- United States

- /

- Retail REITs

- /

- NYSE:GTY

Does Getty Realty’s New $250 Million Debt Issuance Reshape Its Financial Strategy Outlook for GTY?

Reviewed by Sasha Jovanovic

- Getty Realty Corp. recently announced it has entered into agreements to issue US$250 million of senior unsecured notes, carrying a fixed interest rate of 5.76% and set to mature in ten years, with funding scheduled for January 22, 2026.

- This move will provide fresh capital to repay outstanding amounts under Getty Realty’s revolving credit facility and support future investment activity as part of the company’s ongoing financial management strategy.

- We’ll explore how this long-term debt issuance could influence Getty Realty’s investment outlook, especially regarding balance sheet flexibility and growth initiatives.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Getty Realty Investment Narrative Recap

To be a Getty Realty shareholder, you need to believe the automotive-focused real estate model can continue delivering stable cash flows and withstand the gradual shift away from gasoline-based transport. While the recent US$250 million senior notes issuance bolsters Getty’s liquidity and extends its debt maturity profile, it does not fundamentally change the most important catalyst, acquisitions in convenience and automotive retail, nor does it materially lessen the risk from long-term changes in fuel demand. Among the company’s recent announcements, the October 2025 dividend increase is closely tied to operating performance and reflects confidence in future cash flows, supported by steady growth in sales and net income. While shareholder rewards are appealing, the ability to sustain this momentum will still depend on how effectively Getty adapts to industry shifts and manages portfolio risks. But in contrast to the company’s secure-looking financials, investors should have a close look at how accelerating adoption of electric vehicles might affect demand for legacy fuel sites...

Read the full narrative on Getty Realty (it's free!)

Getty Realty's outlook anticipates $252.2 million in revenue and $92.5 million in earnings by 2028. This projection rests on a 6.3% annual revenue growth rate and a $29 million increase in earnings from the current $63.5 million.

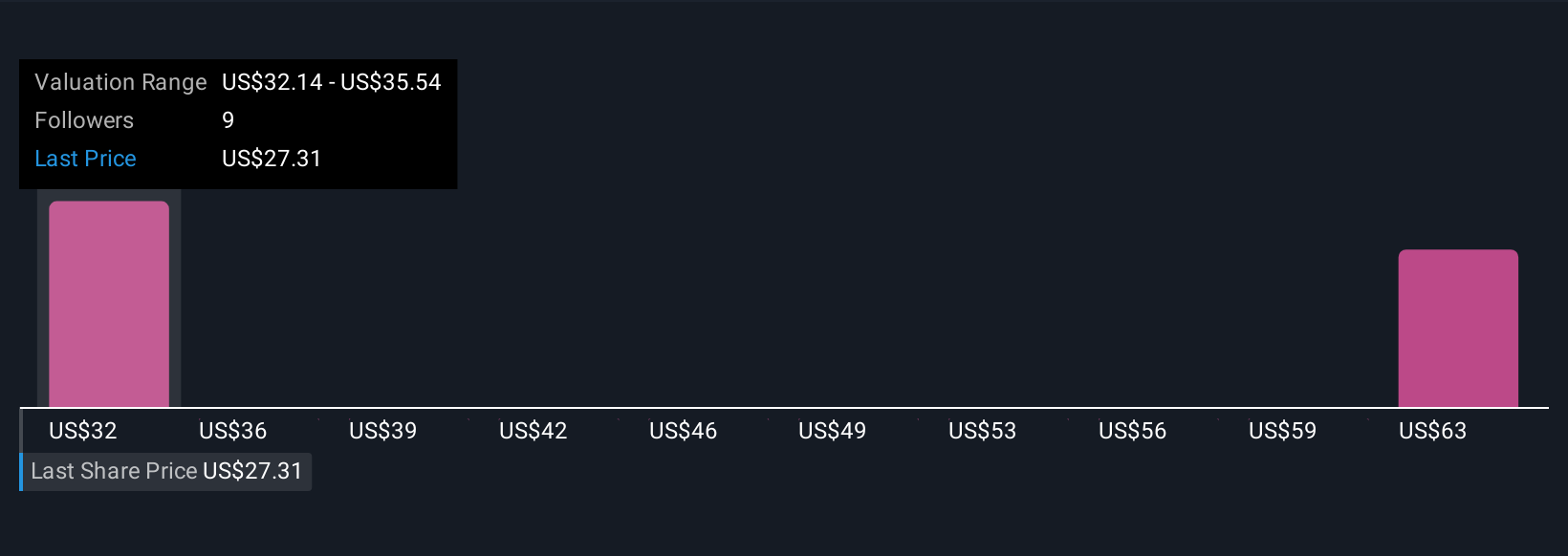

Uncover how Getty Realty's forecasts yield a $32.14 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for Getty Realty vary widely, ranging from US$32.14 to US$66.59 across 2 unique investor models. While there is broad disagreement on true worth, the company’s heavy exposure to shifts in automotive technology and fuel usage hints at potential uncertainty for future cash flows.

Explore 2 other fair value estimates on Getty Realty - why the stock might be worth over 2x more than the current price!

Build Your Own Getty Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getty Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Getty Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getty Realty's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTY

Getty Realty

A publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026