- United States

- /

- Office REITs

- /

- NYSE:EQC

Can You Imagine How Equity Commonwealth's (NYSE:EQC) Shareholders Feel About The 23% Share Price Increase?

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. But Equity Commonwealth (NYSE:EQC) has fallen short of that second goal, with a share price rise of 23% over five years, which is below the market return. Zooming in, the stock is up a respectable 12% in the last year.

See our latest analysis for Equity Commonwealth

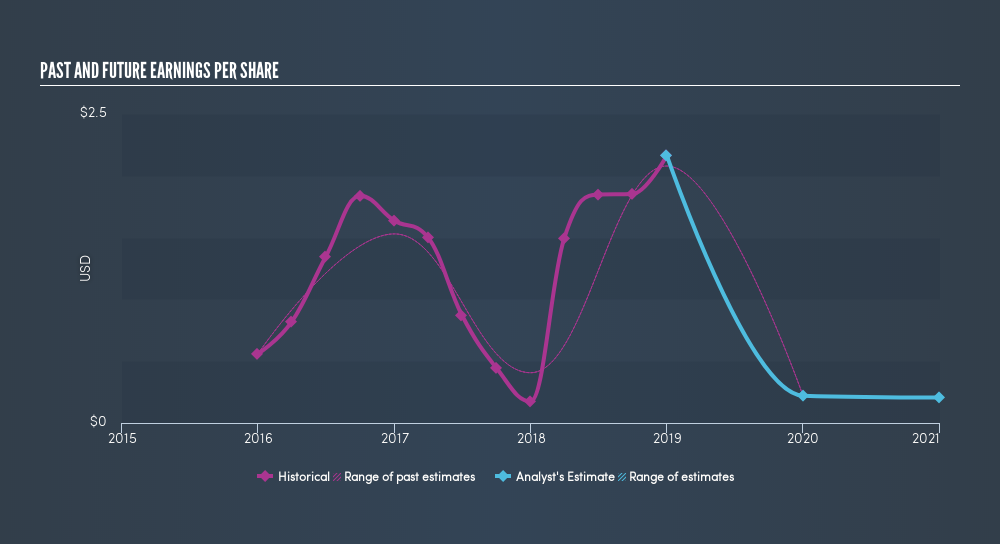

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Equity Commonwealth became profitable. That would generally be considered a positive, so we'd expect the share price to be up. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Equity Commonwealth share price has gained 21% in three years. During the same period, EPS grew by 57% each year. This EPS growth is higher than the 6.4% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Equity Commonwealth has grown profits over the years, but the future is more important for shareholders. This free interactive report on Equity Commonwealth's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Equity Commonwealth's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Equity Commonwealth's TSR of 33% over the last 5 years is better than the share price return.

A Different Perspective

It's good to see that Equity Commonwealth has rewarded shareholders with a total shareholder return of 21% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5.9% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Equity Commonwealth in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:EQC

Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally managed and self-advised real estate investment trust (REIT) with commercial office properties in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives