- United States

- /

- Industrial REITs

- /

- NYSE:EGP

A Fresh Look at EastGroup Properties (EGP) Valuation Following $250 Million Financing Deal

Reviewed by Simply Wall St

EastGroup Properties (EGP) just announced that it secured $250 million in new unsecured term loans, along with some updates to its existing credit agreement. This kind of move can matter for investors because it influences future borrowing costs and provides extra capital flexibility for growth or operations.

See our latest analysis for EastGroup Properties.

EastGroup’s share price has gained real momentum this year, with a 14.5% year-to-date rise and a solid 9.9% total shareholder return over the past twelve months. The strong 30-day and 90-day share price returns suggest that recent news about expanding debt capacity is being viewed as a catalyst. This appears to reinforce confidence in both growth prospects and the company’s ability to manage capital efficiently over the long term.

If you’re curious about where else growth and insider conviction are showing up, it’s worth exploring fast growing stocks with high insider ownership.

With shares closing at $181.18 and analysts’ price targets just 7% higher, while fundamentals like revenue and net income keep rising, is there real upside left for EastGroup, or has the market already priced in the next stage of growth?

Most Popular Narrative: 6.5% Undervalued

The most widely followed narrative points to a fair value of $193.84, which sits above EastGroup’s last close at $181.18. This sets the stage for a fresh look at what’s driving sentiment: robust property demand, ambitious growth forecasts, and mounting expectations for future profit margins.

Structural US population growth and migration to Sunbelt markets continue to underpin robust demand for modern industrial/logistics properties. This trend directly benefits EastGroup's core portfolio and positions the company for sustained revenue and NOI growth as these regions outpace national averages. Persistent e-commerce expansion and ongoing supply chain modernization are ensuring elevated leasing spreads and high occupancy in EastGroup's infill, last-mile logistics facilities. These factors support above-average rental rate growth and drive resilient net margins.

What’s behind that premium price? There is a bold bet on relentless regional growth and a future profit margin that challenges the sector’s usual playbook. Discover which financial leapfrogs this narrative expects EastGroup to achieve before 2028, then see how the numbers fit together.

Result: Fair Value of $193.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macro uncertainty and slower development leasing could limit near-term growth. This makes upside less certain if market headwinds persist.

Find out about the key risks to this EastGroup Properties narrative.

Another View: Industry Multiples Raise Questions

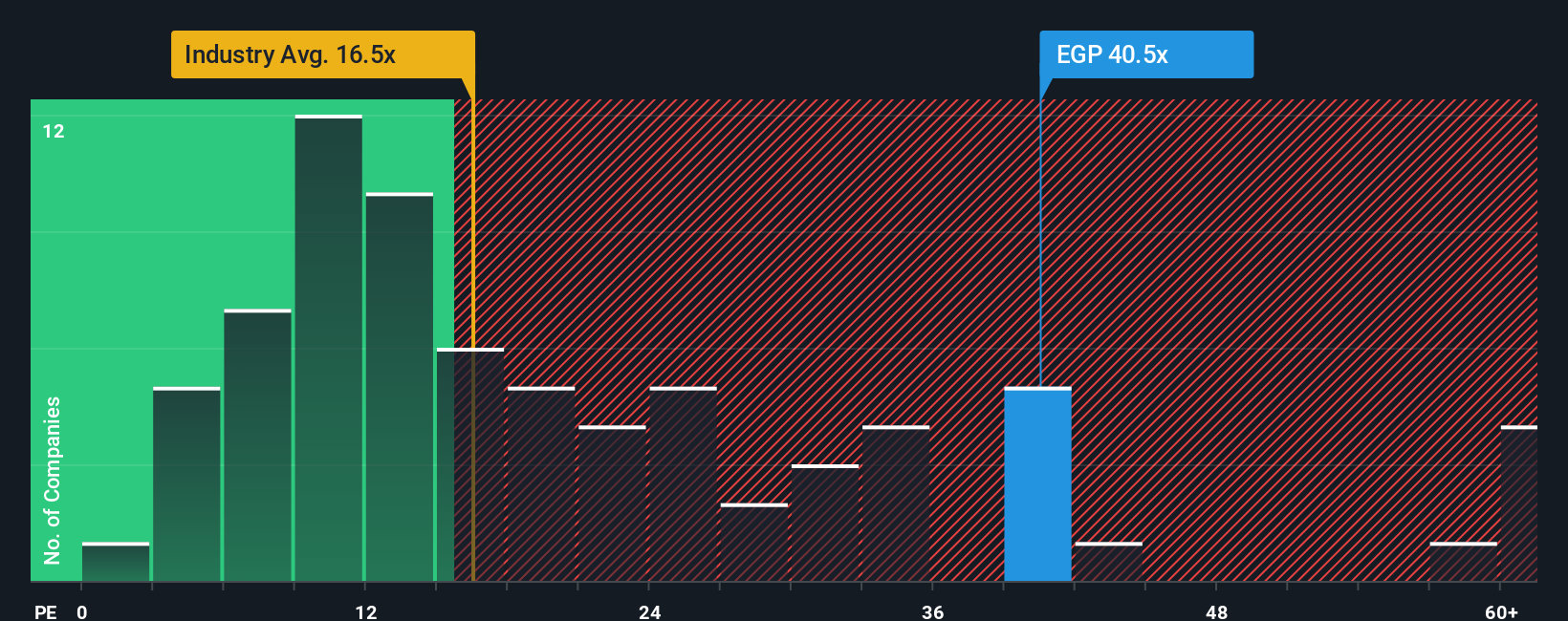

Taking a look from a different angle, EastGroup trades at a price-to-earnings ratio of 38.9x. That is notably higher than both its peers (28.1x) and the wider global industry (16.1x), and even ahead of the fair ratio of 33.5x the market could eventually revert to. This creates a real risk that sentiment is running ahead of fundamentals. Is there enough momentum to keep supporting this premium, or does it set up for a future reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EastGroup Properties Narrative

If you have your own take or want to dig into the data directly, you can easily craft your personal outlook in just a few minutes. Do it your way.

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that winners rarely sit still for long. Get ahead of the curve by finding your next compelling stock idea using Simply Wall Street's dynamic screeners.

- Unearth overlooked value by targeting these 916 undervalued stocks based on cash flows. These screen for high future cash flow potential and may be trading well below their intrinsic worth.

- Tap into the latest healthcare innovation by starting with these 30 healthcare AI stocks, which highlights companies pushing breakthroughs in patient care and AI-driven research diagnostics.

- Boost your potential income with these 15 dividend stocks with yields > 3%, featuring options offering yields over 3%. This can help build a robust and rewarding portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026