- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

CareTrust REIT (CTRE): Assessing Valuation Following Strong Revenue and Income Growth

Reviewed by Simply Wall St

See our latest analysis for CareTrust REIT.

Momentum has clearly been building for CareTrust REIT, with a notable 28% year-to-date share price return and its three-year total shareholder return of 114%. This illustrates long-term strength. While there have been minor pullbacks lately, the overall trend suggests investor confidence in its growth story.

If you're looking to uncover other high-potential opportunities, now is a perfect moment to discover fast growing stocks with high insider ownership.

But with shares near all-time highs and analysts projecting further gains, the real question for investors is whether CareTrust REIT is actually undervalued right now or if the optimism has already been fully priced in.

Most Popular Narrative: 10.3% Undervalued

When compared to the current $33.99 closing price, the most closely watched narrative puts CareTrust REIT's fair value at $37.89. This suggests there may be additional upside if the underlying assumptions prove accurate. The following insight from the narrative focuses on the business model driving this optimism.

The recent acquisition of Care REIT and entry into the U.K. care home market significantly diversifies the asset, operator, and geographic mix. This positions CareTrust to capitalize on global growth in demand for senior housing and post-acute care, which should drive higher future revenues and provide downside protection to earnings.

What is behind this valuation? A closer look reveals it involves optimistic forecasts for future profit margins, ambitious revenue growth, and a target earnings multiple not often found in this sector. Curious how these core expectations help shape the stock’s fair value? Discover what truly distinguishes this valuation.

Result: Fair Value of $37.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion and rising integration costs could pressure margins. These factors may serve as potential catalysts that could challenge the current optimistic outlook.

Find out about the key risks to this CareTrust REIT narrative.

Another View: What Does the Market Multiple Say?

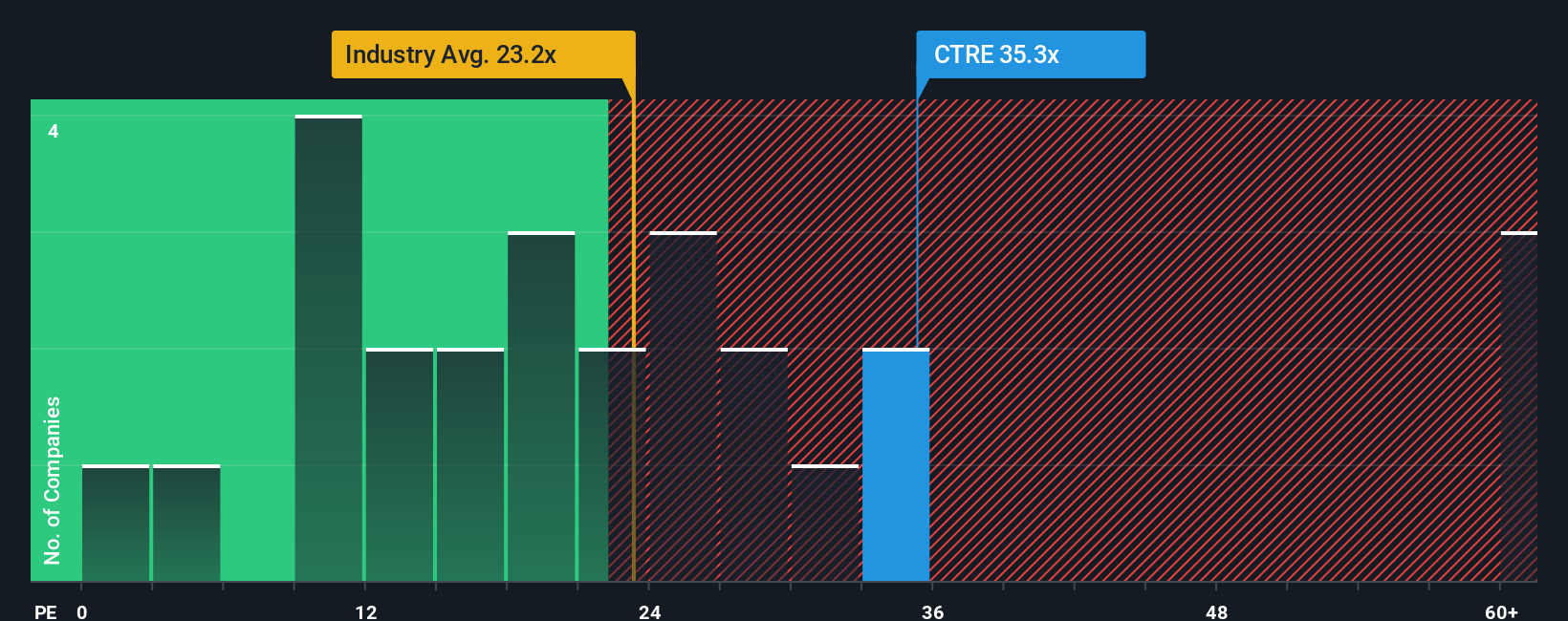

Taking a different angle, the current price-to-earnings ratio stands at 34.6x. That is higher than the global Health Care REITs industry average of 23.6x, but below its peer group average of 59.6x. Compared to the fair ratio of 43.2x, CareTrust REIT may not be cheap but could move closer to that benchmark. Does this present a valuation risk, or is it an opportunity hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CareTrust REIT Narrative

If you have a different perspective or want to dive deeper into the numbers, you can build your own take on CareTrust REIT’s story in just a few minutes. Do it your way

A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio’s growth and don’t let market leaders leave you behind. The Simply Wall Street Screener unlocks powerful opportunities you won’t want to miss.

- Supercharge your returns by targeting companies offering impressive income potential through these 21 dividend stocks with yields > 3% with yields above 3%.

- Seize the possibilities in revolutionary technologies by uncovering the innovators among these 26 AI penny stocks who are set to transform industries with artificial intelligence.

- Capture exceptional value by searching for untapped potential in these 848 undervalued stocks based on cash flows where strong cash flows point to stocks that the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives