- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

How Gregory K. Stapley’s Return to the Board Could Shape CareTrust REIT’s (CTRE) Strategic Direction

Reviewed by Sasha Jovanovic

- On October 21, 2025, CareTrust REIT's Board expanded from five to six directors and appointed Gregory K. Stapley, former CEO and founder, to rejoin the Board effective January 1, 2026, without committee assignments.

- Mr. Stapley’s return brings deep institutional knowledge and signals renewed leadership continuity, reflecting ongoing investment in talent and sector expertise at a pivotal time for the company.

- We'll examine how the addition of Mr. Stapley may influence CareTrust's approach to portfolio growth and sector diversification.

Find companies with promising cash flow potential yet trading below their fair value.

CareTrust REIT Investment Narrative Recap

Shareholders in CareTrust REIT generally need confidence in the ongoing growth of healthcare real estate, especially as the company expands into new markets like the UK. The board appointment of Gregory K. Stapley, with his deep institutional knowledge, signals a commitment to leadership stability, but does not materially change the most important short-term catalyst, delivering successful integration and earnings from recent acquisitions, or the key risk relating to operational and integration challenges from rapid portfolio growth.

Among recent announcements, the acquisition of two UK care homes for approximately US$27 million is especially relevant. Integrating these assets without disruption is central to CareTrust's ability to maintain revenue momentum and manage the risks of geographic and regulatory expansion discussed above.

However, investors should also consider that rapid international expansion brings...

Read the full narrative on CareTrust REIT (it's free!)

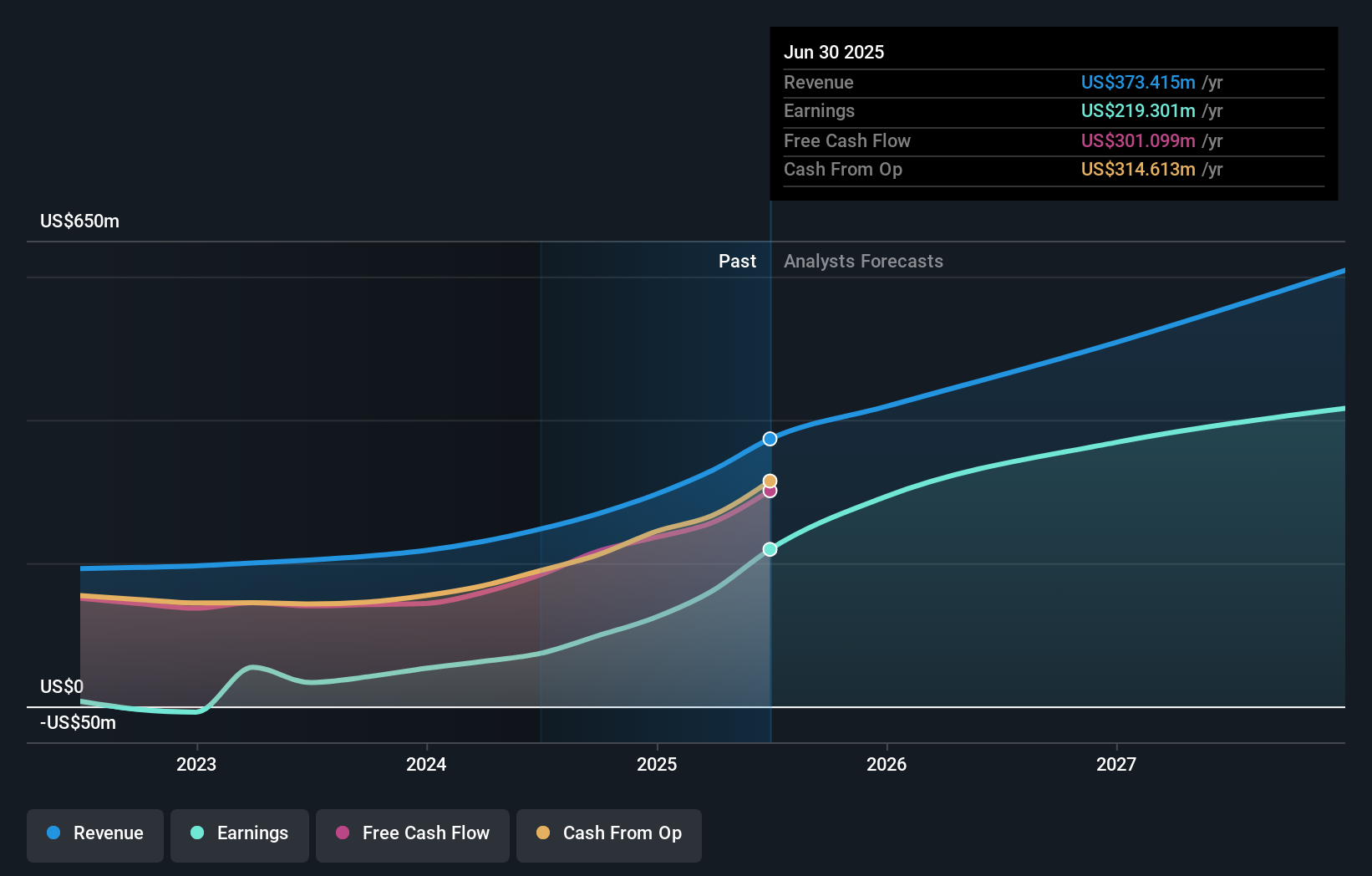

CareTrust REIT's outlook anticipates $649.2 million in revenue and $460.9 million in earnings by 2028. This implies annual revenue growth of 20.2% and an increase in earnings of $241.6 million from the current $219.3 million.

Uncover how CareTrust REIT's forecasts yield a $37.89 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 9 fair value estimates for CareTrust REIT, ranging widely from US$15.35 to US$78.95 per share. These varied viewpoints are set against the backdrop of fast-paced acquisitions and international growth, reminding you that opinions on future performance can be sharply divided.

Explore 9 other fair value estimates on CareTrust REIT - why the stock might be worth over 2x more than the current price!

Build Your Own CareTrust REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CareTrust REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CareTrust REIT's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives