- United States

- /

- Office REITs

- /

- NYSE:CUZ

Should Cousins Properties' (CUZ) Dallas Acquisition and Leasing Momentum Prompt a Portfolio Rethink?

Reviewed by Sasha Jovanovic

- Cousins Properties reported strong third quarter results, with US$248.33 million in revenue and the completion of a US$218 million acquisition in Uptown Dallas, alongside plans to pursue further acquisitions and selective dispositions to enhance geographic diversity and portfolio quality.

- The company’s robust leasing activity and expansion in the competitive Dallas market highlight a focused approach to strengthening its presence in fast-growing Sunbelt markets.

- We'll now explore how Cousins Properties' accelerated leasing and targeted Dallas acquisition may shape its broader investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cousins Properties Investment Narrative Recap

To be a shareholder in Cousins Properties, you need to believe in the continued migration of businesses to Sun Belt cities and Cousins’ ability to capitalize on strong office leasing demand. The recent Dallas acquisition and ongoing search for high-quality Sun Belt assets could be a positive short-term catalyst if they lead to higher occupancy, but exposure to potential regional economic shifts and persistent office sector headwinds remains a key risk. For now, these latest developments do not materially shift the biggest risk: structural changes in office demand due to remote work and tenant migration. One of the most relevant recent announcements is the completion of the Link acquisition in Uptown Dallas for US$218 million. This move signals the company’s focus on portfolio quality and reinforcing its presence in high-growth markets, aligning directly with management’s plan to boost accretive growth and improve occupancy rates, both critical short-term catalysts for the stock. On the other hand, investors should be aware that, despite these steps, concerns about office space oversupply and long-term demand impacts are still looming...

Read the full narrative on Cousins Properties (it's free!)

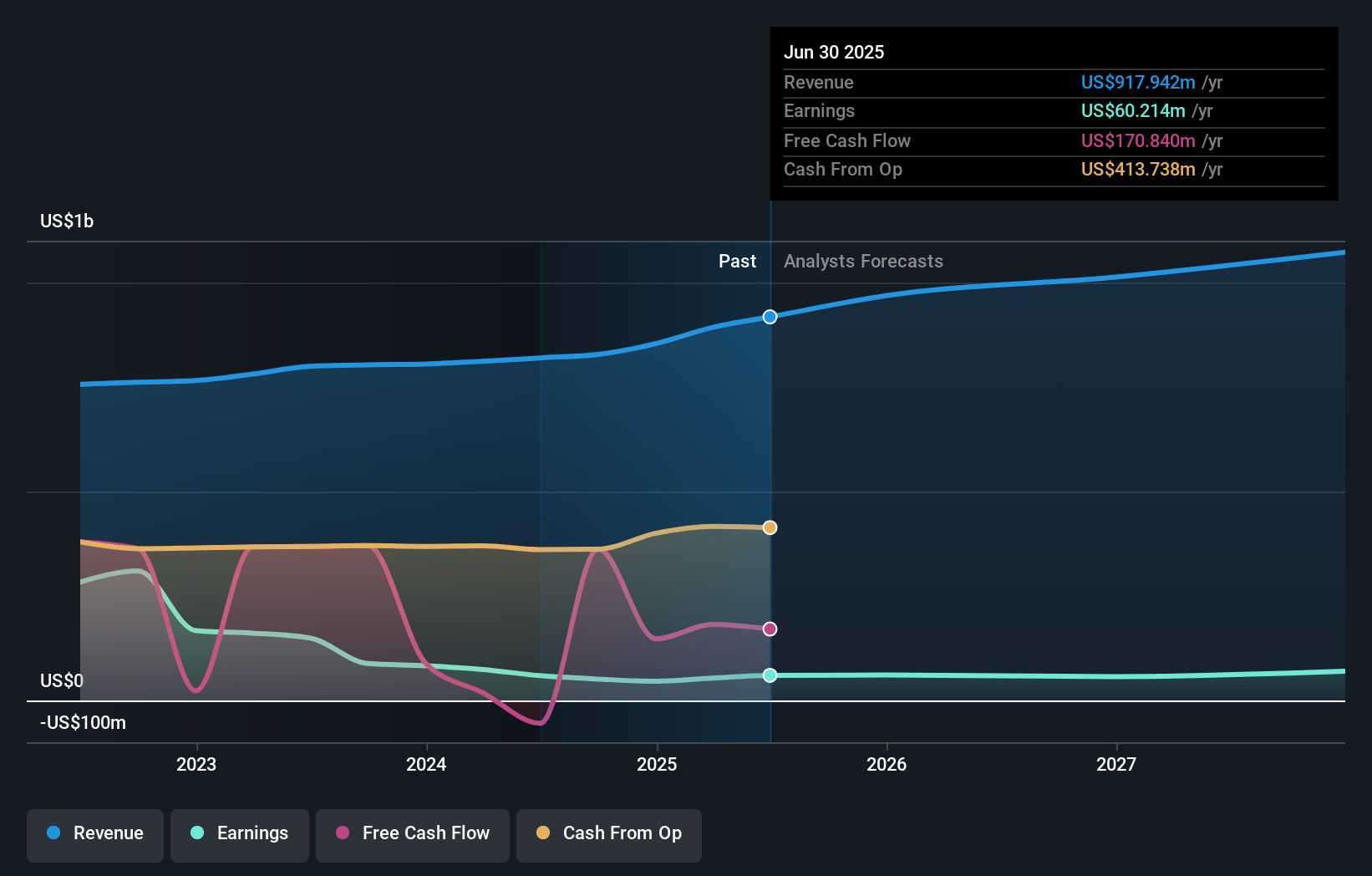

Cousins Properties' outlook anticipates $1.1 billion in revenue and $65.7 million in earnings by 2028. This is based on an assumed 5.2% annual revenue growth rate and a $5.5 million increase in earnings from the current $60.2 million.

Uncover how Cousins Properties' forecasts yield a $32.83 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have valued Cousins Properties between US$32.83 and US$34.43 based on their own forecasts, contributing two distinct perspectives. While the company pushes to improve occupancy through Sun Belt acquisitions, the persistent risk of weakening structural demand for office space means readers can benefit from several alternative viewpoints on future performance.

Explore 2 other fair value estimates on Cousins Properties - why the stock might be worth just $32.83!

Build Your Own Cousins Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cousins Properties research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cousins Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cousins Properties' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUZ

Cousins Properties

Cousins Properties is a fully integrated, self-administered and self-managed real estate investment trust (REIT).

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives