- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

Is CareTrust a Bargain After Shares Surge 33% in 2025?

Reviewed by Bailey Pemberton

If you have your eye on CareTrust REIT and find yourself wondering what to do next, you are in good company. With shares closing recently at $35.31 and a year-to-date return of 33.1%, CareTrust has certainly caught the attention of many investors seeking growth combined with solid fundamentals. Over the last week, CareTrust climbed 2.9%, and its three- and five-year returns are even more striking, up 120.3% and 154.4% respectively. That kind of long-term performance suggests not just momentum, but also a story of a company that has executed well over time.

Some of the renewed enthusiasm comes from CareTrust’s latest moves in the skilled nursing and senior housing segments, as they continue to expand their portfolio and refine partnerships in key markets. This aligns with a broader industry shift in how long-term care assets are managed and valued, which has worked in CareTrust’s favor as investors’ risk perceptions evolve. While there has been plenty of news in the sector, CareTrust’s ability to both grow and adapt is what has attracted attention recently.

When it comes to valuation, things get even more interesting. CareTrust currently scores a 4 out of 6 on our value checks, indicating it is undervalued in four key ways according to major valuation metrics. Of course, numbers never tell the whole story on their own. In the next section, we will break down which valuation methods shed light on CareTrust’s current pricing, and hint at an even better way to think about what this stock may truly be worth.

Approach 1: CareTrust REIT Discounted Cash Flow (DCF) Analysis

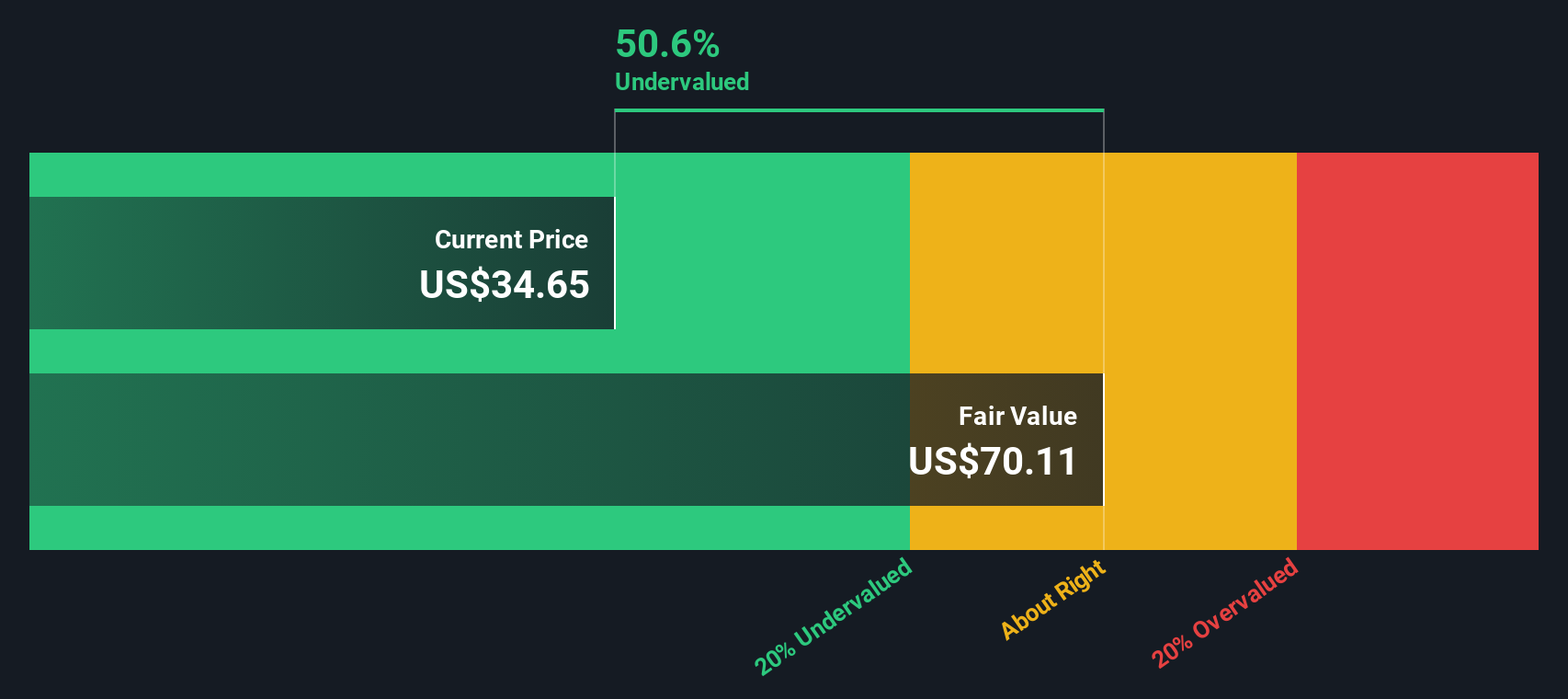

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future adjusted funds from operations, then discounting those cash flows back to today's terms. For CareTrust REIT, this approach considers how much cash the business is expected to generate annually and the likely trajectory of that growth.

Looking at the next decade, analysts have projected that CareTrust's free cash flow could grow steadily, with projections provided up to 2027 and the rest extrapolated. In 2027, CareTrust is expected to produce about $547.9 million in free cash flow. By 2035, this figure is forecasted to reach roughly $987.1 million. This consistent increase suggests healthy growth potential in its core operations, with all cash flow figures reported in US dollars. The valuation process discounts each future year's cash flow back to the present, reflecting both time and risk. The method applied here is the 2 Stage Free Cash Flow to Equity using Adjusted Funds From Operations.

The resulting model indicates an estimated intrinsic value of $78.85 per share. Compared to the current share price of $35.31, the DCF model suggests that CareTrust REIT is trading at a 55.2% discount to its fair value, a meaningful undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CareTrust REIT is undervalued by 55.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CareTrust REIT Price vs Earnings

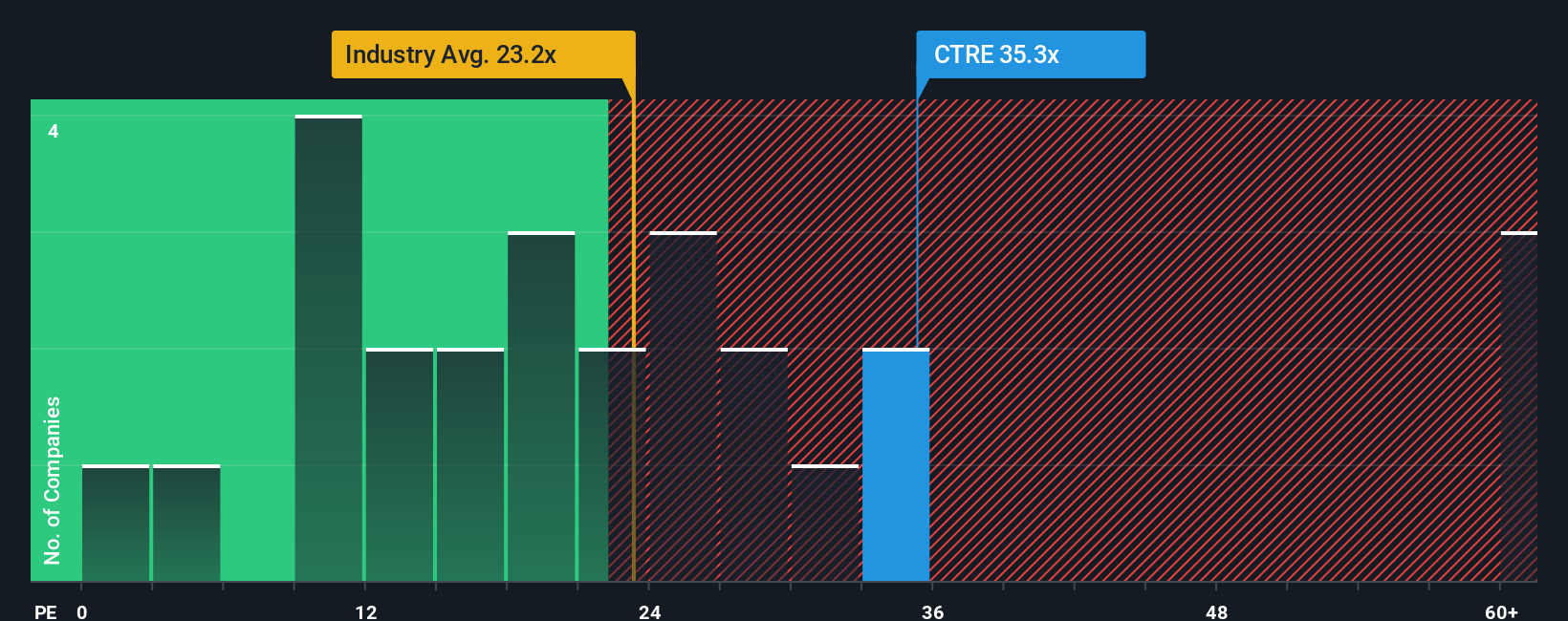

For profitable companies like CareTrust REIT, the Price-to-Earnings (PE) ratio is often the primary valuation metric investors turn to. The PE ratio enables a straightforward comparison of how much investors are paying for each dollar of current earnings, making it especially relevant for businesses with consistent profitability.

Growth expectations and risk factors play a significant role in what constitutes a “normal” or “fair” PE ratio. Companies with higher anticipated earnings growth, stronger margins, and lower perceived risk usually command higher PE multiples. This reflects investors’ willingness to pay a premium for future potential. Conversely, lower-growth or riskier companies are typically valued at lower multiples by the market.

Currently, CareTrust REIT trades at a PE ratio of 36x. This places it above the average of Health Care REITs, which is 24x, and somewhat below the average of its key peers at 60x. While comparisons to these benchmarks provide useful context, they do not tell the whole story, since each company’s circumstances and prospects differ.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio adjusts for specific factors like CareTrust’s earnings growth, profit margins, risks, industry norms, and market capitalization to set a more tailored baseline for valuation. Unlike simple peer or industry comparisons, the Fair Ratio offers a more nuanced perspective on what multiple the stock truly deserves.

For CareTrust REIT, the Fair Ratio is 43.1x. Compared to its current PE of 36x, this suggests the stock is trading below what would be expected given its company-specific characteristics and is potentially undervalued by this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CareTrust REIT Narrative

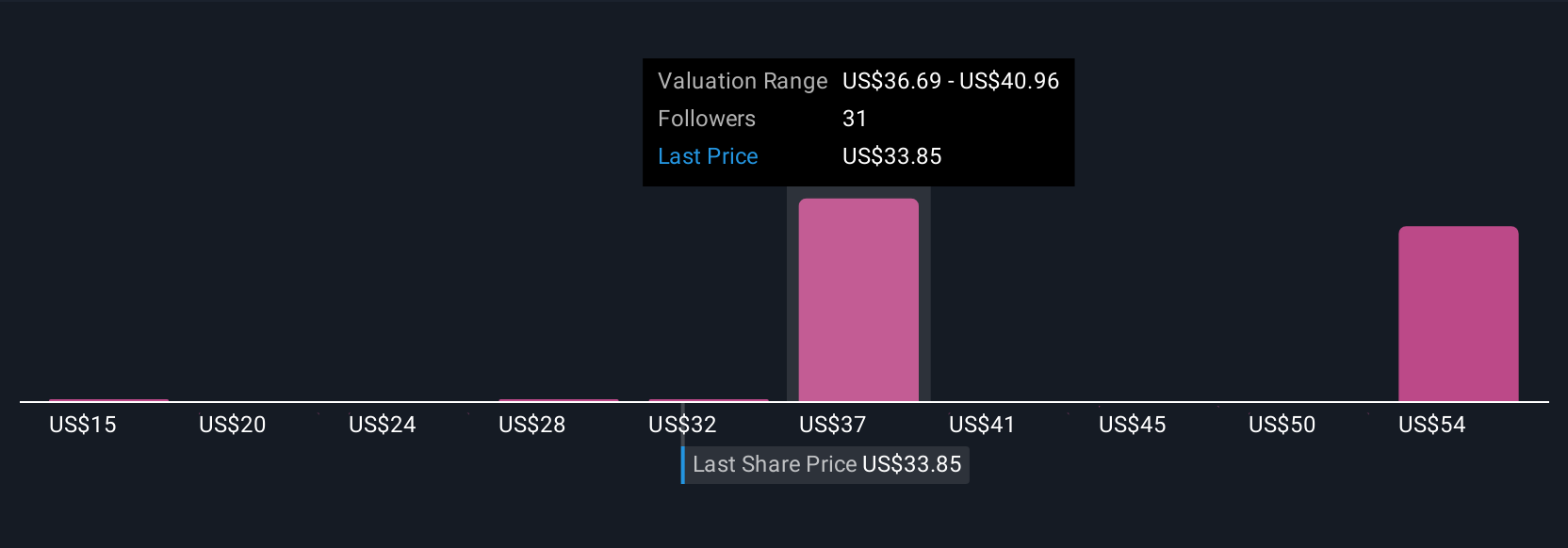

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects the story you believe about a company, whether you see it as a future industry leader or facing headwinds, to expected financial results such as future revenue growth, margins, and fair value. Narratives go beyond the numbers by letting investors translate their perspectives into actual forecasts and valuations, linking a company's journey to a dynamic estimate of its real worth.

This approach is easy to access. On Simply Wall St’s Community page, you can explore, create, and adopt Narratives used by millions of investors. Narratives help you decide when to buy or sell by directly comparing a fact-based Fair Value to the current share price, making investment decisions more transparent. Plus, they are updated automatically as new information such as earnings or big news comes in, ensuring your assessment stays current.

For CareTrust REIT, for example, one Narrative factors in international expansion and portfolio diversification, projecting strong future earnings and a fair value of $39.00 per share. A more cautious perspective anticipates regulatory risks and slower growth, resulting in a fair value of just $33.00 per share. With Narratives, you can easily see what’s driving these differences and choose the story and fair value estimate that matches your outlook.

Do you think there's more to the story for CareTrust REIT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives