- United States

- /

- Office REITs

- /

- NYSE:DEI

Douglas Emmett (DEI): Valuation Insights Following Third Quarter Earnings Weakness and Swing to Net Loss

Reviewed by Simply Wall St

Douglas Emmett (DEI) has just released its third quarter earnings, showing a drop in quarterly sales and revenue compared to last year and a swing to a net loss for the period.

See our latest analysis for Douglas Emmett.

This rough third quarter has weighed on Douglas Emmett’s stock, with the share price sliding 11.4% over the past month and the total shareholder return dropping 31.1% in the past year. Momentum has clearly faded as investors reassess risk and growth potential in light of the latest results.

If you’re curious about what other opportunities the market holds, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With Douglas Emmett's share price sitting well below analyst targets and recent results disappointing, the key question is whether the stock is undervalued at these levels or if the market is already factoring in muted future prospects.

Most Popular Narrative: 22.2% Undervalued

Douglas Emmett’s fair value, as projected by the most influential market narrative, stands notably above the recent closing price. The stage is set for fresh investor speculation and strategic re-evaluation.

The acquisition of a new office building and residential site at the corner of Wilshire and Westwood Boulevards through a joint venture is predicted to generate significant operating and leasing synergies, potentially improving revenue and net margins.

The story behind this fair value is anything but standard. Analysts are betting on a complete shift in profitability and ambitious financial targets. Want to unlock the bold projections powering this valuation? Discover the surprising strategy redefining Douglas Emmett’s earnings potential.

Result: Fair Value of $15.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as tenant departures and rising interest costs could challenge Douglas Emmett’s path to sustained earnings growth and share price recovery.

Find out about the key risks to this Douglas Emmett narrative.

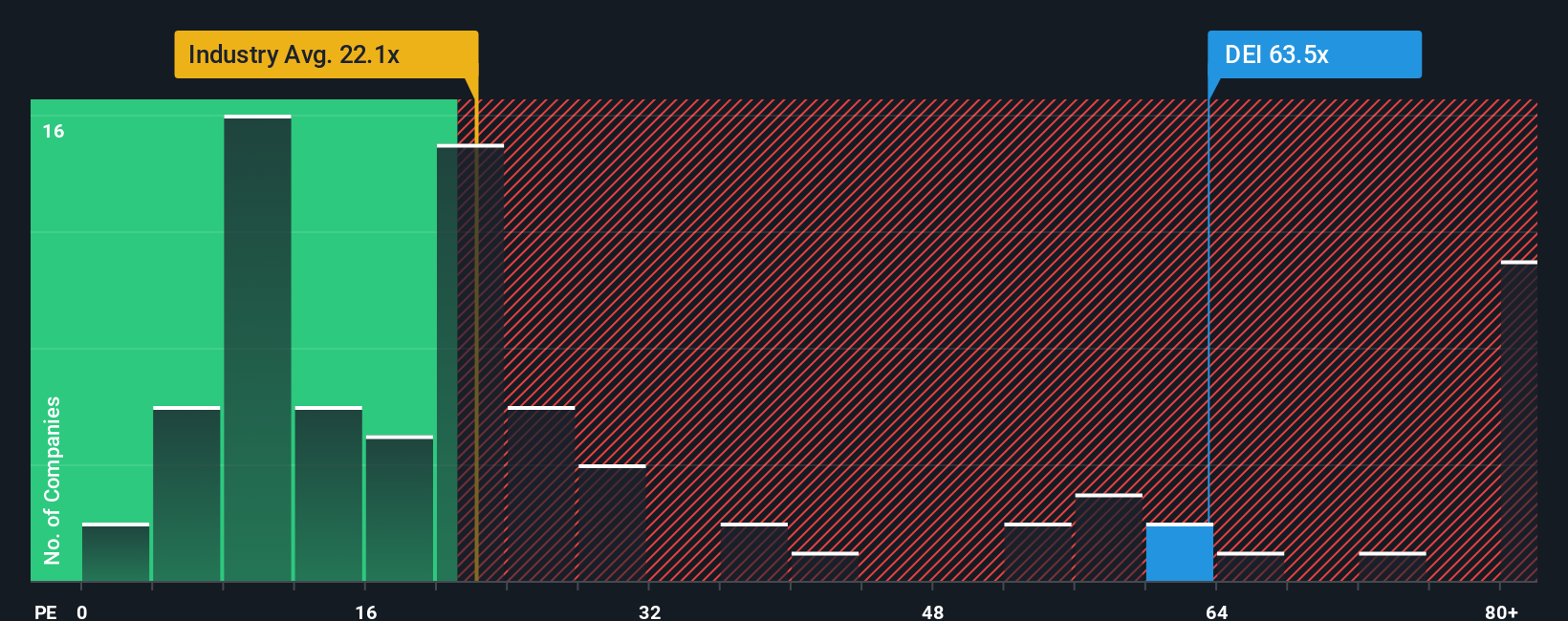

Another View: Multiples Show a Different Story

While fair value analysis points to Douglas Emmett being undervalued, a glance at its price-to-earnings shows a more complicated picture. The company trades at 95.3 times earnings, which is much higher than both its peers at 24.4x and the fair ratio of 7.6x. This suggests investors may be taking on added valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Douglas Emmett Narrative

If you see the numbers differently, or like to reach your own conclusions, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Douglas Emmett research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give your portfolio an edge by tapping into handpicked investment themes. The right opportunity could be waiting, so don't let it pass you by.

- Unlock the potential of tomorrow’s breakthrough technology by checking out these 26 quantum computing stocks. Find companies pioneering advancements in computing and innovation.

- Maximize your search for stable, consistent returns by viewing these 16 dividend stocks with yields > 3%. Discover offerings with attractive yields and solid fundamentals in today's market.

- Accelerate your strategy with these 26 AI penny stocks, which are leading the transformation in automation, smart analytics, and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEI

Douglas Emmett

Douglas Emmett, Inc. (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives