- United States

- /

- Office REITs

- /

- NYSE:BXP

BXP's First Green Bond Mortgage Might Change the Case for Investing in BXP (BXP)

Reviewed by Sasha Jovanovic

- BXP, Inc. announced the closing of a US$465 million, 5.5-year non-recourse green bond mortgage loan secured by The Hub on Causeway in Boston, with proceeds used to repay approximately US$490 million of existing loans on the property.

- This marks BXP's first green bond mortgage financing, highlighting a significant step towards sustainability and financial flexibility in one of its premier mixed-use assets.

- We’ll now assess how BXP’s inaugural green bond financing could influence its long-term investment narrative and sustainability positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

BXP Investment Narrative Recap

To be a shareholder in BXP, you need to believe in the long-term value and resilience of top-tier, centrally located office and mixed-use properties in supply-constrained urban markets. BXP’s recent green bond mortgage at The Hub on Causeway improves financial flexibility but does not materially change the most important near-term catalyst: stabilizing occupancy and lease-up of recent developments, while the biggest risk remains tenant demand and re-leasing challenges in key markets.

One particularly relevant announcement is BXP’s expansion of its unsecured revolving credit facility by US$250 million this spring. This step adds further flexibility at a time when proactive balance sheet management is crucial for funding new developments, refinancing, and supporting occupancy initiatives, closely linked to the company’s ongoing catalyst of advancing high-quality, sustainable projects that attract stable tenants.

By contrast, those watching BXP should be aware of the potential impact if slower leasing or weaker tenant demand persists across major assets, as this could...

Read the full narrative on BXP (it's free!)

BXP's narrative projects $3.7 billion in revenue and $368.8 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $363.9 million increase in earnings from the current $4.9 million level.

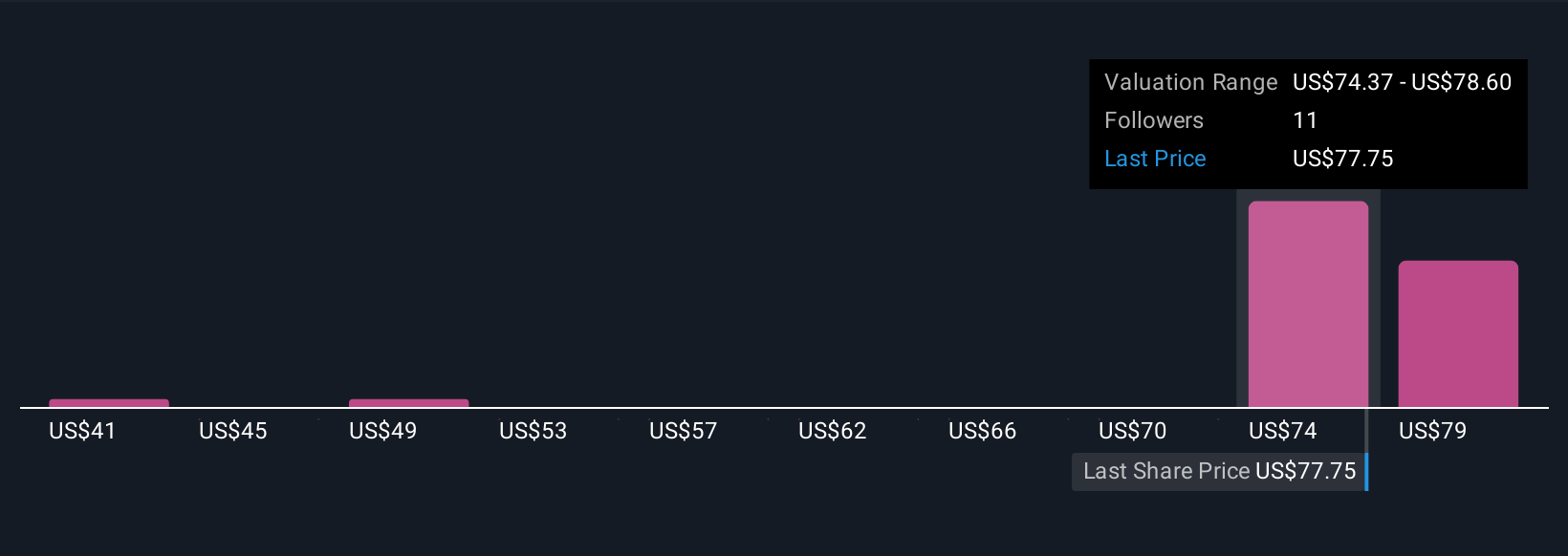

Uncover how BXP's forecasts yield a $79.45 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community range from US$40.50 to US$82.53, reflecting wide variation in investor viewpoints. As you consider these numbers, remember that continued demand from AI and technology tenants is seen as a core business driver for BXP’s outlook, shaping future cash flow and portfolio growth.

Explore 4 other fair value estimates on BXP - why the stock might be worth 43% less than the current price!

Build Your Own BXP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BXP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BXP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BXP's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives