- United States

- /

- Residential REITs

- /

- NYSE:CSR

A Look at Centerspace (CSR) Valuation Following Strong Q3 Results and Revised Guidance

Reviewed by Simply Wall St

Centerspace (CSR) reported strong third quarter results, delivering higher sales and a swing to profitability compared to a year ago. However, its latest update included lower earnings guidance, signaling a more cautious stance for the remainder of the year.

See our latest analysis for Centerspace.

Alongside Centerspace’s swing back to profitability and active share buybacks, its share price gained 10.77% over the past 90 days; however, the year-to-date return remains negative. Over the longer term, total shareholder returns have been modest. This suggests that while short-term momentum has picked up, some caution remains as the company navigates its revised outlook.

If this mix of improving earnings and cautious guidance has you thinking about what else could be moving, it might be the perfect moment to discover fast growing stocks with high insider ownership

With recent gains but softer forward guidance, the question for investors is clear: Is Centerspace’s current price an attractive entry for future upside, or has the market already accounted for any renewed growth?

Most Popular Narrative: 11.5% Undervalued

According to the most closely followed narrative, Centerspace’s fair value is pegged at $67.59, which is 11.5% above the recent close of $59.84. This gap suggests that, while the stock has recovered, there is still room to grow if the narrative’s assumptions play out.

Strategic capital recycling, redeploying proceeds from the sale of lower-margin, less desirable assets in St. Cloud and Minneapolis into newer, higher-growth properties in Salt Lake City and Colorado, enhances average portfolio quality, improves NOI margins, and supports earnings growth as integration is realized. Portfolio repositioning into markets with stable economic bases, strong job growth, and limited new multifamily supply (such as Salt Lake City) increases long-term growth potential and reduces risk of occupancy or rent declines, resulting in higher, more resilient net margins.

Curious what lies behind this optimistic pricing? There is a key ingredient in the narrative: future profitability, margin expansion, and a valuation multiple more typical of high-growth sectors. Wonder what numbers and forecasts drive this price target? Unlock the full narrative and discover the surprising projections for Centerspace’s future.

Result: Fair Value of $67.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risk remains if market tailwinds such as robust job growth do not materialize, or if high leverage limits Centerspace’s financial flexibility.

Find out about the key risks to this Centerspace narrative.

Another View: Market Multiples Tell a Cautionary Story

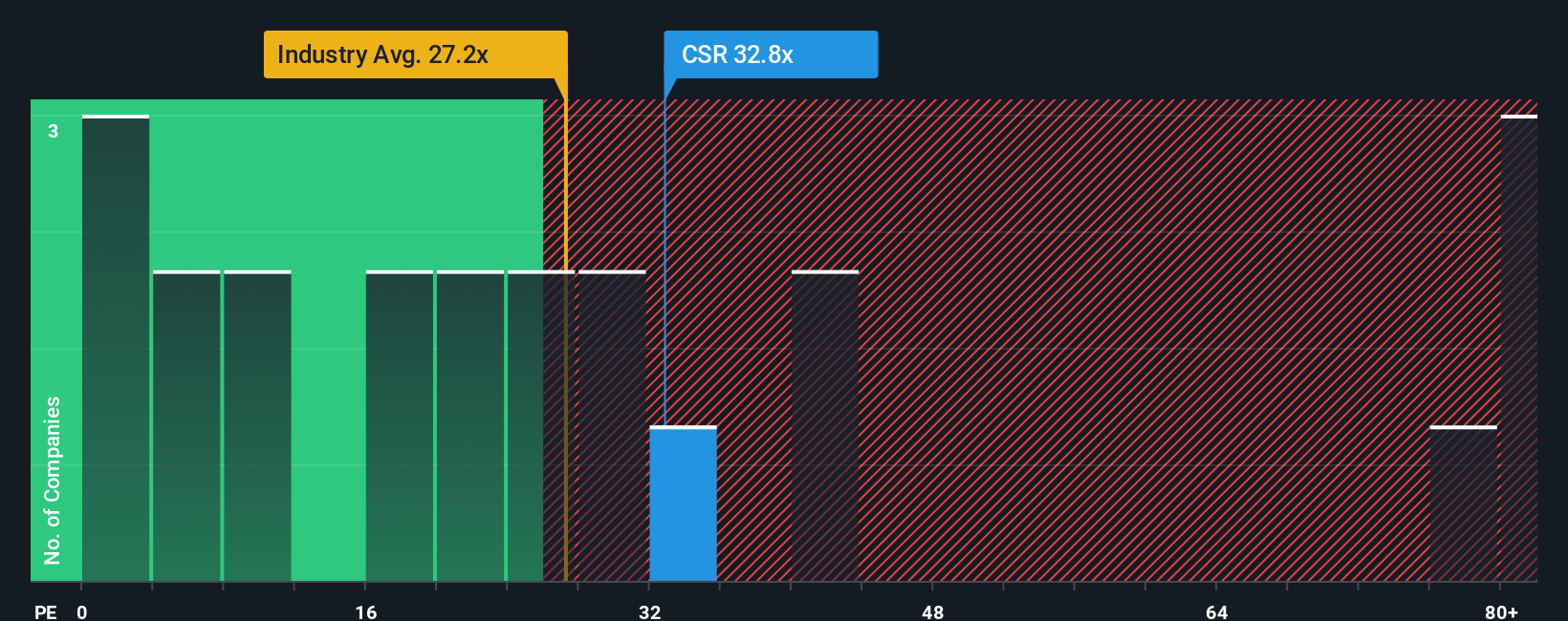

Looking at valuation through the lens of price-to-earnings, Centerspace trades at 32.8x earnings, which is more expensive than the residential REIT industry average of 27.3x and well above a fair ratio of 19.9x. This premium could mean more downside risk if investor preferences shift. Does the current price signal optimism or a warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centerspace Narrative

If you’d rather dig into the numbers yourself or think there’s another angle to this story, you can craft your own perspective in just minutes, so why not Do it your way?

A great starting point for your Centerspace research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their eyes open for the next big opportunity. Don’t let potential winners pass you by when there is so much more to uncover in today’s market.

- Unlock steady income streams and financial strength by evaluating these 20 dividend stocks with yields > 3% offering high yields and proven dividend consistency.

- Capitalize on cutting-edge breakthroughs by checking out these 26 AI penny stocks that are redefining the way we live and invest.

- Spot companies that the market has overlooked and seize bargains with these 843 undervalued stocks based on cash flows before they hit the headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSR

Centerspace

An owner and operator of apartment communities committed to providing great homes by focusing on integrity and serving others.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives