- United States

- /

- Retail REITs

- /

- NYSE:CURB

Does Morgan Stanley's Upgrade Signal a Turning Point for Curbline Properties (CURB) Investor Sentiment?

Reviewed by Sasha Jovanovic

- In the past week, Morgan Stanley upgraded Curbline Properties Corp. to Overweight, reflecting increased confidence in the company's outlook ahead of its expected earnings report of 7 cents per share on revenue of US$40.51 million for the period ending September 30, 2025.

- This upgrade comes as analysts maintain a uniformly positive view on the shares, with no "sell" or "strong sell" recommendations.

- We'll explore how Morgan Stanley's vote of confidence may influence Curbline Properties' investment narrative amid strong analyst sentiment.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Curbline Properties' Investment Narrative?

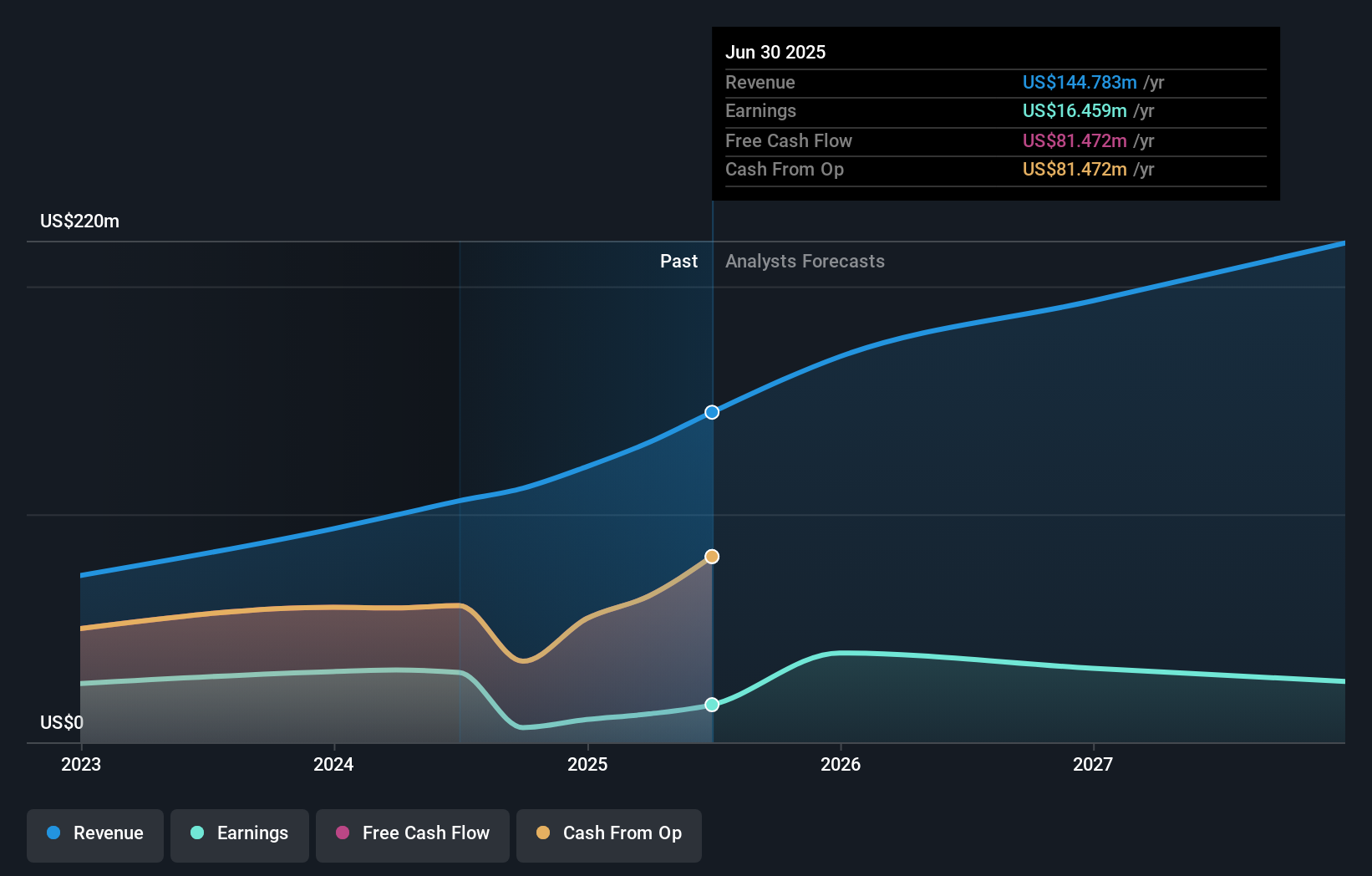

To own shares of Curbline Properties right now, an investor is banking on the company’s potential to deliver steady revenue growth and consistent dividends, even as questions linger about management depth and valuation. The recent upgrade from Morgan Stanley, just ahead of the Q3 earnings announcement, could inject new short-term optimism, possibly affecting market sentiment more than fundamental catalysts like earnings or buybacks. Previously, one of the biggest risks was Curbline’s high valuation compared to peers, combined with fresh faces on the board and a drop in profit margins since last year. The upgrade adds some momentum, reflecting renewed institutional confidence, but it doesn’t erase risks such as the company’s higher-than-average CEO pay, relatively inexperienced management, or lingering concerns over recent insider selling. Higher analyst sentiment may ease near-term selling, but uncertainty around longer-term profit margins remains. Yet, insider selling continues to be a relevant consideration for any investor.

Curbline Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Curbline Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Curbline Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curbline Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Curbline Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curbline Properties' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CURB

Curbline Properties

Engages in the business of owning, managing, leasing, and acquiring a portfolio of convenience shopping centers in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives