- United States

- /

- REITS

- /

- NYSE:EPRT

Essential Properties Realty Trust (EPRT): Margin Decline Challenges Bullish Narratives Despite Strong Revenue Growth

Reviewed by Simply Wall St

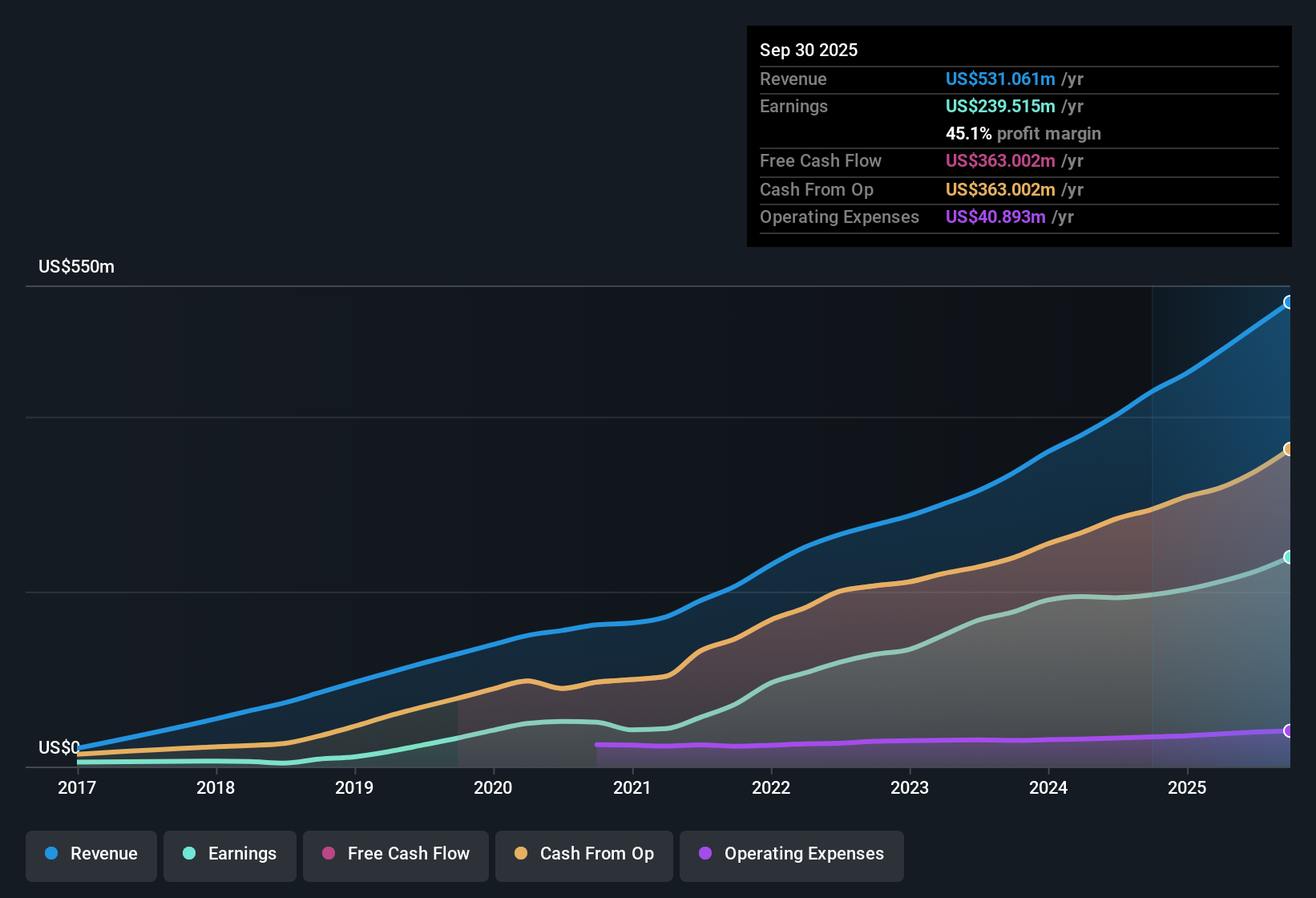

Essential Properties Realty Trust (EPRT) posted revenue growth of 12.2% per year, outpacing the broader US market’s 10% pace, while EPS is forecast to grow at 10.7% annually, slower than the market’s 15.5% rate. The net profit margin stands at 45.2%, slightly below last year’s 45.8%, and annual earnings growth of 22.2% lags the company’s five-year average of 28.5%. With the stock trading at $31.86, well below the estimated fair value based on discounted cash flows, investors are likely to weigh these solid historical and forward growth numbers alongside valuation signals and the company's overall financial position during this earnings season.

See our full analysis for Essential Properties Realty Trust.Next, we dig into how these fresh results compare with the prevailing narratives and expectations. Some themes will hold up, while a few market assumptions could get shaken.

See what the community is saying about Essential Properties Realty Trust

Analyst Price Target Sits 13% Above Current Share Price

- The current share price of $31.86 is 13% below the consensus analyst price target of $35.93, framing recent results as a potential opportunity for upside if expectations are met.

- According to the analysts' consensus view, that gap could close if projected earnings reach $320.5 million by 2028, but

- Consensus expectations require EPRT to trade at a PE of 33.6x on future earnings, which is above the current REITs industry average of 29.4x.

- Analyst forecasts differ widely, with the most bullish expecting $359.8 million in earnings and the most cautious targeting $277 million. This makes future upside dependent on growth delivery.

Looking for a balanced breakdown? See how differing analyst assumptions shape the price target and what it means for your investment stance. 📊 Read the full Essential Properties Realty Trust Consensus Narrative.

DCF Fair Value Suggests a Deep Discount

- Essential Properties trades considerably below its DCF fair value, with the stock at $31.86 against an estimated DCF fair value of $75.48. This indicates a 58% discount based on forecasted cash flows.

- Analysts' consensus view sees this valuation gap as linked to expectations that long-term, inflation-protected leases and stable rent escalations will drive reliable future cash flows,

- The company's average lease term is 14 years with annual contractual rent increases above 2%, strengthening arguments for predictable margins.

- High occupancy and recurring relationships, with 88% of investments from existing tenants, support the premise for long-duration value capture. However, profitability pressures could dampen upside.

Net Margins Edge Down Despite Quality Earnings

- Net profit margin stands at 45.2%, a modest slip from last year's 45.8%, even as the company continues to be recognized for high-quality earnings.

- Consensus narrative frames this margin trend as mostly resilient, helped by revenue diversity and long leases, but flags rising expenses and sector risks as threats to future profitability,

- Major exposure to car wash and restaurant tenants increases sensitivity to industry cycles and credit risk.

- The need for robust tenant quality and tight expense control will be crucial to prevent margins from slipping further.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Essential Properties Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Transform your perspective into a clear narrative in just a few minutes. Do it your way

A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Essential Properties’ margin resilience is being tested by rising expenses and industry-specific risks. This raises concerns about the stability of future earnings and cash flows.

If you’re seeking more reliable performance, use our stable growth stocks screener (2093 results) to find companies demonstrating consistent revenue and profit growth across a variety of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essential Properties Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPRT

Essential Properties Realty Trust

A real estate company, acquires, owns, and manages single-tenant properties in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives