- United States

- /

- Office REITs

- /

- NYSE:HIW

Will Highwoods Properties’ (HIW) Limited AI Market Exposure Shape Its Competitive Position in Office Real Estate?

Reviewed by Sasha Jovanovic

- Earlier this week, Jefferies downgraded Highwoods Properties due to the company’s limited presence in key artificial intelligence growth markets, following several similar analyst actions in recent months. In addition, Highwoods announced the acquisition of the Legacy Union Parking Garage in Uptown Charlotte for US$111.5 million and an extension of its US$200 million bank loan maturity date.

- Analysts see the company’s focus on more traditional office markets as a potential weakness given the rising importance of technology-driven real estate demand.

- We’ll examine how Jefferies’ downgrade, focused on limited AI hub exposure, may influence Highwoods Properties’ overall investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Highwoods Properties Investment Narrative Recap

To own shares of Highwoods Properties, you generally need to believe in the ongoing value of modern office assets in Sun Belt markets, despite headwinds from changing workplace trends. The recent Jefferies downgrade, focused on limited AI hub exposure, does not materially alter the main short term catalyst, which remains the company's ability to maintain or increase occupancy and rental revenues; however, a major risk continues to be office demand softness if hybrid work persists.

Among recent announcements, the extension of Highwoods’ US$200 million unsecured bank loan maturity to January 2029 is particularly relevant, as it speaks to balance sheet flexibility even as analyst concerns shift to tech sector-driven demand and location relevance. This extension, paired with the company's steady dividend policy, may help reassure investors seeking financial stability as the business adapts to evolving office market trends.

In contrast, investors should be mindful of how continued weak leasing momentum or structural changes in tenant demand could challenge...

Read the full narrative on Highwoods Properties (it's free!)

Highwoods Properties is projected to achieve $903.7 million in revenue and $69.7 million in earnings by 2028. This outlook assumes annual revenue growth of 3.5% and an earnings decrease of $56.8 million from current earnings of $126.5 million.

Uncover how Highwoods Properties' forecasts yield a $31.70 fair value, a 6% upside to its current price.

Exploring Other Perspectives

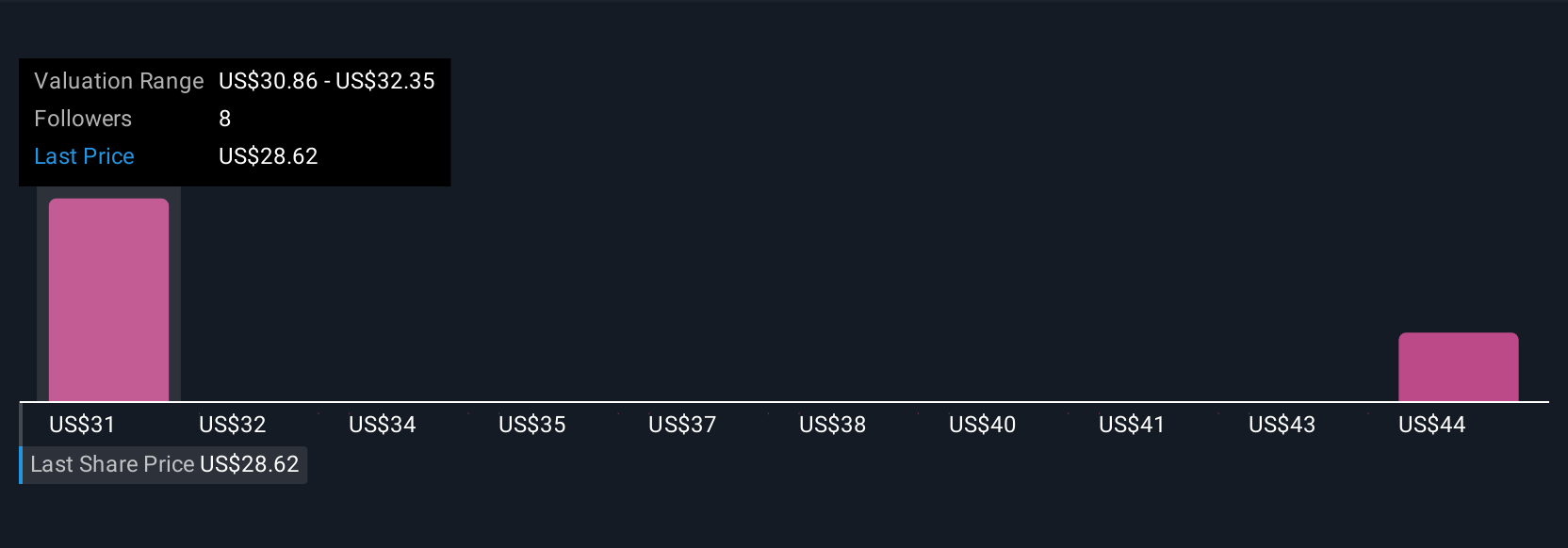

Simply Wall St Community members estimate fair value for Highwoods Properties between US$31.70 and US$41.85, reflecting two distinct outlooks. With office demand trends in flux, you can explore several perspectives on how changing workplace preferences might impact future performance.

Explore 2 other fair value estimates on Highwoods Properties - why the stock might be worth just $31.70!

Build Your Own Highwoods Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Highwoods Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Highwoods Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Highwoods Properties' overall financial health at a glance.

No Opportunity In Highwoods Properties?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE: HIW), fully-integrated office real estate investment trust (REIT) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives