- United States

- /

- Specialized REITs

- /

- NYSE:CCI

Crown Castle (CCI): Exploring Valuation After Raised Outlook and Earnings Beat

Reviewed by Simply Wall St

Crown Castle (CCI) just delivered its second quarter results, and the headline is hard to miss: earnings topped expectations, and management raised its outlook for the rest of 2025. That means upward revisions for key metrics such as adjusted funds from operations, site rental revenue, and EBITDA. However, year-over-year comparisons are still coming in lower. For investors watching this space, these moves suggest that the company’s execution is gaining more confidence from its own leadership, which could influence how the market has been viewing the stock’s prospects.

To put it in context, Crown Castle’s share price has lagged the broader market over the past year, declining by almost 3%. The stock has rebounded by 16% since January. Longer-term holders are still below levels seen a few years ago, but the positive momentum since the start of the year has improved sentiment to some extent, especially with AFFO guidance trending higher. Still, with annual revenue in decline, the market has not overlooked the underlying challenges in Crown Castle’s business model or sector headwinds.

With the recent jump after earnings and an improved outlook, it remains to be seen whether Crown Castle is positioned for a sustained turnaround or if the market has already priced in expectations for future growth.

Most Popular Narrative: 12.6% Undervalued

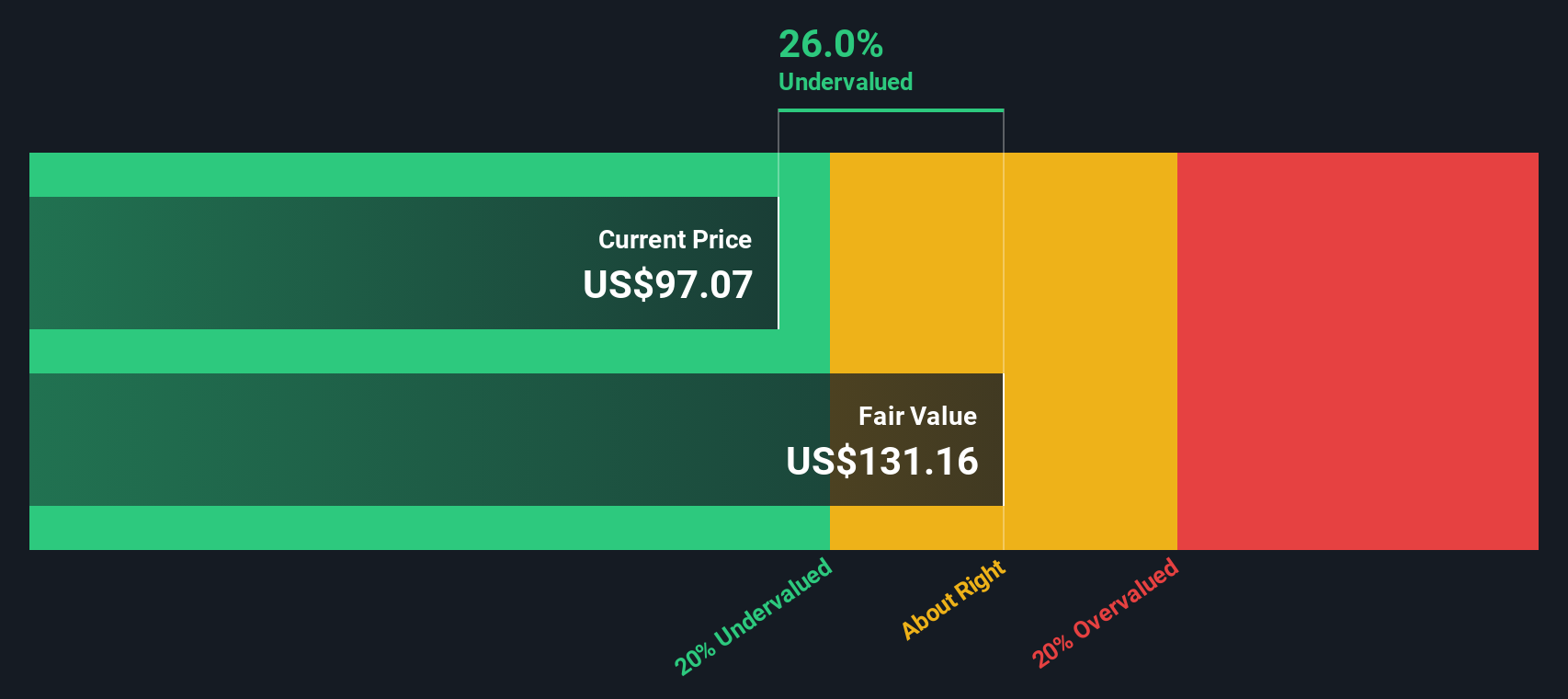

According to the community narrative, Crown Castle is trading at a notable discount to fair value, suggesting that upside potential remains if the narrative’s assumptions come to fruition.

The decision to sell the fiber segment and become a pure-play U.S. tower company could unlock substantial value in the tower business by enhancing focus on operational excellence, customer service, and improved profitability. This could potentially drive higher revenue and net margins.

Want to know the full story behind this undervaluation? This analyst consensus highlights an aggressive profit turnaround and a valuation approach that rests on a bold call, fueled by future margin expansion and ambitious earnings targets. Curious which key forecasts are powering this price? Discover the projections driving this fair value calculation.

Result: Fair Value of $118.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, execution risks tied to regulatory approvals and reduced dividends could challenge the bullish case if delays or cash flow constraints persist.

Find out about the key risks to this Crown Castle narrative.Another View: What Does the DCF Model Say?

For a different perspective, the SWS DCF model also values Crown Castle as trading at a discount compared to its estimate of fair value. This supports the earlier point; however, do both approaches indicate the same outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Crown Castle Narrative

If you see things differently or want to dig into the numbers on your own terms, building your own view is quick and easy. Simply do it your way.

A great starting point for your Crown Castle research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to keep your portfolio ahead of the curve? Don’t settle for the ordinary when so many promising opportunities are right at your fingertips. Uncover investment possibilities that could transform your returns. Check out these handpicked themes and start your search for the next big winner:

- Target reliable income with companies offering strong yields by checking out dividend stocks with yields > 3% in today’s market.

- Pursue innovation by finding stocks at the frontier of healthcare transformation through healthcare AI stocks and see how AI is reshaping patient care and diagnostics.

- Tap into potential value plays by browsing undervalued stocks based on cash flows and spot businesses that may be trading below their true worth based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives