- United States

- /

- Residential REITs

- /

- NYSE:ELS

Is Equity LifeStyle Properties Attractively Priced After Recent 4.9% Share Price Jump?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Equity LifeStyle Properties stock? You are not alone. The company has quietly carved out a niche in the real estate investment trust sector, and recent share price movement has caught investors' attention. Over the past month, shares have climbed 4.9%, suggesting a touch of optimism. Looking at a broader timeframe, the stock is down 7.3% in the past year and nearly 5% year-to-date, so it is fair to ask whether the negative sentiment has gone too far or if caution is still warranted.

Some of this volatility ties back to sector-wide headlines about shifting demand for affordable housing and lifestyle communities, as well as broader macroeconomic uncertainty about interest rates. Investors have also been digesting news of steady portfolio expansion and new community openings, which might have nudged sentiment and helped spark the recent bounce. Despite the short-term recovery, long-term performance is mixed: shares are up 22.7% over five years and 12.7% in three, a decent if not spectacular return compared to REIT peers.

So is the stock undervalued right now? By traditional metrics, Equity LifeStyle Properties lands a value score of 4 out of 6. That means it looks attractively priced on several counts, even if not across the board. In the next section, we will dig into those valuation checks in detail, and at the end, I will show you an even smarter way to frame your investment decision.

Approach 1: Equity LifeStyle Properties Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future adjusted funds from operations, then discounting those expected cash flows back to today’s value. For Equity LifeStyle Properties, this model uses its adjusted funds from operations as a base for projecting future cash generation.

Currently, Equity LifeStyle Properties reports annual free cash flow (FCF) of $596 million. Analysts estimate these cash flows will steadily rise over the coming years, with projections reaching $675 million by 2029. Only the next 5 years of cash flows are directly from analysts, and the remaining years are extrapolated. The DCF model reflects gradual growth, ending with a projected FCF of approximately $867 million in 2035.

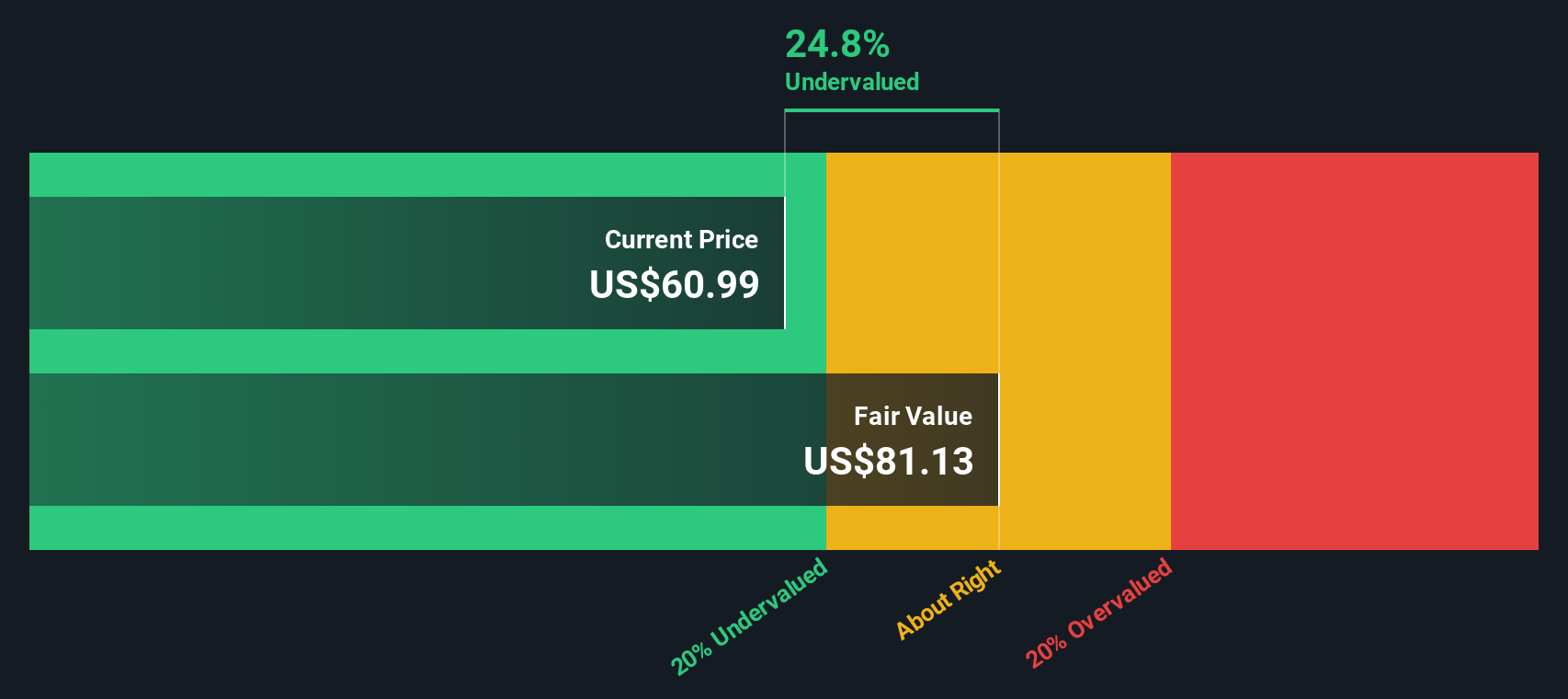

By discounting these future figures back to today’s dollars, the DCF model derives an intrinsic share value of $81.18. This is 21.9% above the current market price, signaling the stock is undervalued based on its long-term cash flow prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equity LifeStyle Properties is undervalued by 21.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Equity LifeStyle Properties Price vs Earnings

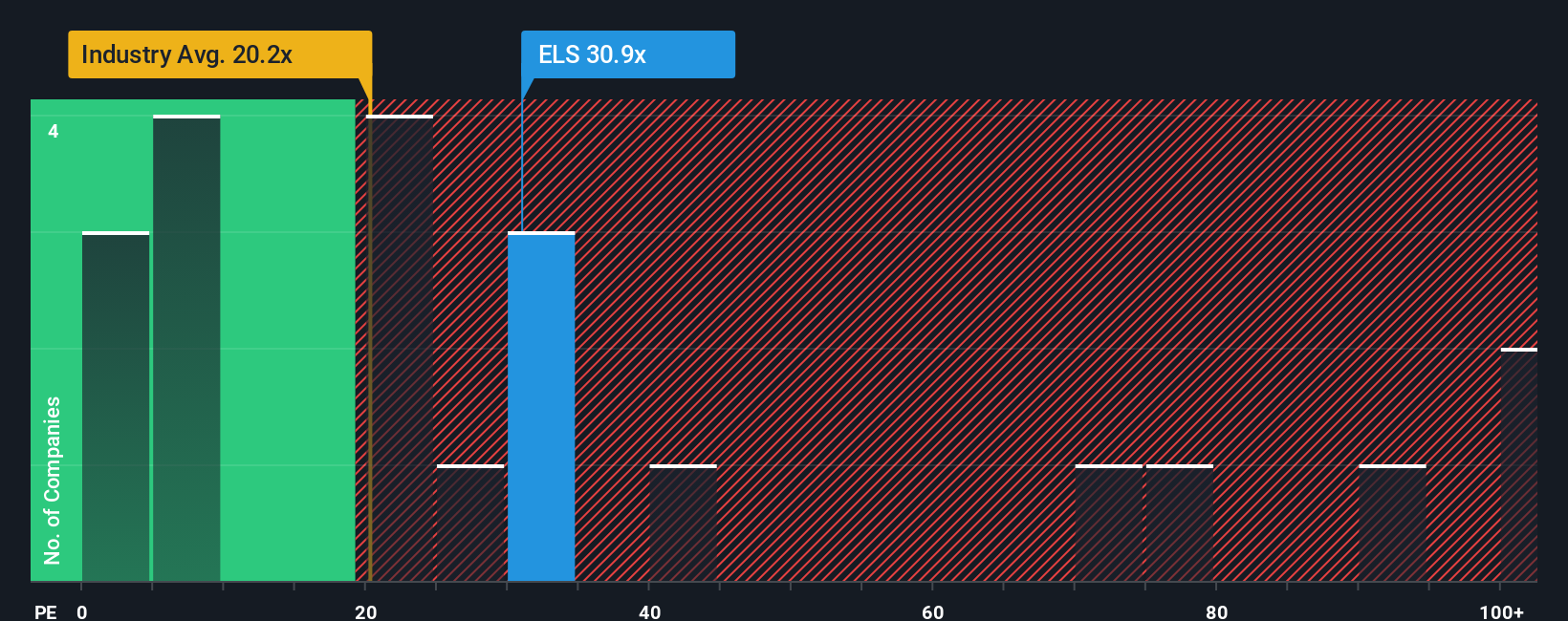

For profitable companies like Equity LifeStyle Properties, the price-to-earnings (PE) ratio is a widely used and meaningful valuation metric. It reflects how much investors are willing to pay for each dollar of earnings, making it especially relevant for businesses with consistent profits.

Generally, a higher PE ratio is justified when investors expect strong future growth or perceive lower risk, while a lower PE ratio signals more caution or lower growth expectations. The "right" PE ratio for any given stock is usually framed by looking at comparable companies and industry standards.

Currently, Equity LifeStyle Properties trades at a PE of 33.4x. For context, the average across the Residential REITs industry is 20.3x, and the peer group average is notably higher at 69.4x. This places Equity LifeStyle somewhere in the middle, higher than its industry but below peers.

However, these simple comparisons do not always tell the full story. That is where the Simply Wall St "Fair Ratio" comes in. This proprietary metric adjusts for crucial company factors such as earnings growth, profit margins, market cap, risk profile, and industry context, offering a more nuanced yardstick than plain peer or industry benchmarks.

For Equity LifeStyle Properties, the Fair Ratio is 33.4x, which matches almost exactly with its current PE. This suggests that the stock's current price is in line with what you would expect, given its specific growth and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equity LifeStyle Properties Narrative

Earlier, we mentioned there is an even smarter way to approach valuation. Let us introduce you to Narratives. A Narrative is a simple and powerful way for you to define your perspective on a company, combining your own story about its future with expected figures like revenue growth, margins, and fair value.

Unlike traditional ratios or analyst targets, a Narrative links the company's background and industry trends directly to a financial forecast. This then leads to a dynamic estimate of fair value. Narratives are easy to use and available right now within the Simply Wall St Community page, trusted by millions of investors worldwide.

With Narratives, you can see if the company's current share price is higher or lower than your own calculated fair value. This can help you make informed buy or sell decisions tailored to your outlook. Because Narratives update automatically as new data or news comes in, your view always stays up to date and relevant.

For example, when it comes to Equity LifeStyle Properties, one investor’s Narrative might see lasting Sunbelt housing demand supporting a fair value as high as $79.00. Another may focus on margin risks and see a lower target of $62.50. With Narratives, both perspectives are just a click away.

Do you think there's more to the story for Equity LifeStyle Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity LifeStyle Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELS

Equity LifeStyle Properties

We are a self-administered, self-managed real estate investment trust (“REIT”) with headquarters in Chicago.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives