- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Assessing Digital Realty Trust’s (DLR) Valuation After Recent Steady Share Price Gains

Reviewed by Kshitija Bhandaru

Digital Realty Trust (DLR) shares have edged higher over the past month, reflecting ongoing investor interest in data center operators as demand for cloud and AI infrastructure continues. The stock’s roughly 7% gain highlights this steady momentum.

See our latest analysis for Digital Realty Trust.

Digital Realty Trust’s gradual climb this month comes after a year of steady progress, with its 12-month total shareholder return of 13.7% signaling that investor confidence is mounting around the company’s expanding data center footprint and exposure to surging cloud infrastructure demand. While news headlines have been relatively quiet lately, the sustained momentum in total returns suggests that long-term holders continue to see solid value and growth potential in this company.

If you’re watching the data infrastructure story unfold, now is a great opportunity to discover See the full list for free.

With shares up, but still trading below analyst price targets and some measures of intrinsic value, the real question is whether Digital Realty Trust offers genuine upside or if the market has already accounted for its future growth.

Most Popular Narrative: 11.1% Undervalued

Digital Realty Trust’s most popular narrative places its fair value at $195.44, notably above the last close of $173.75. This dynamic raises pressing questions about what assumptions are driving the perceived upside and how sustainable future growth will be.

Digital Realty's record backlog of leases, which have not yet commenced, indicates strong future revenue potential and earnings growth due to steady demand for data center capacity, particularly from AI and cloud service providers.

Want to know why this fair value is so much higher than today’s price? Hint, it is all about surging demand and a strategic revenue growth play. The financial logic at the heart of this price target may surprise you. There is a hidden earnings story ready to reshape expectations. Curious which big projections are fueling it? Dive in to uncover the full narrative.

Result: Fair Value of $195.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as oversupply in key markets and rising interest rates. Either of these factors could pressure Digital Realty’s growth trajectory.

Find out about the key risks to this Digital Realty Trust narrative.

Another View: The Multiple Tells a Different Story

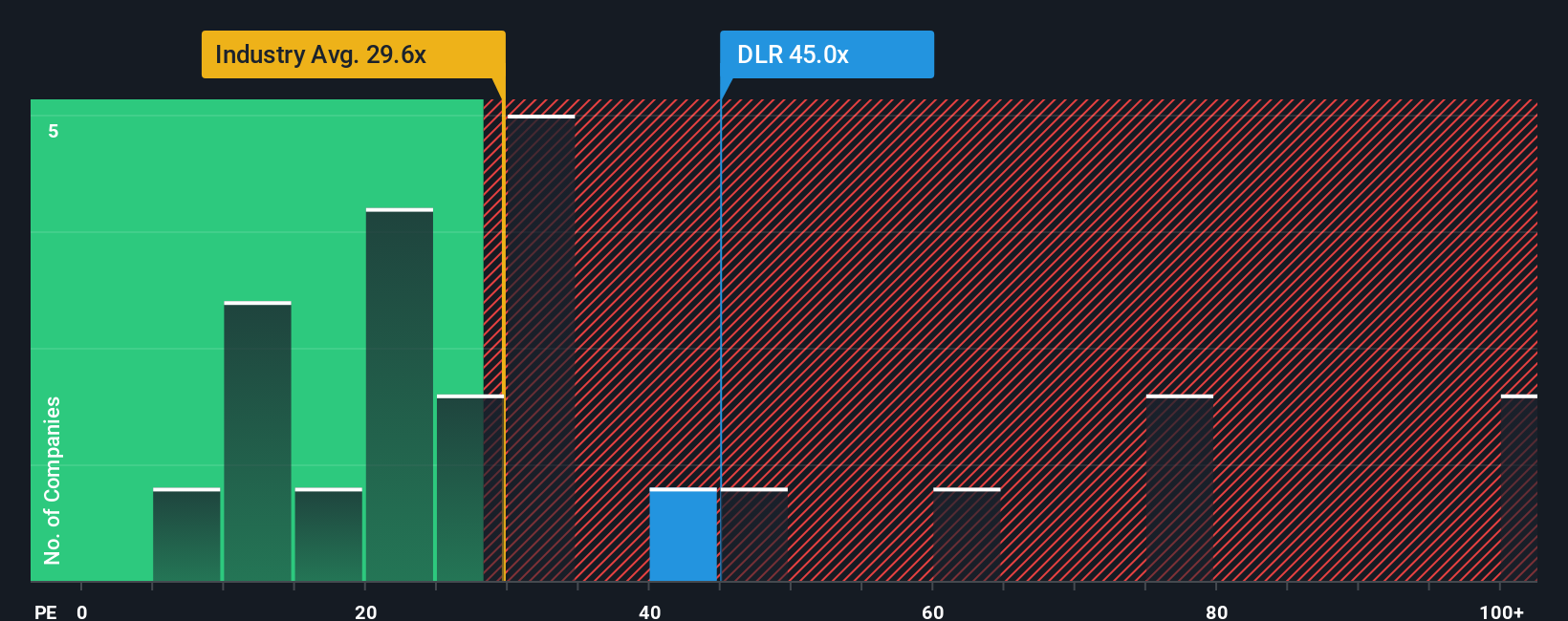

Looking at how the market values Digital Realty Trust compared to similar companies paints a different picture. The current price-to-earnings ratio stands at 44.2x, which is notably higher than both the US Specialized REITs industry average of 29.6x and the peer group average of 39x. It even exceeds the fair ratio, which sits at 30.3x. Such a premium could signal optimism about future prospects, but it also means investors are paying up, leaving less room for disappointment. Does this stretched ratio highlight hidden risks, or is it justified by growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own story in just a few minutes, so why not Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Expand your watchlist with fresh ideas and seize trends other investors might be missing. Now is your chance to get ahead of the curve with these standout picks:

- Capture high yields and steady income when you check out these 19 dividend stocks with yields > 3% with strong performance and reliable payouts.

- Ride the AI revolution by uncovering cutting-edge market movers through these 24 AI penny stocks as they shape tomorrow’s technology landscape.

- Get a jump on emerging breakthroughs and rapid growth in next-gen computing by exploring these 26 quantum computing stocks making waves in this fast-evolving field.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives