- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

Should CareTrust REIT’s (CTRE) Surging Q3 Results and Higher Earnings Forecast Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Earlier this month, CareTrust REIT reported third quarter 2025 results, highlighting a very large increase in revenue and net income year-over-year, and updated its unaudited full-year 2025 earnings guidance to a range of US$1.41 to US$1.42 per diluted share.

- This performance underscores the effects of recent acquisitions and portfolio expansion, resulting in pronounced operational growth and higher expected earnings for the year.

- We will examine how these robust third quarter results and raised annual earnings outlook impact CareTrust REIT's investment narrative and growth prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CareTrust REIT Investment Narrative Recap

To be a CareTrust REIT shareholder, you generally need to believe in the long-term growth and stability of the senior housing and healthcare real estate sectors, as well as the company's ability to successfully execute large acquisitions and expand its portfolio without excessive risk. The recent surge in third quarter revenue and net income, together with raised 2025 earnings guidance, strengthens confidence in the company’s short-term growth catalyst, continued external expansion. However, rapid portfolio growth also amplifies the most significant risk: integration challenges and the potential for value-dilutive deals. The latest results support near-term momentum, but the integration and performance of new assets remains a key area to watch for possible disruptions to earnings reliability; the impact of this news on the risk profile is real but not yet material.

Among recent announcements, the September acquisition of two UK care homes for US$27 million is most closely connected to the third quarter performance boost. This deal reflects CareTrust's efforts to diversify geographically and benefit from demand in new markets, helping provide revenue upside while supporting the positive drivers behind the company’s raised outlook.

Yet just as growth accelerates, investors should be aware of the increased integration risk that comes with a larger, more complex portfolio, particularly if...

Read the full narrative on CareTrust REIT (it's free!)

CareTrust REIT's narrative projects $649.2 million in revenue and $460.9 million in earnings by 2028. This requires 20.2% annual revenue growth and a $241.6 million increase in earnings from the current $219.3 million.

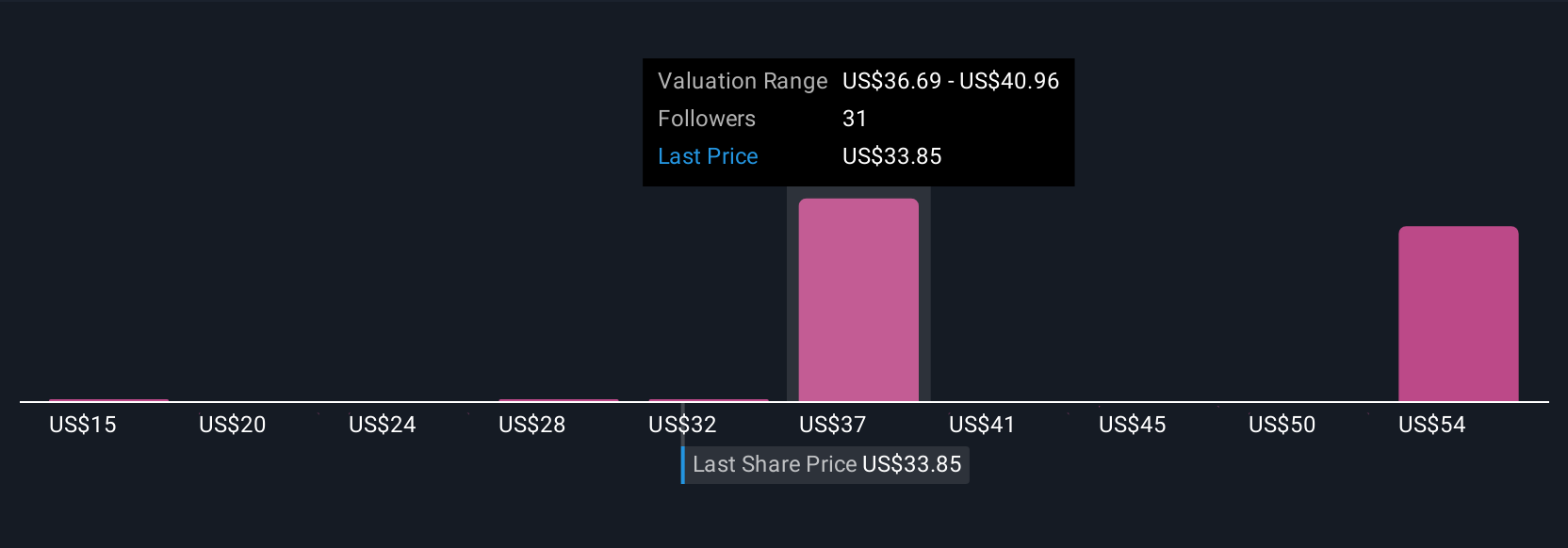

Uncover how CareTrust REIT's forecasts yield a $37.89 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Nine private investors in the Simply Wall St Community assigned fair value estimates for CareTrust REIT ranging from US$15.35 to US$86.30 per share, highlighting strong differences. While opinions vary, the company’s recent surge in revenue and ongoing portfolio expansion are critical themes informing expectations of future performance.

Explore 9 other fair value estimates on CareTrust REIT - why the stock might be worth over 2x more than the current price!

Build Your Own CareTrust REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CareTrust REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CareTrust REIT's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives