- United States

- /

- Retail REITs

- /

- NYSE:BRX

Is Brixmor Property Group’s (BRX) Management Succession Plan Built to Withstand Unexpected Executive Changes?

Reviewed by Sasha Jovanovic

- On October 16, 2025, Brixmor Property Group announced that CEO James M. Taylor Jr. began a temporary medical leave of absence, appointing President and COO Brian T. Finnegan as interim CEO during his absence.

- This leadership transition places renewed attention on the company's succession planning and the stability of its management team during periods of executive change.

- We’ll examine how the interim CEO appointment may impact expectations for management continuity and the existing investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Brixmor Property Group Investment Narrative Recap

Brixmor Property Group’s investment appeal centers on the resilience and growth potential of grocery-anchored shopping centers, where high occupancy and rent growth are key drivers. The temporary handover of CEO duties to Brian T. Finnegan, following James M. Taylor Jr.’s medical leave, brings short-term attention to management continuity but is not expected to materially affect the most important catalysts or amplify prevailing risks, such as tenant disruptions or cap rate pressure.

Among recent events, Brixmor’s addition to the Russell 1000 Defensive and Russell 1000 Value-Defensive indexes stands out. This inclusion highlights ongoing recognition of the company’s stable cash flows and defensiveness in retail real estate, serving as context for investor confidence in management’s ability to maintain core operations, even during transitional periods.

However, it’s important for investors to keep in mind that, despite strong fundamentals, persistent tenant disruption risk remains a key consideration if anchor vacancies accelerate…

Read the full narrative on Brixmor Property Group (it's free!)

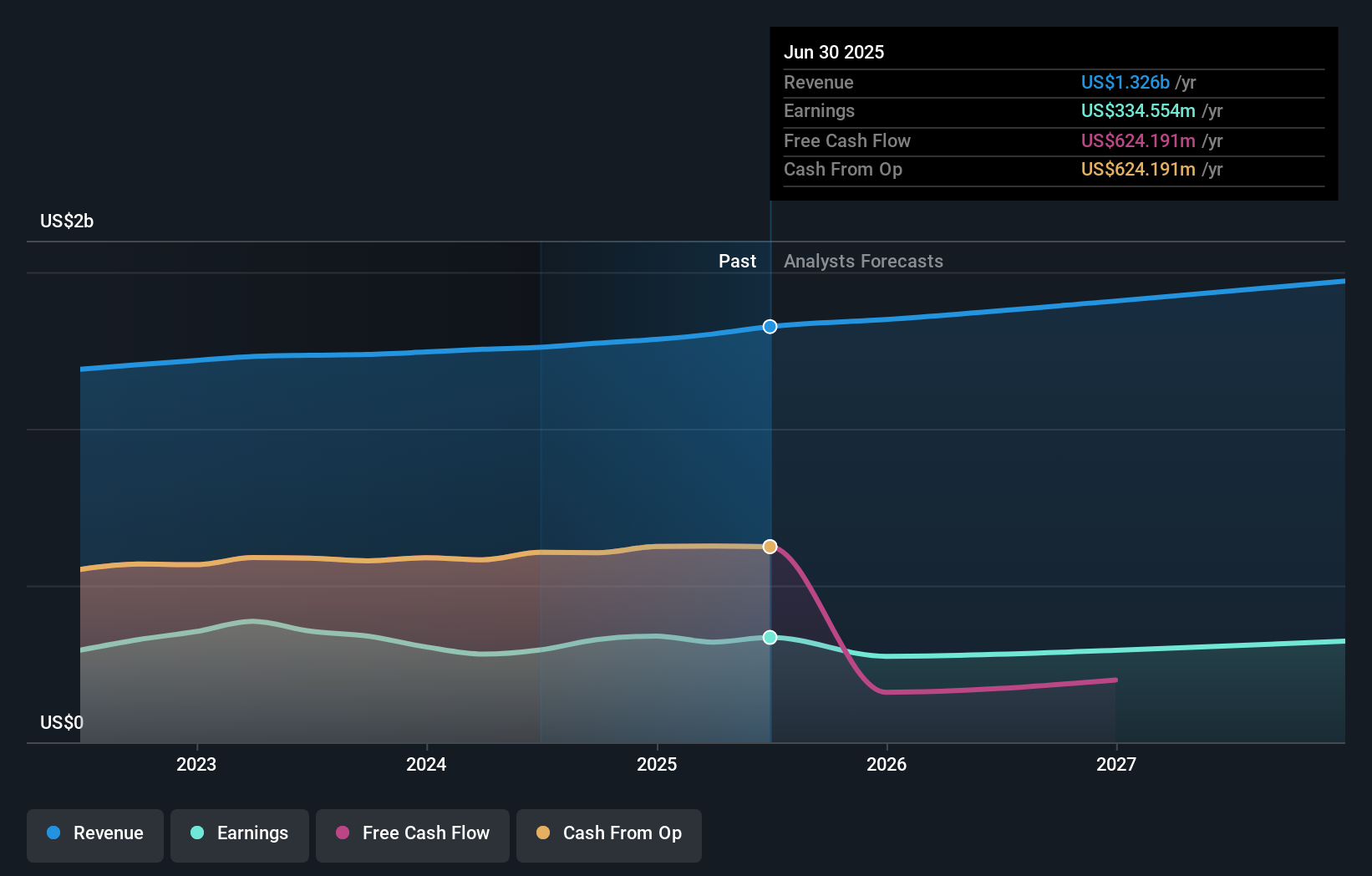

Brixmor Property Group's outlook anticipates $1.5 billion in revenue and $310.2 million in earnings by 2028. This is based on a projected 4.8% annual revenue growth rate, with earnings expected to decline by $24.4 million from the current $334.6 million.

Uncover how Brixmor Property Group's forecasts yield a $29.94 fair value, a 10% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community places BRX at US$29.94. While investors see steady asset value, heightened tenant disruption risk may have broader consequences than management change alone. Explore a variety of perspectives before making a decision.

Explore another fair value estimate on Brixmor Property Group - why the stock might be worth just $29.94!

Build Your Own Brixmor Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brixmor Property Group research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Brixmor Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brixmor Property Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brixmor Property Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRX

Brixmor Property Group

Brixmor (NYSE: BRX) is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers.

Undervalued with moderate risk and pays a dividend.

Similar Companies

Market Insights

Community Narratives