- United States

- /

- Retail REITs

- /

- NYSE:GTY

The Bull Case For Getty Realty (GTY) Could Change Following Q3 Earnings Beat and 12th Dividend Hike

Reviewed by Sasha Jovanovic

- Getty Realty Corp. reported strong third quarter results for the quarter ended September 30, 2025, with net income rising to US$23.35 million from US$15.34 million a year earlier and a 3.2% increase in its quarterly dividend to US$0.485 per share, the twelfth consecutive year of dividend growth.

- This performance was driven by growth in revenues, profitability, and a continued commitment to returning value to shareholders, supported by ongoing property acquisitions and high portfolio occupancy.

- We'll look at how the increase in quarterly dividend and earnings growth shapes Getty Realty's investment case going forward.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Getty Realty Investment Narrative Recap

For investors considering Getty Realty, the core appeal rests on stable, inflation-protected cash flows from long-term leases in the convenience and automotive service sectors, supported by disciplined acquisitions and a steady dividend. The recent jump in earnings and another dividend increase serve as strong validation for this approach, yet do not have a material impact on the most pressing short-term risk: how quickly industry headwinds, such as the shift to electric vehicles and potential changes in transportation habits, could weaken occupancy and cash flows.

One of the key announcements from this quarter was the 3.2% increase in Getty Realty’s dividend, representing its twelfth consecutive year of dividend growth. This underscores management’s ongoing focus on returning capital to shareholders, even as questions linger about long-term growth opportunities and the threat of asset obsolescence due to evolving mobility trends.

However, investors should not overlook the growing risk that increased adoption of electric vehicles brings for traditional automotive real estate, especially if demand for fuel and related services declines faster than...

Read the full narrative on Getty Realty (it's free!)

Getty Realty's outlook anticipates $252.2 million in revenue and $92.5 million in earnings by 2028. This implies a 6.3% annual revenue growth rate and a $29 million earnings increase from current earnings of $63.5 million.

Uncover how Getty Realty's forecasts yield a $32.14 fair value, a 15% upside to its current price.

Exploring Other Perspectives

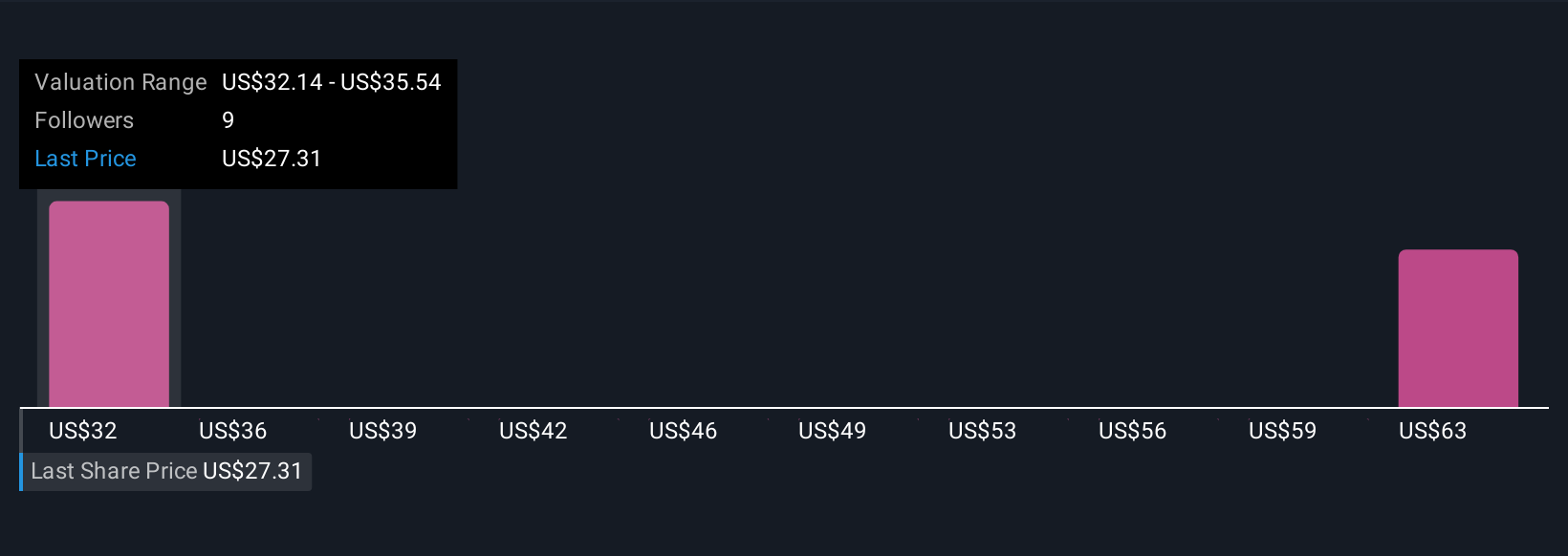

Private estimates from the Simply Wall St Community place Getty Realty’s fair value between US$32.14 and US$62.26 per share, based on two distinct views. While many assume stability from high occupancy and long leases, shifting sector fundamentals may challenge assumptions about sustainable rental growth.

Explore 2 other fair value estimates on Getty Realty - why the stock might be worth just $32.14!

Build Your Own Getty Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getty Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Getty Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getty Realty's overall financial health at a glance.

No Opportunity In Getty Realty?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTY

Getty Realty

A publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives