- United States

- /

- Office REITs

- /

- NYSE:BXP

Is BXP's US$600 Million Note Offering and Hub Refinancing Changing Its Capital Structure Story (BXP)?

Reviewed by Sasha Jovanovic

- BXP completed a private offering of US$600 million in exchangeable senior notes and secured US$465 million in refinancing for The Hub on Causeway, reflecting significant recent capital activity.

- These actions highlight BXP’s efforts to bolster liquidity and optimize its debt profile, which could shape the company’s position for future growth and development projects.

- We’ll explore how BXP’s substantial note issuance signals a focus on financial flexibility and influences the company’s overall investment story.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BXP Investment Narrative Recap

To be a BXP shareholder, you generally need to believe in the long-term recovery of premier office and life science properties in major US markets and the ability of high-quality, centrally located assets to attract tenants and command premium rents. The recent removal from the FTSE All-World Index is unlikely to materially impact short-term leasing catalysts or the most significant risk: ongoing challenges in backfilling vacant space and achieving stable occupancy amid evolving tenant demand and sector-specific slowdowns.

One announcement closely related to near-term catalysts is Workday’s new lease in BXP’s Reston Town Center, which helps address the risk of larger tenants vacating space. This move may provide some support for occupancy levels and showcases BXP’s ability to attract well-capitalized tenants in markets where demand is shifting, though broader leasing and rent-mark-to-market concerns remain crucial for investors to monitor as the story unfolds.

By contrast, investors should be aware that headline occupancy could still come under pressure if demand across key office and life sciences assets...

Read the full narrative on BXP (it's free!)

BXP's narrative projects $3.7 billion in revenue and $368.8 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $363.9 million increase in earnings from $4.9 million currently.

Uncover how BXP's forecasts yield a $78.22 fair value, a 3% upside to its current price.

Exploring Other Perspectives

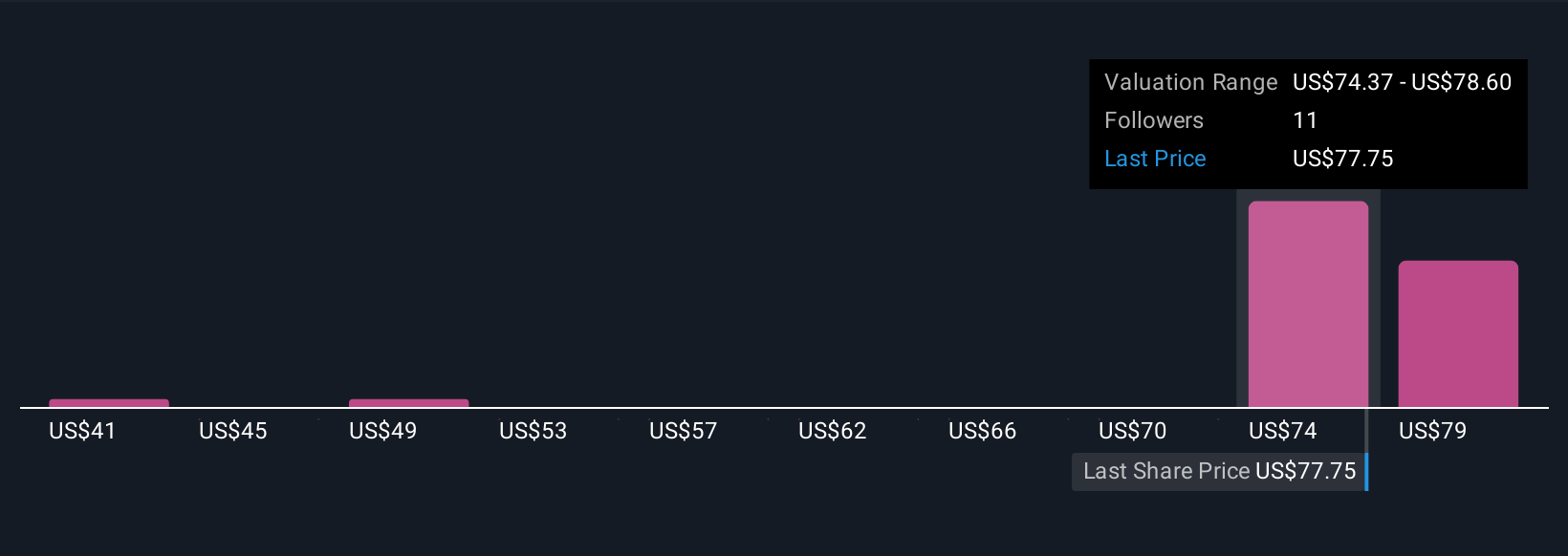

Simply Wall St Community members set fair value targets for BXP ranging from US$40.50 to US$83.31 across four distinct estimates. While several participants see upside, persistent sector-specific leasing headwinds remain top of mind for many, shaping expectations for BXP’s future performance.

Explore 4 other fair value estimates on BXP - why the stock might be worth 46% less than the current price!

Build Your Own BXP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BXP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BXP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BXP's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives