- United States

- /

- Industrial REITs

- /

- NYSE:FR

First Industrial Realty Trust (FR): Fresh Analyst Coverage and Strong Results Spark New Valuation Debate

Reviewed by Kshitija Bhandaru

Cantor Fitzgerald has just initiated coverage on First Industrial Realty Trust (FR), putting a spotlight on the company’s speculative development strategy. At the same time, First Industrial Realty Trust reported second quarter results that surpassed forecasts and announced an at-the-market equity offering to raise capital for new projects.

See our latest analysis for First Industrial Realty Trust.

First Industrial Realty Trust’s recent surge in investor attention follows not just the fresh analyst coverage and above-expectation results, but also a resilient showing in its long-term performance. While the latest equity raise reflects management’s confidence in future growth opportunities, momentum has cooled. The stock has a flat 1-year total shareholder return, and shares are now trading at $51.50. Still, the three-year total shareholder return of 24% indicates that patient holders have been rewarded through cycles.

If you’re curious where else momentum and fundamentals might be aligning, it could be an ideal moment to broaden your perspective and discover fast growing stocks with high insider ownership

With analysts split on First Industrial Realty Trust’s prospects and the stock trading below average price targets, the key question emerges: is there still untapped value here, or has the market already accounted for all its growth potential?

Most Popular Narrative: 8.6% Undervalued

The most widely followed narrative puts First Industrial Realty Trust’s fair value at $56.33, a modest premium to its recent closing price of $51.50. The stage is set by assumptions that rely heavily on the sustainability of recent rental gains and future profit margins amidst shifting market dynamics.

The company is currently benefiting from exceptionally strong rental rate growth (cash rental rate increases of 33 to 38 percent on new and renewal leasing), likely reflecting the ongoing shift toward e-commerce and supply chain reorganization. Investors may be overestimating the sustainability of these double-digit rent spreads given evolving demand and increased tenant caution, which could inflate both current revenue and forward earnings expectations.

Wondering what kind of future growth justifies this fair value? Unlock the narrative’s boldest assumptions, especially related to future earnings and profit margins, by reading the full story. The real justification behind this price may surprise you.

Result: Fair Value of $56.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent strong rental growth and limited new industrial supply could drive revenue and occupancy rates higher than analysts expect, which could challenge this cautious narrative.

Find out about the key risks to this First Industrial Realty Trust narrative.

Another View: Looking Through the Lens of Price Ratios

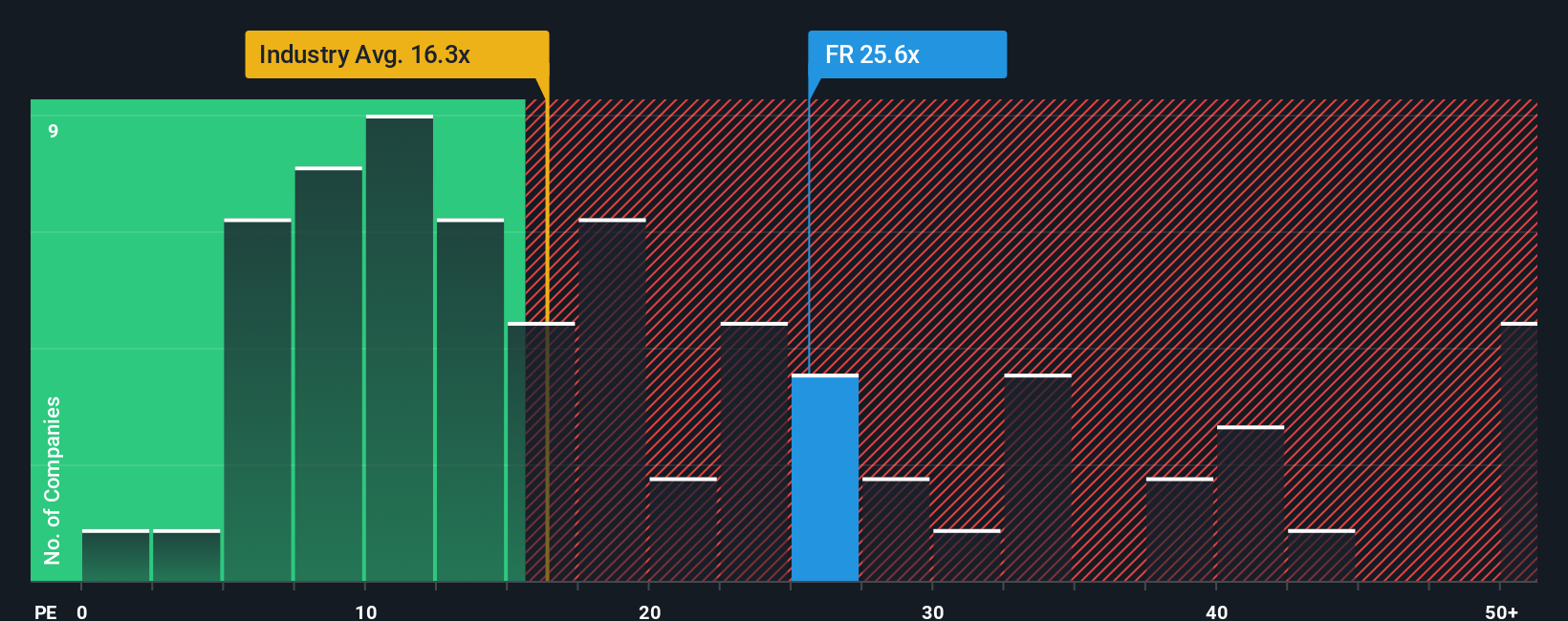

While the fair value estimate paints First Industrial Realty Trust as undervalued, a closer look at its price-to-earnings ratio reveals a different story. FR trades at 25.2 times earnings, which is more expensive than the global industrial REITs average of 16.4, but cheaper than its peer group at 30.6. The current ratio is also well below its calculated fair ratio of 32.4. This creates an interesting split: does the market demand justify this premium, or could it indicate extra risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Industrial Realty Trust Narrative

If you see the numbers differently or want to apply your own research approach, you can build a personalized view of First Industrial Realty Trust in just a few minutes with Do it your way

A great starting point for your First Industrial Realty Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to level up your portfolio, now is the moment to go after bold opportunities and see which trends are reshaping the market.

- Spot under-the-radar value by checking out these 909 undervalued stocks based on cash flows based on cash flows and shrewd financial metrics.

- Supercharge your returns with income-generating picks. Jump into these 19 dividend stocks with yields > 3% that offer reliable yields above 3%.

- Get ahead of the innovation curve and explore these 24 AI penny stocks packed with companies powering the AI revolution from the ground up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FR

First Industrial Realty Trust

First Industrial Realty Trust, Inc. (NYSE: FR) is a leading U.S.-only owner, operator, developer and acquirer of logistics properties.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives