- United States

- /

- Specialized REITs

- /

- NYSE:CCI

The Bull Case For Crown Castle (CCI) Could Change Following Fiber Sale and Raised Earnings Outlook

Reviewed by Sasha Jovanovic

- Crown Castle reported third-quarter 2025 earnings that surpassed analyst expectations and raised its full-year outlook for site rental revenues and AFFO, driven by strong demand from U.S. wireless carriers and operational efficiencies.

- The company announced the planned sale of its Small Cells and Fiber segment for US$8.5 billion, aiming to become a pure-play U.S. tower operator with proceeds supporting a US$3 billion share buyback and a revised dividend strategy linked to AFFO.

- We'll explore how the increased full-year guidance and focus on U.S. tower operations may alter Crown Castle's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Crown Castle Investment Narrative Recap

To own Crown Castle as a shareholder, you need conviction in the long-term growth of US wireless infrastructure and the durability of tower leasing revenues, especially as 5G expansion drives demand for tower space. The latest earnings beat and raised guidance reinforce the near-term catalyst from strong US carrier leasing, but the biggest risk, the potential for execution challenges or delays in the planned Small Cells and Fiber segment sale, remains unchanged for now, as the deal’s closure is still pending regulatory approval.

The company’s announcement to divest its Small Cells and Fiber business for US$8.5 billion is directly relevant, as this transaction marks Crown Castle’s shift to a pure-play US tower operator and provides the financial firepower for a US$3 billion share buyback and revised dividend framework. How efficiently this transformation unfolds could meaningfully impact operating results and investor confidence throughout the transition period.

But for investors looking beyond the headlines, another area worth watching is the risk that sale timing or regulatory setbacks...

Read the full narrative on Crown Castle (it's free!)

Crown Castle's outlook anticipates $4.6 billion in revenue and $1.6 billion in earnings by 2028. This scenario requires a 10.7% yearly revenue decline and a $5.5 billion increase in earnings from the current level of -$3.9 billion.

Uncover how Crown Castle's forecasts yield a $117.27 fair value, a 19% upside to its current price.

Exploring Other Perspectives

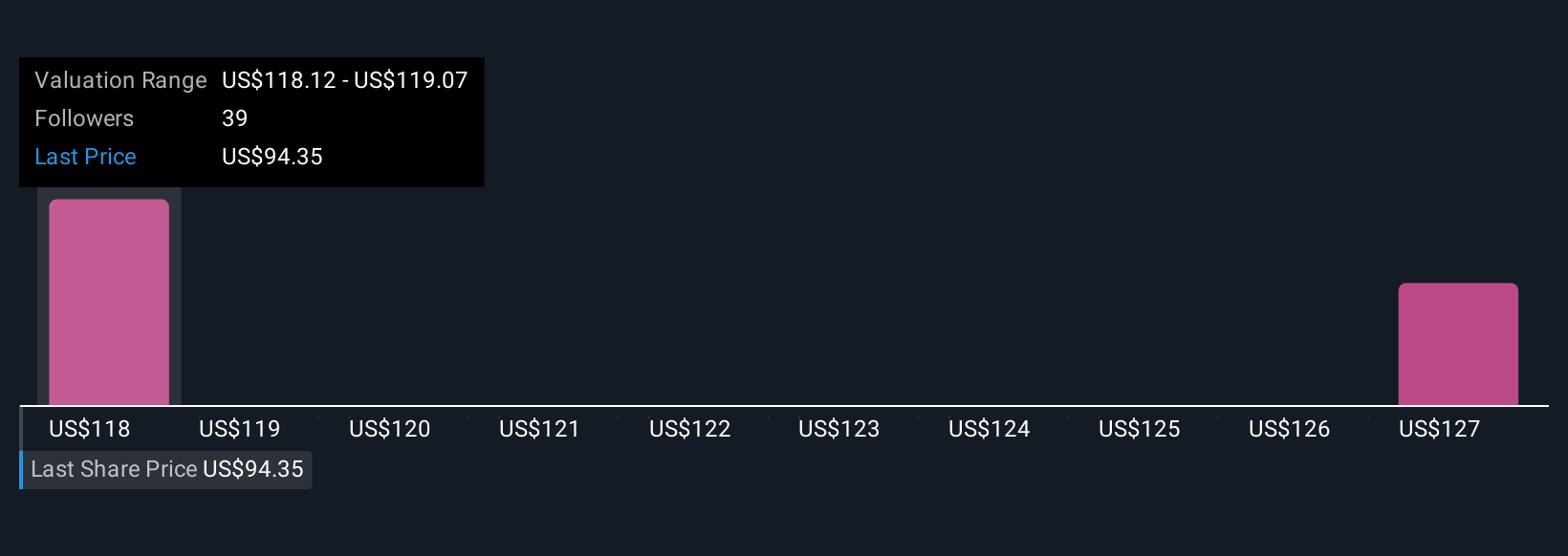

Three recent fair value estimates from the Simply Wall St Community range from US$102.56 to US$139.92, reflecting a broad spectrum of private investor views. This diversity aligns with ongoing uncertainty around the successful sale of Crown Castle’s fiber segment, which could influence both financial flexibility and future earnings.

Explore 3 other fair value estimates on Crown Castle - why the stock might be worth as much as 42% more than the current price!

Build Your Own Crown Castle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Castle research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crown Castle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Castle's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives