- United States

- /

- Office REITs

- /

- NYSE:HIW

Leasing Surge Might Change The Case For Investing In Highwoods Properties (HIW)

Reviewed by Simply Wall St

- Highwoods Properties recently secured over 750,000 square feet of second-generation leases since April 1 across its business districts portfolio.

- This leasing momentum highlights tenant demand for Highwoods' office assets, even as analyst sentiment remains cautious on the company’s outlook.

- We'll assess how these substantial new leases impact the company's investment narrative, particularly regarding expectations for future leasing activity.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Highwoods Properties Investment Narrative Recap

To be a shareholder in Highwoods Properties, you need to believe that quality office assets in prime business districts will continue to attract tenants even as broader economic uncertainty weighs on the sector. The recent announcement of over 750,000 square feet in second-generation leases certainly supports faith in tenant demand, but with upcoming leasing capital expenditures remaining a concern, the news does not fully resolve the most important short-term catalyst, sustainable leasing momentum, or the prominent risk of elevated costs impacting cash flow and dividends.

Of recent announcements, the acquisition of the Advance Auto Parts Tower in Raleigh stands out. This sizable addition, which is fully leased and adjacent to an existing Highwoods asset, aligns with the ongoing portfolio upgrade strategy and complements the positive leasing momentum, while still leaving macroeconomic and cost risk factors front of mind for investors.

Yet, despite strong recent leasing, investors should be aware that future increases in leasing capital expenditure could still...

Read the full narrative on Highwoods Properties (it's free!)

Highwoods Properties is projected to reach $885.2 million in revenue and $88.3 million in earnings by 2028. This outlook assumes a 2.2% annual revenue growth rate, but earnings are expected to decrease by $11.5 million from the current level of $99.8 million.

Exploring Other Perspectives

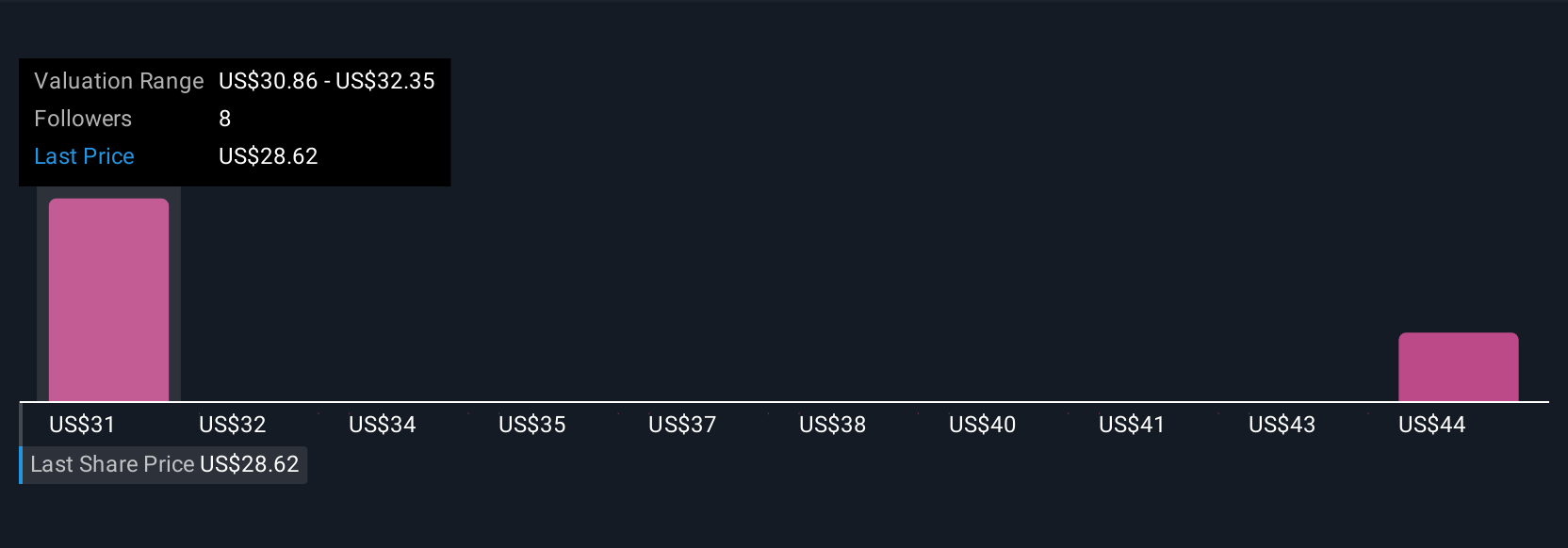

Community estimates from Simply Wall St range from US$30.86 to US$46.16 based on two contrasting outlooks. With macroeconomic pressures and higher capital needs on the radar, you might find other investors’ viewpoints valuable before making up your mind.

Build Your Own Highwoods Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Highwoods Properties research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Highwoods Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Highwoods Properties' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE: HIW), fully-integrated office real estate investment trust (“REIT”) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives