- United States

- /

- Specialized REITs

- /

- NYSE:CCI

The Bull Case For Crown Castle (CCI) Could Change Following Utility-Focused Anterix TowerX Partnership Announcement

Reviewed by Sasha Jovanovic

- On November 12, 2025, Anterix and Crown Castle jointly announced the launch of Anterix TowerX, a turnkey service designed to accelerate and optimize the deployment of 900 MHz private LTE networks for utilities across the U.S., leveraging Crown Castle’s network of more than 40,000 tower sites.

- This collaboration not only streamlines wireless infrastructure projects for the utility sector but also highlights Crown Castle’s deeper integration into nationwide critical infrastructure modernization efforts.

- We’ll now explore how this new turnkey tower partnership might shape Crown Castle’s investment narrative by expanding its reach in utility-driven network deployments.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Crown Castle Investment Narrative Recap

To own Crown Castle, investors need confidence in the company’s U.S. tower business as a durable foundation amid the push for nationwide connectivity and infrastructure upgrades. The Anterix TowerX partnership expands utility sector exposure, but it does not materially affect the near-term catalyst, which remains the company’s focused transition to a pure-play tower model after selling the fiber segment. The biggest risk today continues to be execution challenges around asset divestment and regulatory approvals, which may delay revenue if not managed well.

Among recent announcements, the November 2025 dividend declaration stands out. Crown Castle has maintained a quarterly cash dividend of US$1.0625 per share, even as cash flows and earnings remain under pressure, highlighting the company’s ongoing commitment to returning capital amid operational shifts. This approach supports the near-term investment narrative of shareholder alignment but does not reduce the uncertainties tied to repositioning toward core tower operations.

Yet, while the company is pushing into new opportunities, investors should pay special attention to potential regulatory delays around…

Read the full narrative on Crown Castle (it's free!)

Crown Castle's outlook forecasts $4.6 billion in revenue and $1.6 billion in earnings by 2028. This implies a 10.7% annual decline in revenue and a $5.5 billion increase in earnings from current earnings of -$3.9 billion.

Uncover how Crown Castle's forecasts yield a $116.06 fair value, a 24% upside to its current price.

Exploring Other Perspectives

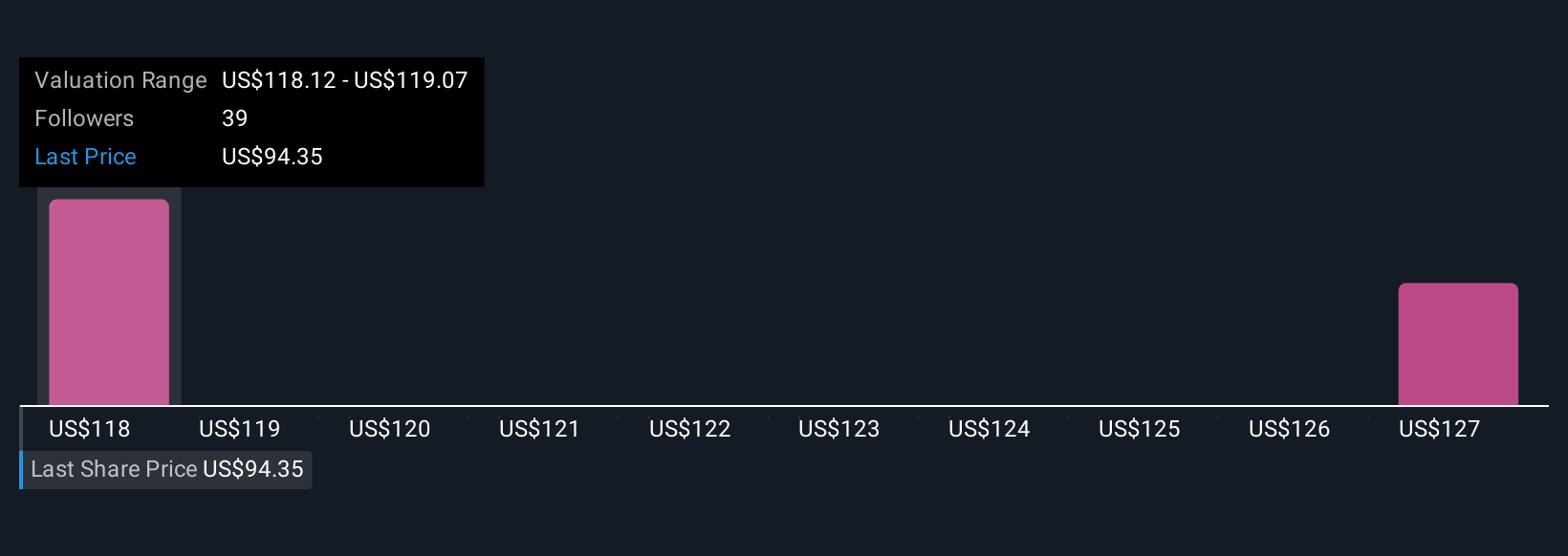

Three members of the Simply Wall St Community estimate Crown Castle’s fair value between US$102.56 and US$130.90 per share. While many feel growth in utility network deployments could benefit the tower business, execution risks tied to the fiber segment sale still weigh on near-term performance, so it’s important to consider a range of viewpoints.

Explore 3 other fair value estimates on Crown Castle - why the stock might be worth just $102.56!

Build Your Own Crown Castle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Castle research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crown Castle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Castle's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives