- United States

- /

- Industrial REITs

- /

- NYSE:EGP

EastGroup Properties (EGP): Margin Decline Challenges Bullish Valuation Narrative Despite DCF Discount

Reviewed by Simply Wall St

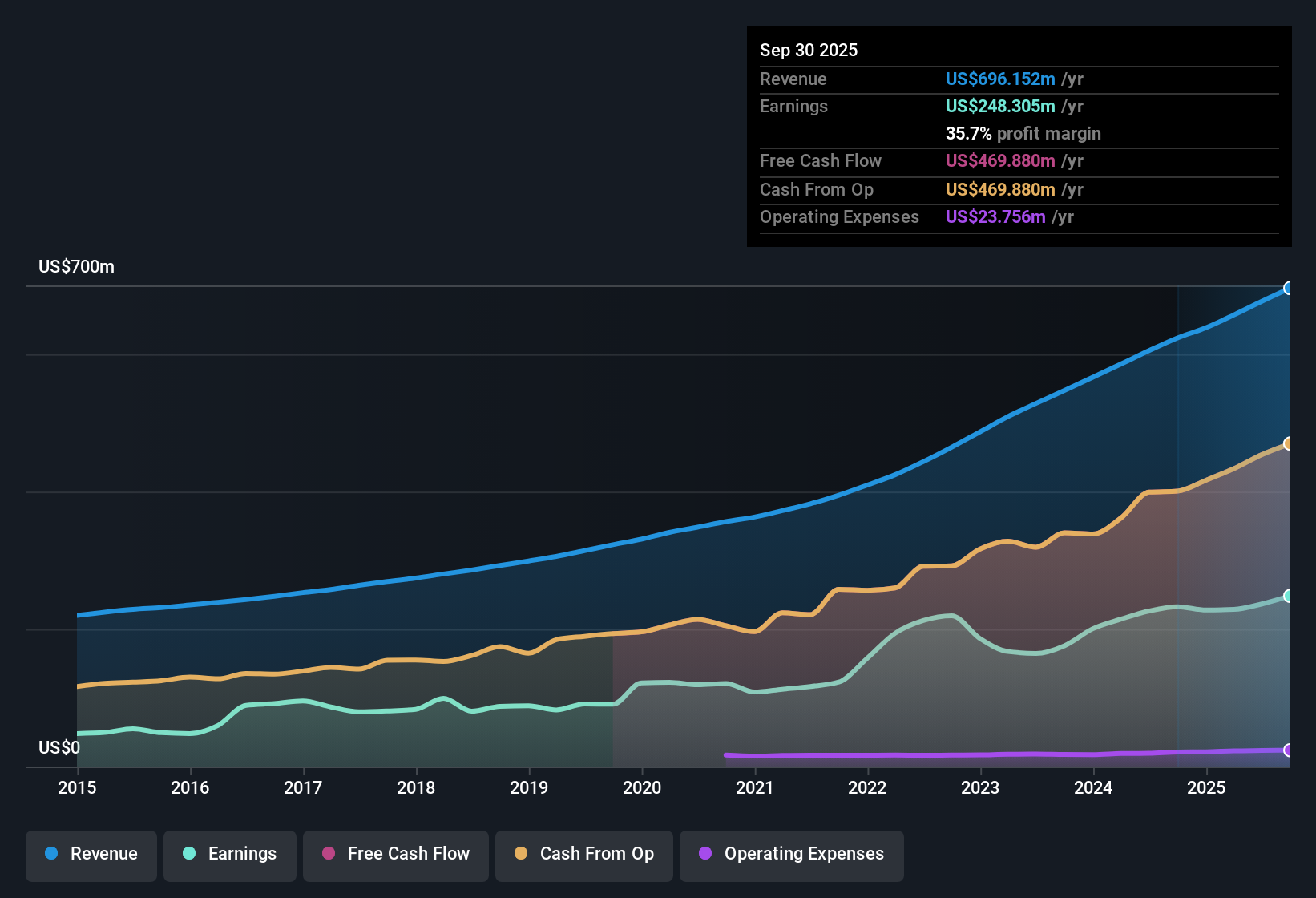

EastGroup Properties (EGP) capped another year of steady growth, with revenue expanding at 9.7% per year, which is slightly below the broader US market’s pace. The company’s EPS is forecast to climb 10.3% annually, also trailing the US average, while profit margins compressed, dipping from last year’s 37% to 35.7%. Despite the modest slowdown, a five-year earning growth rate of 14.3% underscores EastGroup’s longer-term consistency, even as the most recent annual gain moderated to 6.8%.

See our full analysis for EastGroup Properties.Now, let’s put these headline results next to the narratives that usually drive investor sentiment and see which story holds up. Some expectations could get reinforced, while others may run into new questions.

See what the community is saying about EastGroup Properties

Pricing Power Rides on Sunbelt Demand

- Analysts expect EastGroup’s revenue will rise by 10.8% per year for the next three years, outpacing the company’s recent annual growth and pointing to renewed momentum as regional fundamentals improve.

- Analysts' consensus view notes that strong absorption in the Sunbelt and limited new supply support high occupancy rates and healthy leasing spreads.

- They highlight how ongoing migration trends and supply chain modernization are boosting EastGroup’s infill logistics facilities, underpinning revenue and NOI growth that is projected to remain ahead of national averages.

- However, the consensus narrative also acknowledges that constrained capital access and regional economic shifts could test this momentum if those tailwinds taper.

Consensus expectations point to continued outperformance, but question marks linger as to whether Sunbelt strength can outweigh looming macro headwinds. 📊 Read the full EastGroup Properties Consensus Narrative.

Margins Stabilize With Profit Rate Rebound Forecast

- Profit margins are projected to increase from 34.9% today to 36.9% over the next three years, shifting direction after last year’s moderation.

- According to the analysts' consensus view, EastGroup’s portfolio is positioned to benefit from elevated rental demand in last-mile facilities and supply-constrained markets.

- Consensus expects margin expansion to resume, driven by pricing power in technology-driven Sunbelt metros and stable occupancy rates.

- Analysts also point out that margin recovery will depend on avoiding spikes in concessions and successfully managing exposure to markets facing regulatory or climate headwinds.

DCF Valuation Shows Steep Discount, Multiples Still Rich

- Shares recently traded at $177.20, well below the DCF fair value estimate of $230.46, suggesting upside. Yet on a PE basis (38x), the stock trades at a sizable premium to the global industrial REITs sector average of 16.7x.

- The analysts' consensus view highlights this valuation gap; strong forecasts and high-quality growth justify a premium, but investors need confidence in future margin expansion and stable capital markets to close the divide.

- If you believe EastGroup can achieve projected earnings of $339.7 million by 2028, then today’s discount versus DCF fair value may appeal.

- However, consensus also flags that further gains hinge on revenue hitting $921.3 million and ability to sustain growth without significant cost inflation or capital market constraints.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EastGroup Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the data from a different angle. Share your unique perspective and shape your own story in just a few minutes with Do it your way.

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite consistent long-term growth, EastGroup Properties faces concerns with premium valuations and the need to prove continued margin expansion to justify its price.

If you'd prefer companies trading at more attractive prices backed by strong fundamentals, focus your search on these 877 undervalued stocks based on cash flows to discover undervalued opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives