- United States

- /

- Office REITs

- /

- NYSE:BXP

A Fresh Look at Boston Properties (BXP) Valuation After Major New Financing and Notes Offering

Reviewed by Kshitija Bhandaru

BXP, Inc. (BXP) recently completed two significant financing deals that have caught the market’s interest. The company secured $465 million for The Hub on Causeway and increased a private notes offering to $850 million.

See our latest analysis for BXP.

BXP has kept investors watching, with a recent run of high-profile financings and news of major tenants like Workday moving in, even as it was dropped from the FTSE All-World Index. Despite some volatility, the company’s 3-year total shareholder return of nearly 23% highlights its longer-term resilience. Recent price moves suggest momentum is steady but not breakout.

If big REIT maneuvers have you thinking about broader opportunities, now's a smart time to discover fast growing stocks with high insider ownership

With BXP showing prudent balance sheet management and a stream of new deals, investors are left to wonder whether the recent strength is just the start of a more compelling valuation story or if the market has already anticipated future growth.

Most Popular Narrative: 3.3% Undervalued

BXP’s current share price is trading just below the most popular narrative’s fair value estimate, suggesting a touch of upside if the narrative’s assumptions play out. The narrative brings renewed focus on select property markets and evolving tenant demand, which could redefine BXP’s growth trajectory from here.

Occupancy and rent growth for BXP's high-quality, centrally located assets and premier developments are set to benefit from a marked return to in-person work mandates and a strong "flight to quality," as demonstrated by significant tenant demand, tightening vacancies (notably in NYC and Boston), and double-digit increases in asking rents in premier submarkets. This supports higher future revenues and NOI per square foot.

Want to discover what really powers this valuation? The secret behind the price target: aggressive profit margin expansion, a rare future earnings leap, and bold assumptions about high-end office demand. Can BXP outpace its past and justify the optimism? Get the full scoop to see which numbers turn this theory into a potential opportunity.

Result: Fair Value of $78.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing occupancy declines and persistent leasing challenges could undermine the optimistic outlook and trigger renewed caution among investors and analysts alike.

Find out about the key risks to this BXP narrative.

Another View: What Does Our DCF Model Say?

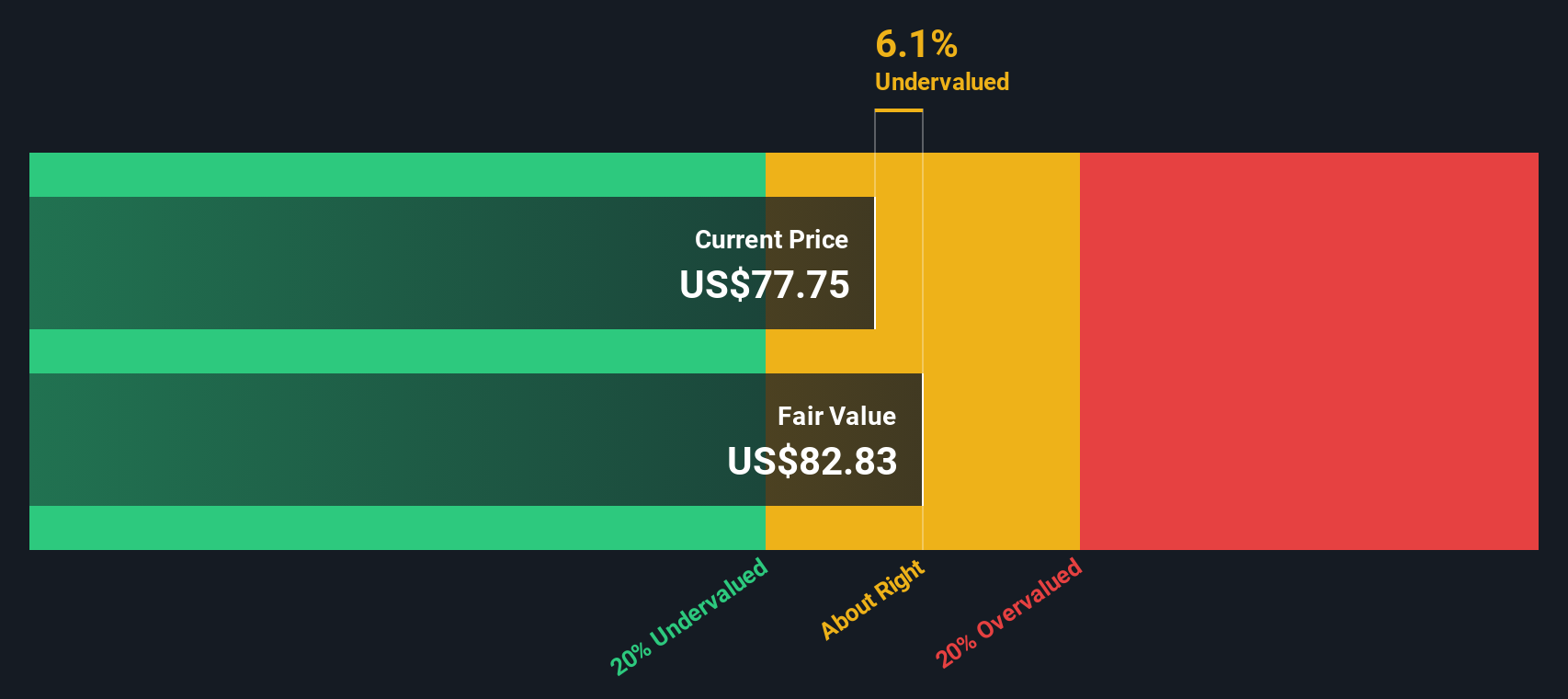

Taking a different perspective, the Simply Wall St DCF model suggests BXP is trading below its estimated fair value, coming in at $83.31. This points to a potential undervaluation that may not be fully reflected in analyst targets. Does this method reveal hidden upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BXP Narrative

If you see things differently or want to dive into the numbers on your own terms, you can craft your perspective in just a few minutes. Do it your way

A great starting point for your BXP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that tomorrow’s big winner can emerge from unexpected places. Give yourself the edge by checking out these carefully curated stock opportunities before they take off.

- Tap into untapped value by reviewing these 910 undervalued stocks based on cash flows packed with companies trading below their true worth and primed for future growth.

- Capitalize on future healthcare breakthroughs, starting with these 31 healthcare AI stocks where innovative firms are harnessing artificial intelligence to transform patient care and diagnostics.

- Capture reliable income streams by scanning these 19 dividend stocks with yields > 3% featuring stocks with robust dividend yields and a strong record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives