- United States

- /

- Office REITs

- /

- NYSE:BXP

Introducing Boston Properties (NYSE:BXP), The Stock That Dropped 11% In The Last Three Years

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Boston Properties, Inc. (NYSE:BXP) shareholders, since the share price is down 11% in the last three years, falling well short of the market return of around 41%.

Check out our latest analysis for Boston Properties

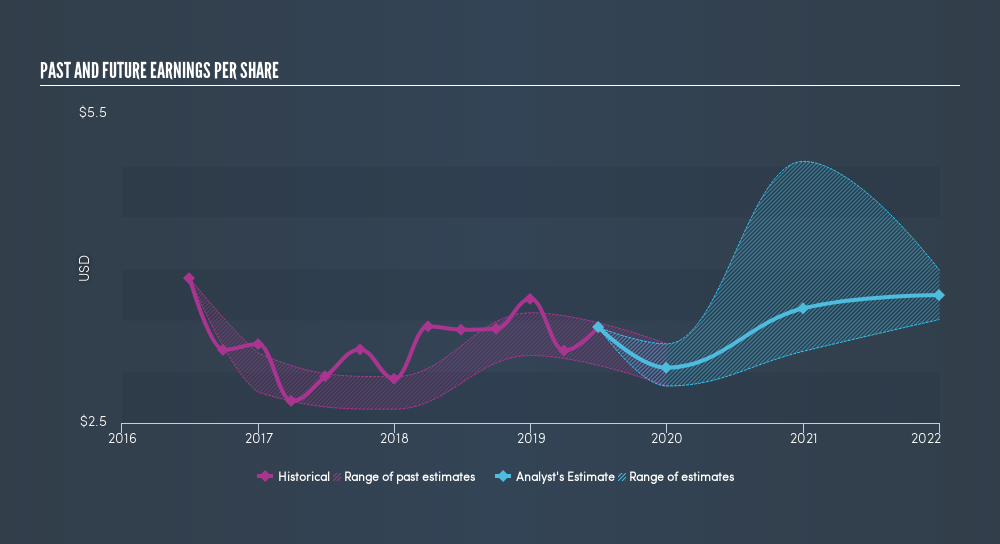

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Boston Properties saw its EPS decline at a compound rate of 4.2% per year, over the last three years. This change in EPS is reasonably close to the 3.7% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

This free interactive report on Boston Properties's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Boston Properties the TSR over the last 3 years was -3.2%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Boston Properties provided a TSR of 1.1% over the last twelve months. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 4.1% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. If you would like to research Boston Properties in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives