- United States

- /

- Specialized REITs

- /

- NYSE:DLR

How Does Digital Realty’s Growth Outlook Stack Up After Recent Data Center Expansion?

Reviewed by Bailey Pemberton

Thinking about what to do with your Digital Realty Trust shares, or wondering if now is the right time to get involved? You are definitely not alone. With data at the center of every industry, it's natural to be intrigued by a company that provides the backbone for so much of the world's cloud infrastructure. Yet, while the narrative around Digital Realty Trust certainly gives off long-term optimism, the stock's journey has been far from a straight shot upward.

Taking a glance at recent performance, Digital Realty Trust’s price edged down by 0.7% over the past week and has barely budged over the last month, up just 0.1%. Year to date, the stock is down 1.7%. Looking further outward, the chart reveals a different story entirely: up 9.4% over twelve months, and an impressive 103.4% over three years. Five-year holders have still seen a 35.9% gain, which highlights steady, if sometimes bumpy, growth. Investors watching data center demand, as well as the recent buzz about shifting risk perceptions and new market partnerships, may see reasons for the stock to attract fresh interest or caution.

But price action alone does not determine whether the stock offers value right now. Drilling into six key valuation checks, Digital Realty Trust is currently undervalued in 2 of them, giving it a value score of 2. So, is it a hidden bargain, fairly priced, or something else entirely? Let’s break down how traditional valuation methods stack up. Stay tuned, as we will examine an even sharper lens for judging the company’s real value before wrapping up.

Digital Realty Trust scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Digital Realty Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by taking Digital Realty Trust’s adjusted funds from operations, projecting future cash flows, and then discounting those amounts back to today’s dollars. This approach aims to estimate what the underlying business is truly worth, regardless of near-term market swings.

Right now, Digital Realty Trust generates annual Free Cash Flow of about $2.02 billion. According to current analyst estimates, the company’s Free Cash Flow is expected to steadily increase, reaching $3.63 billion by the end of 2029. For the years beyond analysts’ coverage, cash flow forecasts are extrapolated by Simply Wall St, continuing this steady upward trend.

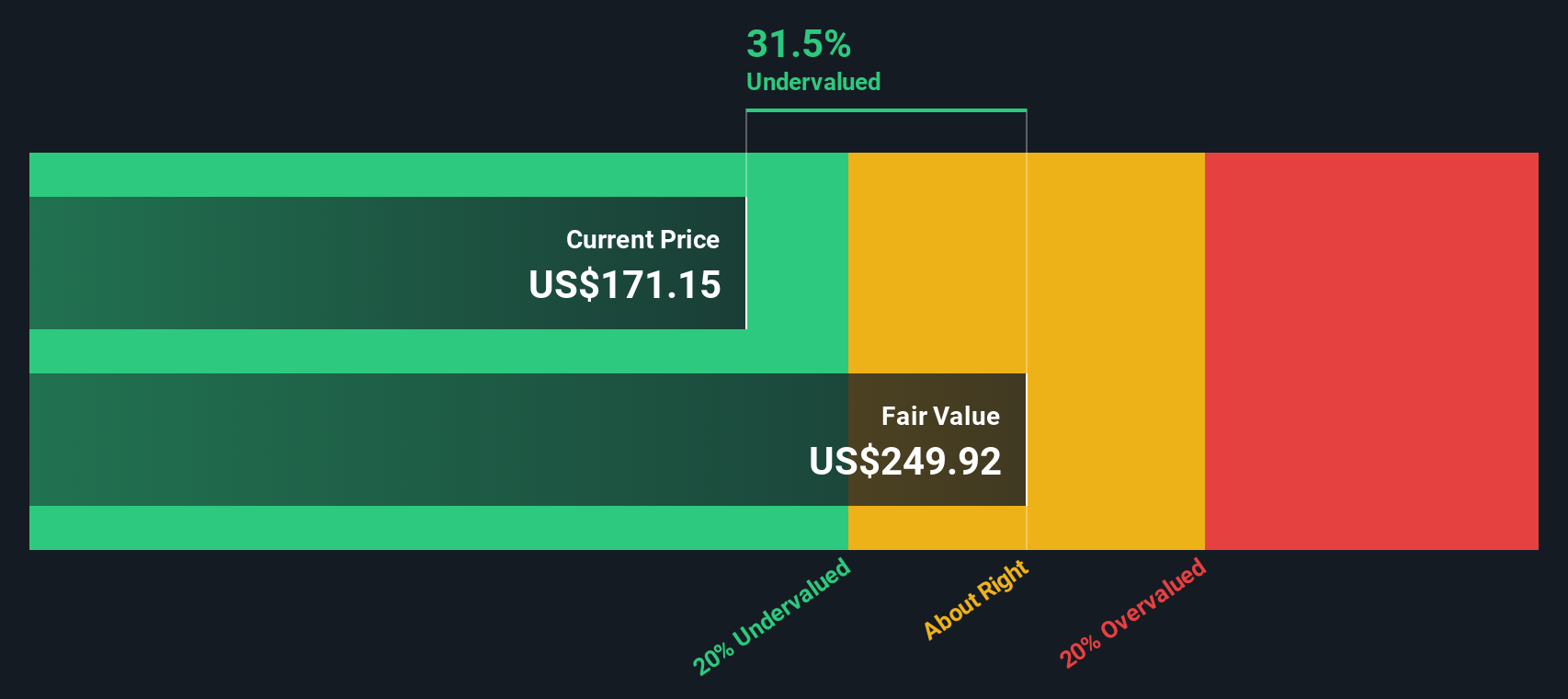

Running these projections through the DCF model, the resulting estimated intrinsic value for Digital Realty Trust lands at $249.18 per share. That calculation implies the stock is 30.2% undervalued compared to its current share price. Investors may be getting a significant discount on the company’s future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 30.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Digital Realty Trust Price vs Earnings

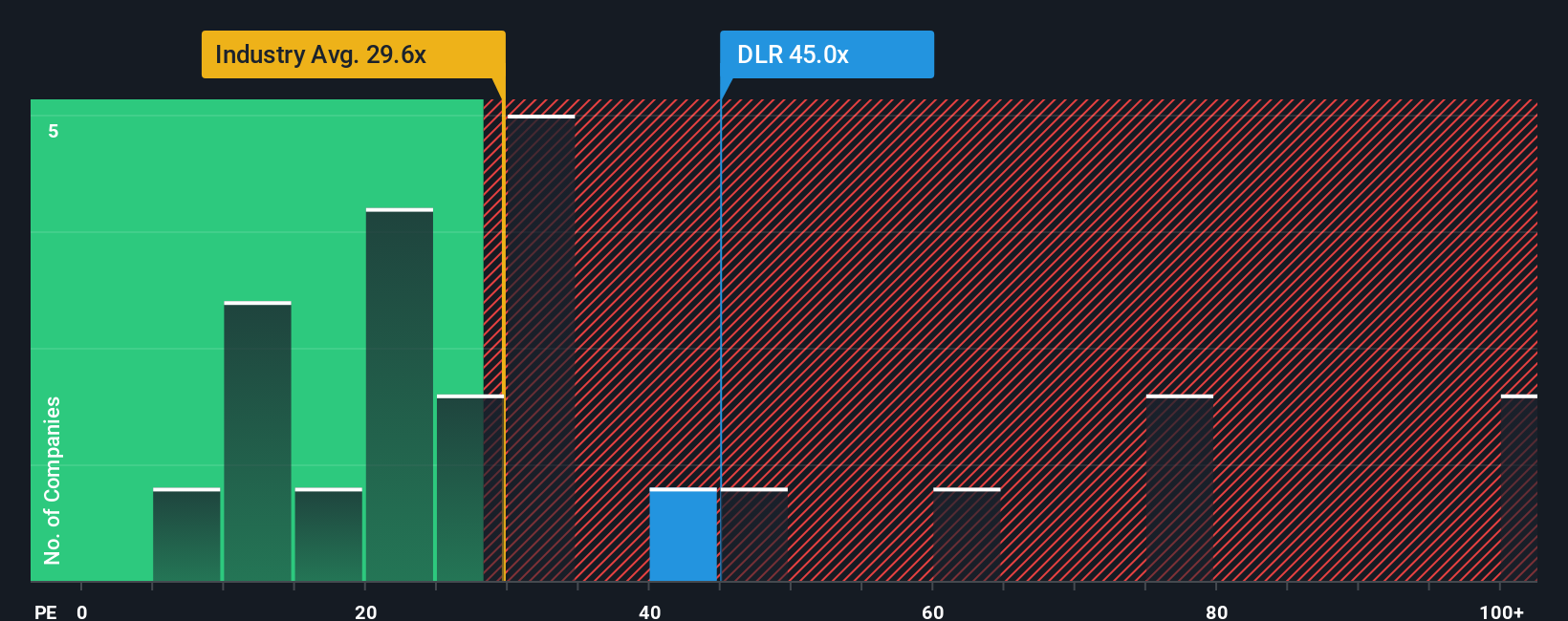

For profitable companies like Digital Realty Trust, the price-to-earnings (PE) ratio is a classic and insightful way to assess valuation. The PE ratio tells investors how much they are paying for each dollar of company earnings, making it especially relevant when a company's profits are both positive and consistent.

The "normal" or "fair" PE ratio for any stock is shaped by investor expectations for future growth and the perceived risks in the business. Companies with higher growth prospects or lower risks can often justify a premium PE, while those facing uncertainties or slower growth typically trade for lower multiples.

Currently, Digital Realty Trust trades at a PE ratio of 44.2x. By comparison, the industry average in the Specialized REITs segment is just 17.5x, while the average among its closest peers stands at 40.3x. This suggests the stock commands a meaningful premium to most of its sector, reflecting optimism about its future prospects or lower risk profile.

To move beyond simple averages, Simply Wall St uses a "Fair Ratio" in this case, 30.1x which is tailored to Digital Realty Trust's own growth outlook, profit margins, market risks, and overall industry context. Unlike plain peer or industry comparisons, the Fair Ratio method offers a smarter benchmark anchored in company-specific fundamentals.

Comparing Digital Realty Trust’s current PE of 44.2x to its Fair Ratio of 30.1x points to a stock trading significantly above where it would be considered fair value using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Digital Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, where you explain what you believe will drive its success or setbacks in the future, then translate your view into expected revenue, profit, and fair value numbers. Narratives bring investing to life by linking Digital Realty Trust’s real-world catalysts and risks directly to a tailored financial forecast, letting you see how your assumptions stack up to the numbers.

With Narratives on Simply Wall St’s Community page, millions of investors use this powerful and easy tool to decide when to buy or sell by comparing their own Fair Value to the current share price, based on their perspective. As markets move and new information like earnings or big news emerges, Narratives update dynamically, so your story stays relevant and accurate. For example, some investors may see AI-driven demand and project a fair value over $195 for Digital Realty Trust, while others anticipate margin pressure or competition and set their fair value as low as $110. Your investment thesis is always reflected by your numbers.

For Digital Realty Trust, we’ll make it straightforward for you by presenting previews of two leading Digital Realty Trust Narratives:

- 🐂 Digital Realty Trust Bull Case

Fair Value: $195.44

Current discount to fair value: 11.0%

Expected revenue growth: 11.5%

- Strong demand for data center capacity and strategic expansions is expected to drive future revenue growth and improve profitability.

- Sustainability initiatives, such as green data centers and renewable energy use, are anticipated to enhance cost savings and strengthen market competitiveness.

- Key risks include potential oversupply, rising interest rates impacting financing costs, and increased competition from both new and established players.

- 🐻 Digital Realty Trust Bear Case

Fair Value: $110.45

Current premium to fair value: 57.5%

Expected revenue growth: 7%

- AI, cloud computing, and digital transformation are fueling strong demand, with global and hyperscale expansion presenting near- and mid-term growth opportunities.

- Valuation is seen as reasonable now, but risks include rising interest rates, increasing debt costs, and intensified competition, which could challenge future profitability.

- Potential overcapacity, operational execution, and tenant concentration risks may limit upside if industry trends change or execution falters.

Do you think there's more to the story for Digital Realty Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives