- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty (DLR): Evaluating Valuation Following New Analyst Coverage and Enterprise AI Partnership Announcements

Reviewed by Kshitija Bhandaru

Digital Realty Trust (DLR) has drawn new attention after Morgan Stanley initiated coverage and the company announced fresh partnerships with Dell Technologies, DXC Technology, and Lumen Technologies. These moves position Digital Realty to capture rising demand for enterprise AI and hybrid cloud services.

See our latest analysis for Digital Realty Trust.

Digital Realty’s latest partnerships and coverage from Morgan Stanley have coincided with the stock holding steady near $173, as investors weigh new AI and hybrid cloud initiatives against short-term share price volatility. Despite a modest 1-year share price move, the total shareholder return has climbed 7.5% over the last year and nearly doubled over three years. This suggests momentum could be building as confidence grows around AI-driven growth prospects.

If you’re looking for the next big opportunity in digital infrastructure, it’s a great time to discover other high-growth tech and AI stocks — See the full list for free.

With shares hovering near recent highs and analysts pointing to healthy upside, the question now is whether Digital Realty remains undervalued in the rush for AI infrastructure, or if the market has already factored in future growth potential.

Most Popular Narrative: 11.6% Undervalued

With the narrative setting a fair value at $195.44 compared to Digital Realty’s $172.73 last close, investors are looking at potential upside and renewed bullish sentiment. Expectations that data center demand and recent strategic actions could fuel significant future growth also play a role in shaping sentiment.

Digital Realty's record backlog of leases, which have not yet commenced, indicates strong future revenue potential and earnings growth due to steady demand for data center capacity, particularly from AI and cloud service providers.

Want to peek behind the curtain of this valuation? The boldest forecasts hinge on a surge in revenue, along with an unusually high earnings multiple that bucks the industry trend. Curious what surprising assumptions justify such a premium? See which figures power this target and why some believe Digital Realty is poised for a breakout.

Result: Fair Value of $195.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion could outpace demand, and higher interest rates might squeeze margins, challenging the optimism around Digital Realty’s future growth.

Find out about the key risks to this Digital Realty Trust narrative.

Another View: Market Ratios Raise a Flag

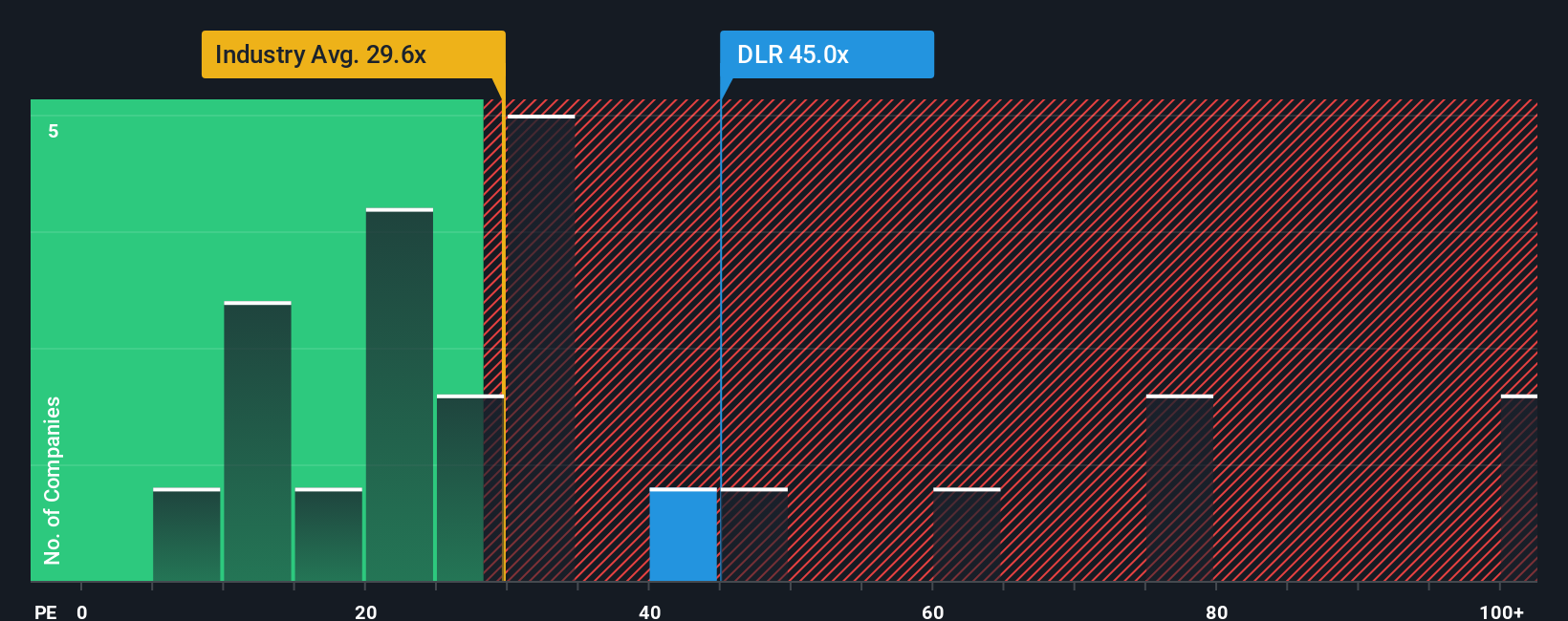

Looking beyond forward-looking price targets, Digital Realty’s valuation appears expensive when considering its price-to-earnings ratio of 43.9x. This is considerably higher than both the peer average of 40.3x and the US Specialized REITs industry at 28.8x. It is also well above the fair ratio of 30.1x based on regression analysis. This difference suggests that investors could be taking on valuation risk at current levels. Does the market see something others do not, or are expectations running too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you want to dig deeper or bring your own perspective to the numbers, you can quickly craft your own story in just a few minutes. Do it your way

A great starting point for your Digital Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let tomorrow’s biggest opportunities pass you by. The smartest investors always keep an eye on fresh trends, high-potential disruptors, and value plays others overlook.

- Tap into untapped potential with these 3596 penny stocks with strong financials, featuring companies making waves with strong financial performance and bold innovation.

- Boost your passive income by checking out these 18 dividend stocks with yields > 3%, which are delivering attractive yields above the market average and show solid fundamentals.

- Stay at the forefront of technology by following these 24 AI penny stocks, set to benefit from advances in artificial intelligence and next-generation solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives