- United States

- /

- Health Care REITs

- /

- NYSE:CHCT

Community Healthcare Trust (CHCT) Losses Accelerate, Testing Bullish Valuation Narratives

Reviewed by Simply Wall St

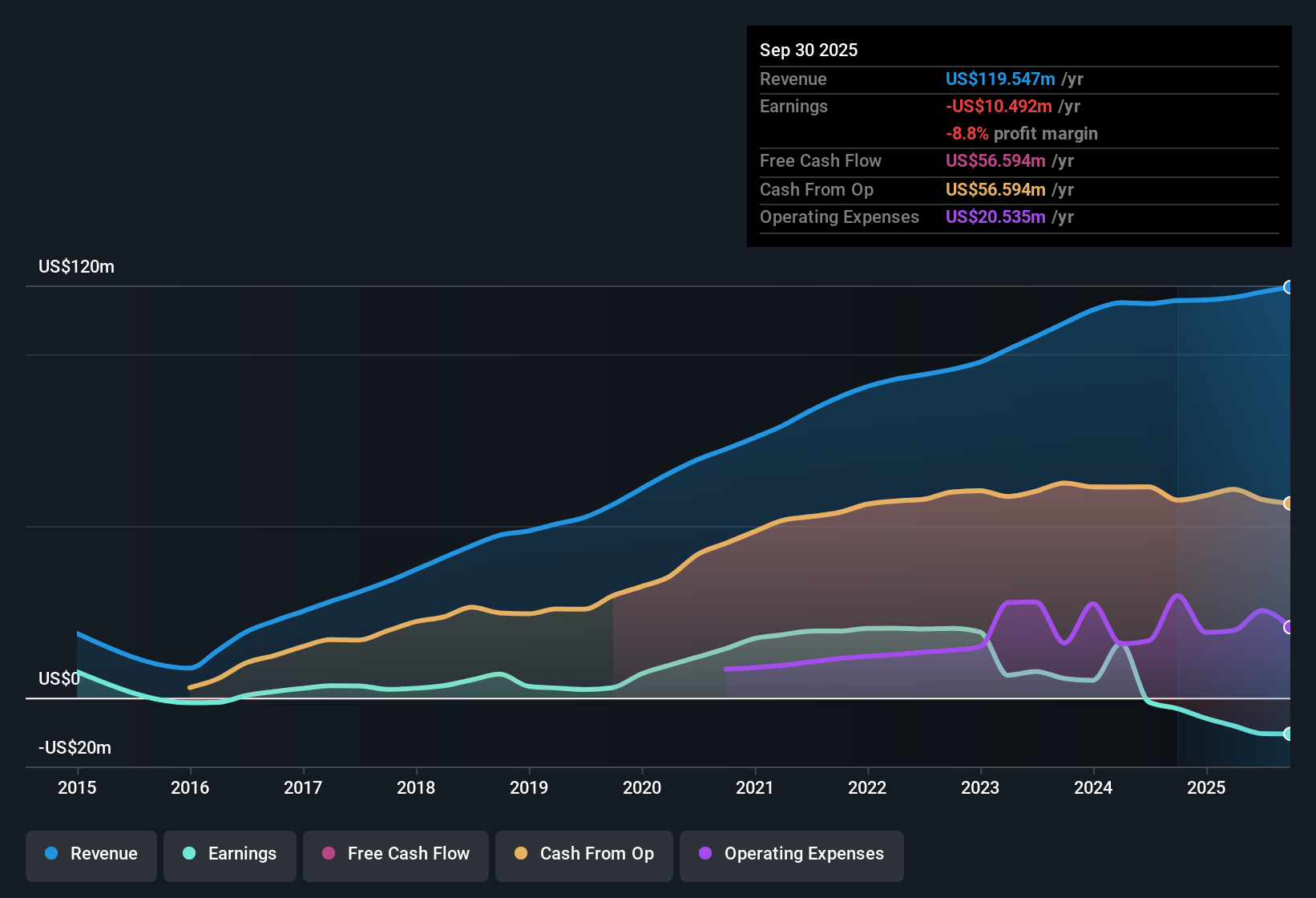

Community Healthcare Trust (CHCT) remains in the red, posting another year of losses that have accelerated at an annual rate of 49.5% over the past five years. Despite this track record, the company is guiding for a sharp turnaround with earnings forecast to grow by 55.06% per year and potentially swing into profitability within three years. Revenue is expected to rise 9% annually, which is slightly behind the broader US market’s 10.2% pace. Shares currently trade at $14.43, well below a discounted cash flow fair value estimate of $59.85, offering a notable value gap for investors to consider.

See our full analysis for Community Healthcare Trust.The next step is putting these numbers in context, specifically how the recent results stack up against the most widely held narratives about CHCT and what that means for investors looking ahead.

See what the community is saying about Community Healthcare Trust

Margins Projected to Shift from -8.8% to 13.3%

- Analysts expect CHCT's profit margins to turn the corner, moving from -8.8% today to 13.3% in three years. This marks a major swing highlighting the forecasted shift from losses to meaningful profitability.

- According to the analysts' consensus view, this margin improvement is set against the backdrop of projected earnings growth to $19.8 million and EPS of $0.54 by September 2028.

- This turnaround is anticipated to be powered by steady revenue gains and cost control, helping net operating income outpace the pace of acquisition-related expenses.

- Margin guidance assumes disciplined capital management continues, with no major shocks from tenant transitions or unexpected G&A inflation.

- Consensus narrative notes that a focus on secondary and tertiary markets, where leasing activity and property demand support higher occupancy, should help both margin expansion and long-term stability for shareholder returns.

- Maintaining above-average occupancy and smooth operator transitions are key consensus factors meant to underpin revenue and dividend growth in the years ahead.

Reliance on Capital Recycling Adds Execution Risk

- One risk flagged in filings is that CHCT is funding planned $146 million of acquisitions by recycling capital from asset sales, rather than tapping equity or additional debt. Any delay or discount on asset sales could directly limit portfolio expansion and future earnings growth.

- The consensus narrative highlights that this reliance on disciplined capital recycling over new borrowing is intended to optimize capital deployment now that interest rates are elevated, but

- Persistent dependence on asset sales brings execution risk, especially if proceeds fall short or are delayed, potentially impacting accretion to earnings and funds available for dividends.

- The current environment makes it harder to source quality acquisitions with attractive yields, intensifying the need to get capital cycling exactly right for growth to materialize as forecast.

Valuation Gap: DCF Fair Value Versus Peer Discounts

- Shares trade at $14.43, markedly below the DCF fair value of $59.85, and CHCT’s price-to-sales ratio of 3.3x sits below the US Health Care REITs industry average (4.8x) yet above that of its closest peers (2.7x), showing mixed signals for value-focused investors.

- Analysts' consensus view points to the 17.9 price target, which is 20.9% above current levels, but flags that for this valuation to hold up, CHCT must reach $148.8 million in revenues and a forward PE ratio of 33.7x by 2028. This trajectory is only justifiable if margin and capital allocation assumptions prove accurate.

- The wide spread between fair value, analyst targets, and peer multiples creates both opportunity and skepticism. Value seekers are betting on a sustained turnaround, while doubters point to financial position and execution risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Community Healthcare Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Share your perspective and craft a unique narrative to showcase your view in just a few minutes. Do it your way.

A great starting point for your Community Healthcare Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

CHCT's dependence on asset sales for expansion and lingering losses highlight ongoing concerns about the company's financial stability and balance sheet strength.

If you’d rather sidestep these balance sheet risks, discover companies with healthier fundamentals and reliable financial footing in our solid balance sheet and fundamentals stocks screener (1981 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHCT

Community Healthcare Trust

A real estate investment trust that focuses on owning income-producing real estate properties associated primarily with the delivery of outpatient healthcare services in our target sub-markets throughout the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success