- United States

- /

- Office REITs

- /

- NYSE:DEA

Easterly Government Properties (DEA) Margin Decline Reinforces Cautious Growth Narrative Heading Into Earnings

Reviewed by Simply Wall St

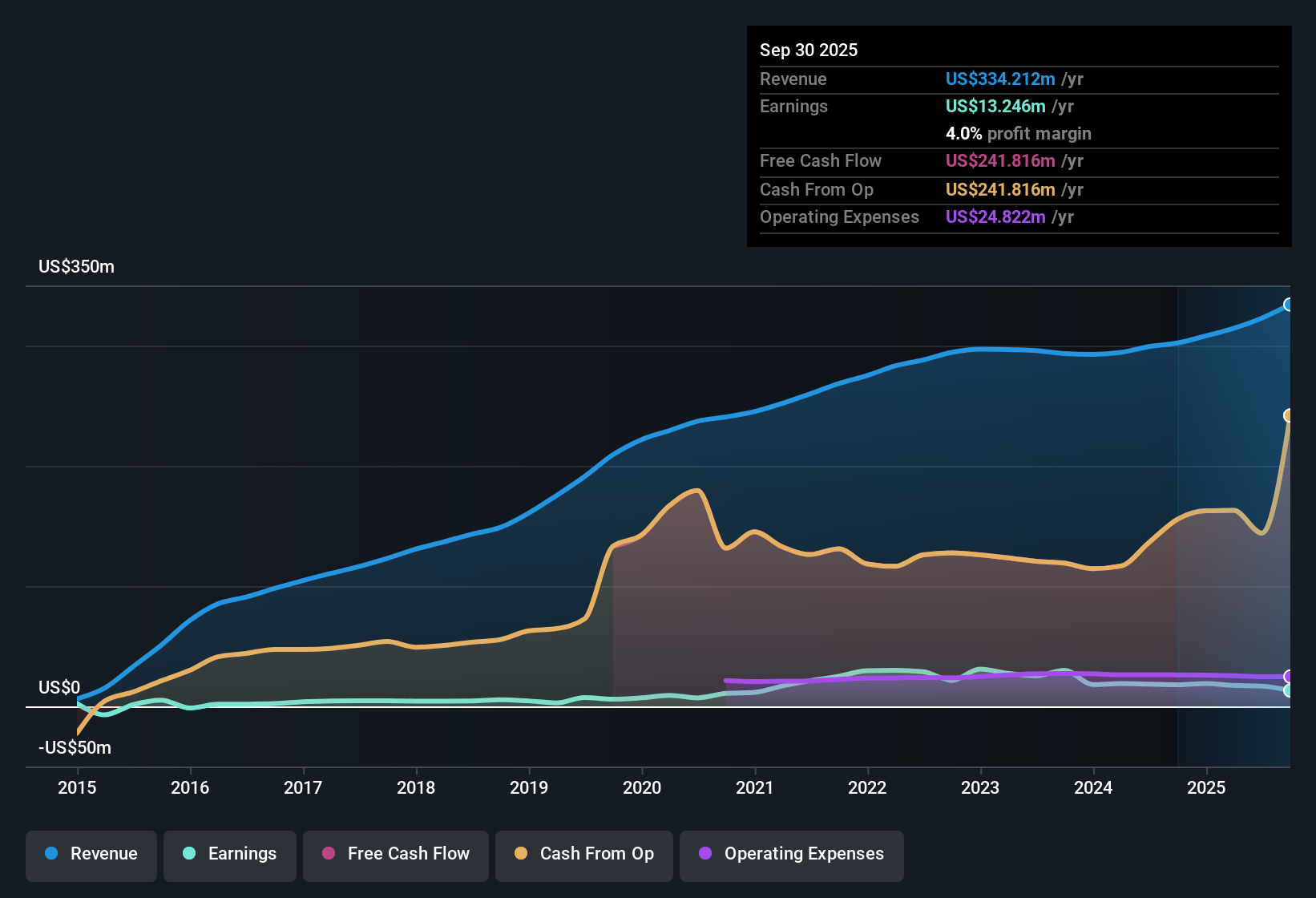

Easterly Government Properties (DEA) is forecasting revenue growth of 6.4% per year, which trails the US market's average of 10.1%. Earnings are expected to inch up by 2.4% annually, also lagging the market average of 15.5%. After a year of negative earnings growth and a slip in net profit margins from 6.2% to 5.2%, investors will be weighing the significance of muted growth forecasts, elevated valuation multiples, and ongoing financial risks as the company's earnings results come into focus.

See our full analysis for Easterly Government Properties.Next, we are setting these results against the dominant narratives circulating in the market to see which themes hold up and which might need a rethink.

See what the community is saying about Easterly Government Properties

PE Ratio Jumps Well Above Peers

- Easterly Government Properties is currently trading at a Price-to-Earnings Ratio of 57.9x, notably higher than the Global Office REITs industry average of 22.4x and peer average of 35.5x.

- Analysts' consensus view suggests that while the premium PE ratio signals investor expectations for stability from secure government leases, it raises concern that potential future earnings growth projected at just 2.4% per year may not be enough to justify such a high multiple.

- The consensus narrative emphasizes the value of long-term, non-cancelable government leases supporting revenue, but highlights that elevated capital costs and cautious acquisition activity could compress future profit margins further.

- There is noticeable tension between the company's high-quality tenant profile, which typically warrants a premium, and its subdued earnings outlook and lower net margins, which temper the case for paying up at current multiples.

- To see how this valuation drama compares to broader market trends and the full community perspective, check the detailed consensus narrative for more layers behind the headlines. 📊 Read the full Easterly Government Properties Consensus Narrative.

Dividend Sustainability Remains a Key Risk

- The company’s financial position and the sustainability of its dividend are flagged as significant risks, especially in light of management’s recent comment about elevated capital costs now “in the 8s” percent range.

- Bears argue that the company’s reliance on a stable, government-backed income stream is offset by immediate financial pressures:

- The dividend reset earlier this year has created an overhang on investor sentiment, and tight capital markets could limit access to affordable financing for growth or maintaining current payouts.

- Evolving government agency demands, along with trends towards streamlining agency footprints, increases the risk that future lease renewals or terminations may further threaten both occupancy rates and dividend safety.

Net Margins Compress as Costs Bite

- Net profit margins have narrowed from 6.2% last year to 5.2% currently, showing direct pressure on profitability despite long-term leases.

- Analysts' consensus view notes both positives and challenges:

- Stable, high occupancy rates and long, non-cancelable government leases continue to support revenues, but persistent elevated capital costs and selective acquisition activity threaten to hold margins at low levels or even drive further declines.

- Federal real estate modernization offers opportunity for steady rental income, yet limited built-in rent escalators mean that inflation or higher financing costs may not be fully offset, potentially shrinking margins even further in a rising cost environment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Easterly Government Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? Share your view and craft a narrative in just a few minutes with your own unique insights. Do it your way

A great starting point for your Easterly Government Properties research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Easterly Government Properties faces pressure from high valuation multiples, sluggish earnings growth, and tightening margins in a challenging financial climate.

If you want to find stocks with more attractive valuations and stronger growth prospects, start with these 870 undervalued stocks based on cash flows to discover opportunities that may offer better value for your investment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Easterly Government Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEA

Easterly Government Properties

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives