- United States

- /

- Office REITs

- /

- NYSE:ESRT

Empire State Realty Trust (ESRT) Expands Credit Facility with New $210 Million Loan Will Liquidity Shift Drive Strategic Flexibility?

Reviewed by Sasha Jovanovic

- On November 14, 2025, Empire State Realty Trust announced an amended and expanded credit agreement with Wells Fargo Bank, Bank of America, and other lenders, securing a new US$210 million senior unsecured term loan facility, expandable up to US$310 million, to support working capital and general corporate needs through January 2029.

- This agreement increases the company's liquidity, offers flexible prepayment options, and links interest rates to potential investment grade ratings, enhancing financial flexibility and capital management capabilities.

- We’ll explore how this enhanced credit facility may shape Empire State Realty Trust’s investment outlook, especially regarding improved access to capital.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Empire State Realty Trust Investment Narrative Recap

To be a shareholder in Empire State Realty Trust, you would need to see long-term value in its prime New York assets and recurring income streams, while recognizing that earnings are affected by both tourism volatility and office space demand. The recent US$210 million senior unsecured term loan provides additional flexibility, but does not materially change the most pressing short-term catalyst, which remains resilient leasing momentum in its core office portfolio. The risk of further declines in Observatory segment income due to external travel factors continues to warrant close monitoring.

Of the recent announcements, the November 12, 2025 expansion lease with Gerson Lehrman Group stands out as especially relevant. This lease expansion highlights core tenant retention and growing demand for high-quality office space, a key catalyst for supporting revenue amid shifting urban work trends and rising expenses.

In contrast, investors should be aware that even robust liquidity can still leave ESRT exposed if global tourism to New York City fails to recover ...

Read the full narrative on Empire State Realty Trust (it's free!)

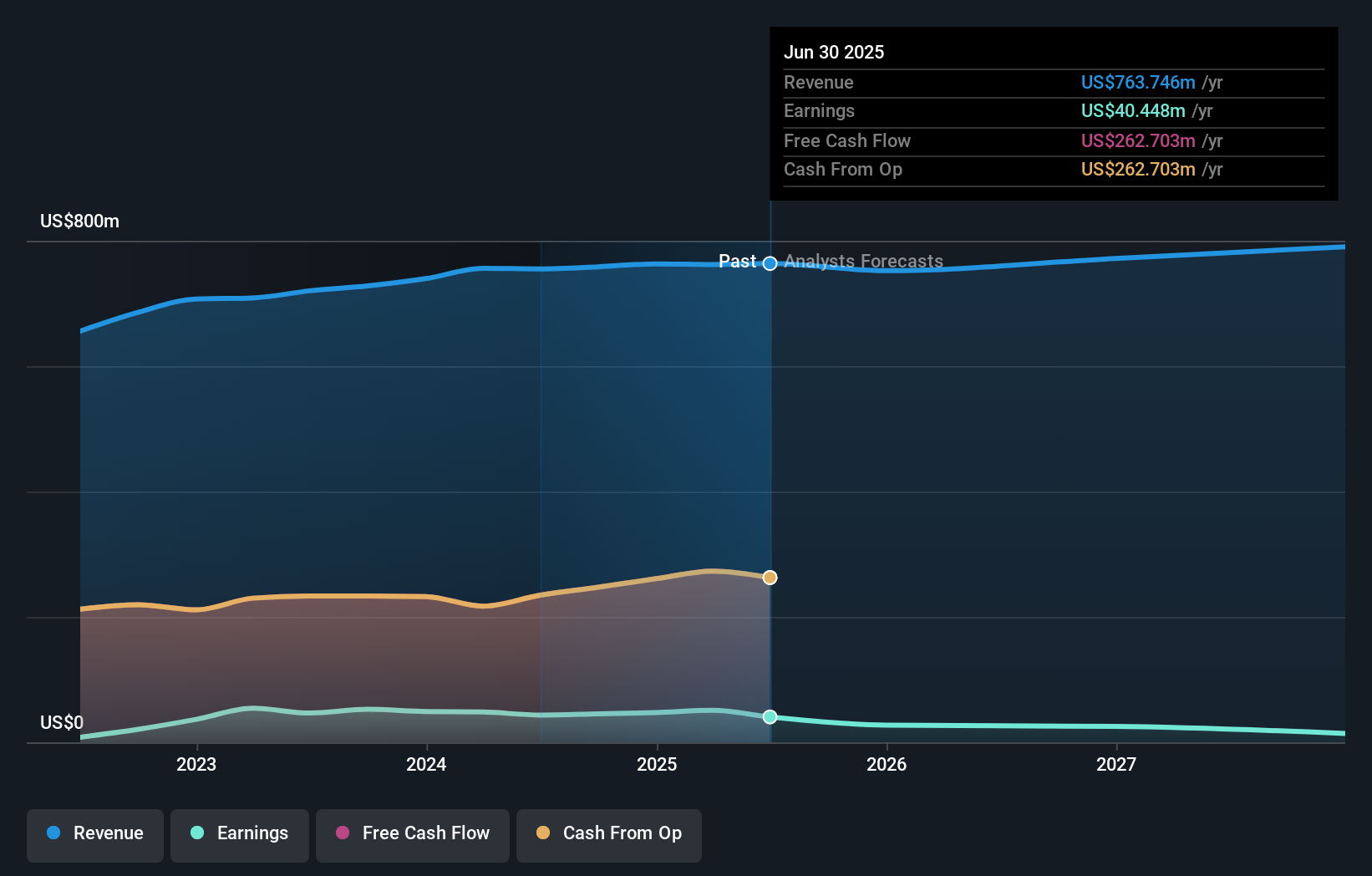

Empire State Realty Trust's outlook anticipates $797.6 million in revenue and $13.7 million in earnings by 2028. This implies a 1.5% annual revenue growth rate but a significant earnings decrease of $26.7 million from current earnings of $40.4 million.

Uncover how Empire State Realty Trust's forecasts yield a $8.55 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Based on one fair value estimate from the Simply Wall St Community, ESRT's US$8.55 valuation remains above recent trading levels. While some see substantial upside, ongoing cost pressures affecting net margins remind you that perspectives on value and risk can vary, consider evaluating multiple viewpoints.

Explore another fair value estimate on Empire State Realty Trust - why the stock might be worth just $8.55!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026