- United States

- /

- Residential REITs

- /

- NYSE:EQR

How a Rare Analyst Upgrade at Equity Residential (EQR) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, an analyst upgraded Equity Residential to "Strong Buy," highlighting its rare value amid a market seen as broadly overvalued, with the company's portfolio benefiting from strong apartment demand and resilient leasing spreads.

- This upgrade emphasizes Equity Residential's potential for steady growth, driven by its diversified presence in both coastal and Sunbelt markets and a historically high yield.

- We'll explore how the recognition of resilient apartment demand may influence Equity Residential's investment outlook moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Equity Residential Investment Narrative Recap

To be a shareholder in Equity Residential today, you need confidence in the durability of apartment demand in premium coastal and Sunbelt markets, and trust in the company’s ability to maintain leasing resilience despite new supply and regional economic fluctuations. The recent upgrade spotlights value and upside potential, but the most important short-term catalyst, rental demand stability, remains most exposed to local economic shifts and employment trends, which this news does not fundamentally change.

One relevant development is Equity Residential’s reaffirmed 2025 guidance for same-store revenue growth between 2.6% and 3.2%, alongside expected high occupancy of 96.4%. This underscores management’s ongoing belief in solid rental demand and occupancy, echoing analysts’ positive near-term outlook while supporting the case behind recent bullish sentiment.

By contrast, investors should also be aware that local economic volatility and regulatory challenges in costly urban markets could shift the outlook if...

Read the full narrative on Equity Residential (it's free!)

Equity Residential's narrative projects $3.5 billion in revenue and $669.9 million in earnings by 2028. This requires 4.3% yearly revenue growth and a decrease of $330 million in earnings from the current $1.0 billion level.

Uncover how Equity Residential's forecasts yield a $73.80 fair value, a 17% upside to its current price.

Exploring Other Perspectives

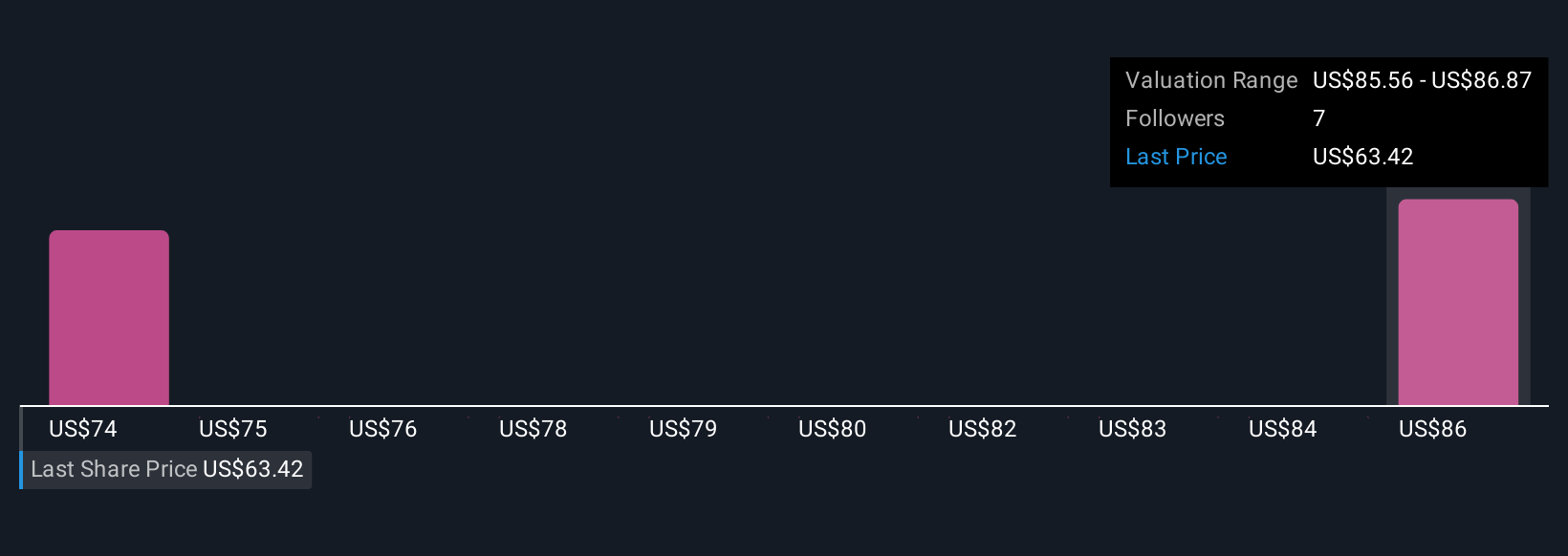

Two Simply Wall St Community members pegged Equity Residential’s fair value between US$73.80 and US$86.85. While revenue and occupancy guidance signals stability, investors recognize that regulatory and local economic risks could surprise, underscoring the importance of weighing several viewpoints before making any decisions.

Explore 2 other fair value estimates on Equity Residential - why the stock might be worth as much as 38% more than the current price!

Build Your Own Equity Residential Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equity Residential research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Equity Residential research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equity Residential's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Residential might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives