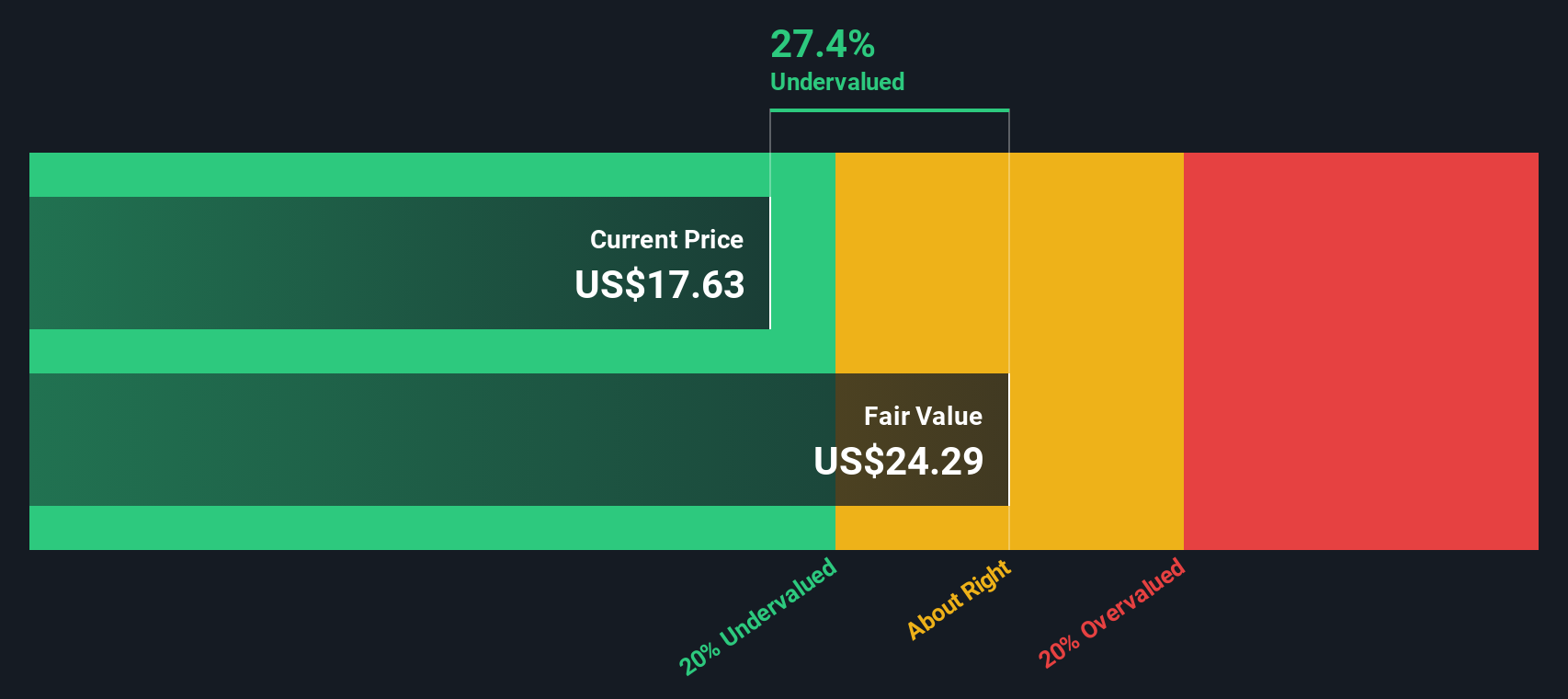

When all these projections and discount factors are combined, the model calculates an intrinsic value for Healthcare Realty Trust shares of $23.34. This figure is about 24.0% higher than its current trading price, signaling that based on cash flow fundamentals, the stock appears to be undervalued according to this well-established financial model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Healthcare Realty Trust is undervalued by 24.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

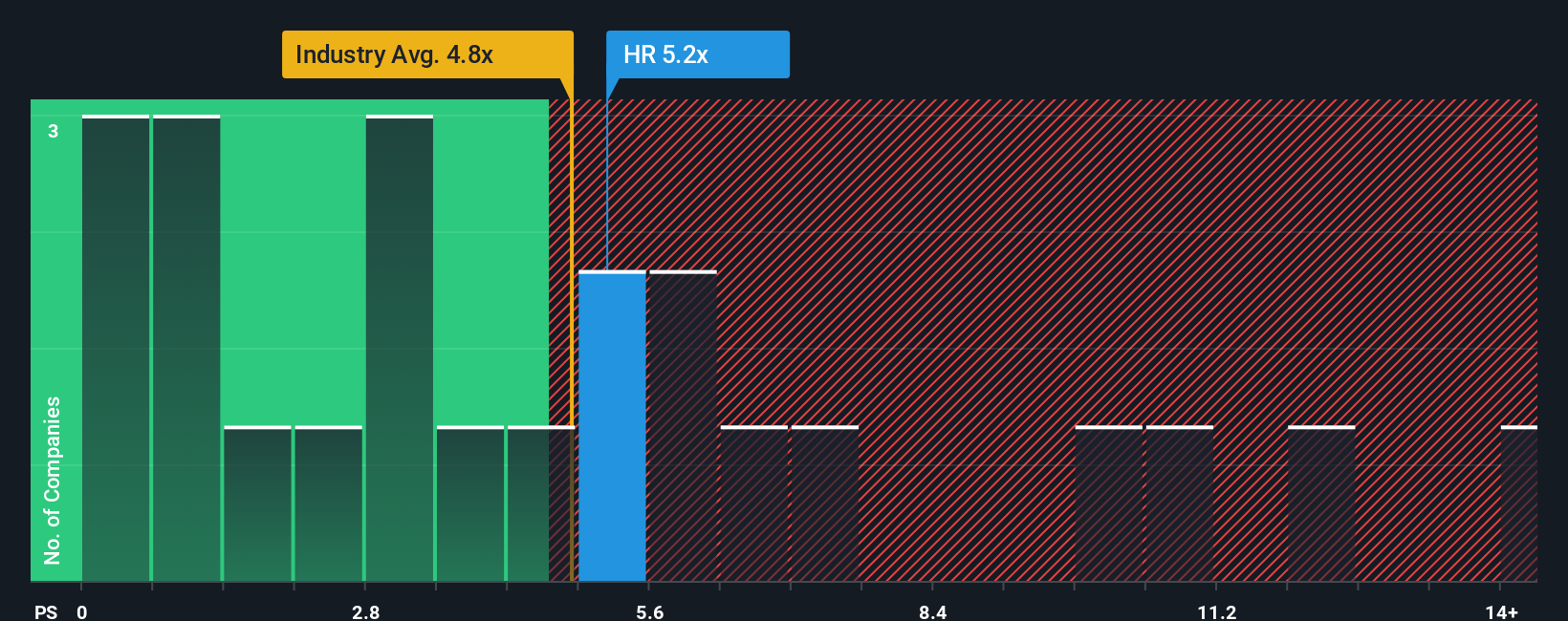

Approach 2: Healthcare Realty Trust Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation tool for healthcare REITs like Healthcare Realty Trust, especially when companies have unpredictable or negative earnings due to industry-specific accounting or non-cash charges. This ratio lets us compare a company’s value relative to its total sales, offering a more normalized view than traditional earnings multiples would provide.

Growth prospects and business risk both influence what counts as a “fair” P/S ratio. Companies expected to grow faster, with stable and predictable revenues, typically justify higher multiples. Conversely, higher risks or stagnating growth should lead to a more conservative valuation.

Healthcare Realty Trust is currently trading at a 5.1x P/S ratio. By comparison, the industry average is 6.29x, and its closest peers average 7.96x. While these benchmarks are helpful, Simply Wall St uses a proprietary “Fair Ratio” metric, which is calculated as 4.72x for Healthcare Realty Trust. The Fair Ratio takes into account key elements like earnings growth, margin, risk factors, and company size, resulting in a more tailored benchmark than simple peer or industry averages.

In this case, the real P/S ratio of 5.1x sits only slightly above the Fair Ratio of 4.72x, a difference well within a reasonable range. That suggests shares are trading at about the “right” price given the company’s fundamentals and sector standing.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Healthcare Realty Trust Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, Simply Wall St’s straightforward feature that lets you craft a story behind the numbers for Healthcare Realty Trust. Rather than just relying on static ratios or analyst targets, investors can use Narratives to tie together their own beliefs about the company’s future, estimate key financial outcomes, and see how those views translate into a fair value, all in one place. This approach is unique because it connects Healthcare Realty Trust’s real-world story, such as aging demographics and modern outpatient expansion, to dynamic forecasts and an actionable valuation range that update automatically as new earnings, news, and data are released.

Creating or reviewing Narratives is fast and accessible through Simply Wall St’s Community page, where millions of investors share perspective and discuss fair value scenarios. Narratives help you decide when to buy or sell by calculating a fair value from your assumptions and instantly comparing it to today’s share price. For example, some investors are bullish, projecting rapid operational improvement and assigning a value up to $20.00, while others emphasize risks like sluggish occupancy and tougher markets, landing as low as $16.00; both views are reflected transparently, empowering you to compare, challenge, and refine your own thesis.

Do you think there's more to the story for Healthcare Realty Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HR

Healthcare Realty Trust

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives