- United States

- /

- Industrial REITs

- /

- NYSE:EGP

Will Strong Sunbelt Growth and Moody’s Upgrade Change EastGroup Properties' (EGP) Expansion Narrative?

Reviewed by Sasha Jovanovic

- On October 23, 2025, EastGroup Properties reported third-quarter earnings, showcasing revenue of US$182.14 million and net income of US$66.94 million, both up from the previous year, alongside an increased dividend and elevated rental rates in high-growth Sunbelt markets.

- Moody’s Ratings recently upgraded the outlook for EastGroup Properties from stable to positive, reflecting enhanced credit quality and the potential for lower borrowing costs to support future expansion initiatives.

- We'll explore how EastGroup’s stronger leasing spreads and dividend hike may alter its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

EastGroup Properties Investment Narrative Recap

To be a shareholder in EastGroup Properties, you need to believe in the sustained growth of e-commerce and migration to Sunbelt markets continuing to drive robust demand for modern logistics properties. The recent earnings report reinforces these structural tailwinds with solid leasing spreads and revenue, though it does not materially change the near-term catalyst, which remains the pace of tenant decision-making in larger spaces. The biggest risk still centers on prolonged leasing cycles and heightened exposure to sluggish markets like California.

One particularly relevant announcement is EastGroup’s 10.7% dividend increase, the 183rd consecutive quarterly distribution, announced in August. This boost underscores management’s confidence in the company’s operating model and strengthens the short-term investment case focused on recurring income generation. Investors paying close attention to EastGroup’s yield and payout reliability may view this as a signal of resilience against short-term market turbulence.

However, be aware that in contrast to headline growth trends, the risk of slower leasing activity in key development markets is something investors should closely monitor...

Read the full narrative on EastGroup Properties (it's free!)

EastGroup Properties' outlook anticipates $921.3 million in revenue and $339.7 million in earnings by 2028. This scenario assumes annual revenue growth of 10.8% and a $103.2 million increase in earnings from the current $236.5 million.

Uncover how EastGroup Properties' forecasts yield a $191.89 fair value, a 7% upside to its current price.

Exploring Other Perspectives

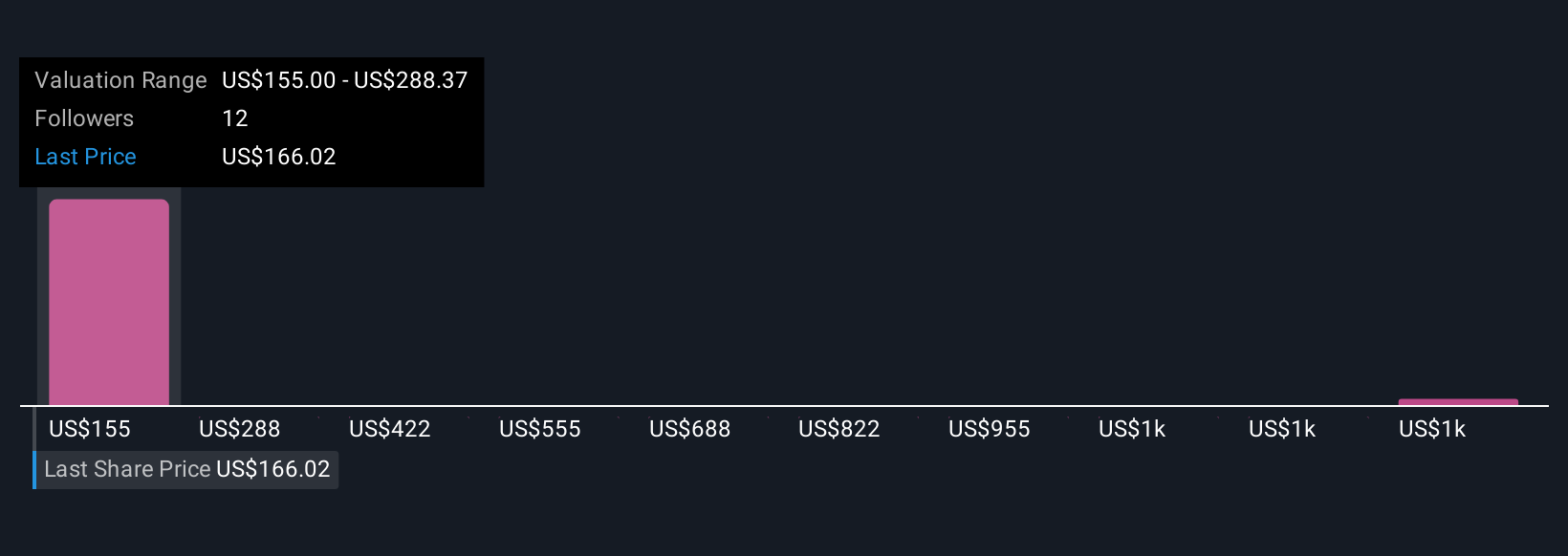

Retail investors in the Simply Wall St Community peg EastGroup Properties’ fair value between US$155 and US$1,488, based on five distinct estimates. While optimism around Sunbelt-led leasing growth persists, the wide range of opinions signals varied confidence in the company’s ability to overcome risks like prolonged tenant decision cycles.

Explore 5 other fair value estimates on EastGroup Properties - why the stock might be worth 13% less than the current price!

Build Your Own EastGroup Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EastGroup Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EastGroup Properties' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives