- United States

- /

- REITS

- /

- NYSE:BNL

Broadstone Net Lease (BNL): A Fresh Look at Valuation After New Facility Completion and Off-Market Expansion Deals

Reviewed by Simply Wall St

Broadstone Net Lease (BNL) has reached a milestone with substantial completion of its first maintenance, repair, and overhaul facility at Dayton International Airport. This facility is tied to Sierra Nevada Corporation’s contract with the U.S. Air Force.

See our latest analysis for Broadstone Net Lease.

Recent progress on the Dayton airport facility adds to a string of milestone announcements for Broadstone Net Lease, including new off-market development deals and continued dividend payments. While recent earnings signaled mixed results, investor optimism appears to be building as the company’s share price is up 15% year-to-date, and its 1-year total shareholder return stands at over 10%, reflecting solid momentum as expansion projects move forward.

If this steady growth and sector activity have your attention, now's a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading near a 10 percent discount to analyst price targets and growth projects in the pipeline, investors are left asking whether Broadstone Net Lease is undervalued or if future growth is already priced in.

Most Popular Narrative: 8.1% Undervalued

Broadstone Net Lease’s narrative fair value of $19.60 stands above the latest close at $18.10, underlining a gap investors will want to watch as new developments unfold. Market sentiment may be shifting, but the story behind this valuation reveals much more.

Disciplined portfolio repositioning, reducing exposure to riskier healthcare and office assets while recycling capital into resilient industrial and retail assets, has improved risk-adjusted returns and reduced lease rollover risk. This may lead to future multiple expansion and increased AFFO per share.

Curious what’s driving the jump in fair value? The narrative banks on growing margins, a steady expansion pipeline, and bold profit projections underpinned by strategic asset shifts. The details inside might surprise you. Explore the assumptions that shape this high-stakes outlook.

Result: Fair Value of $19.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant credit risks and intensifying competition in the net lease sector could pose challenges to Broadstone Net Lease’s growth outlook if not effectively managed.

Find out about the key risks to this Broadstone Net Lease narrative.

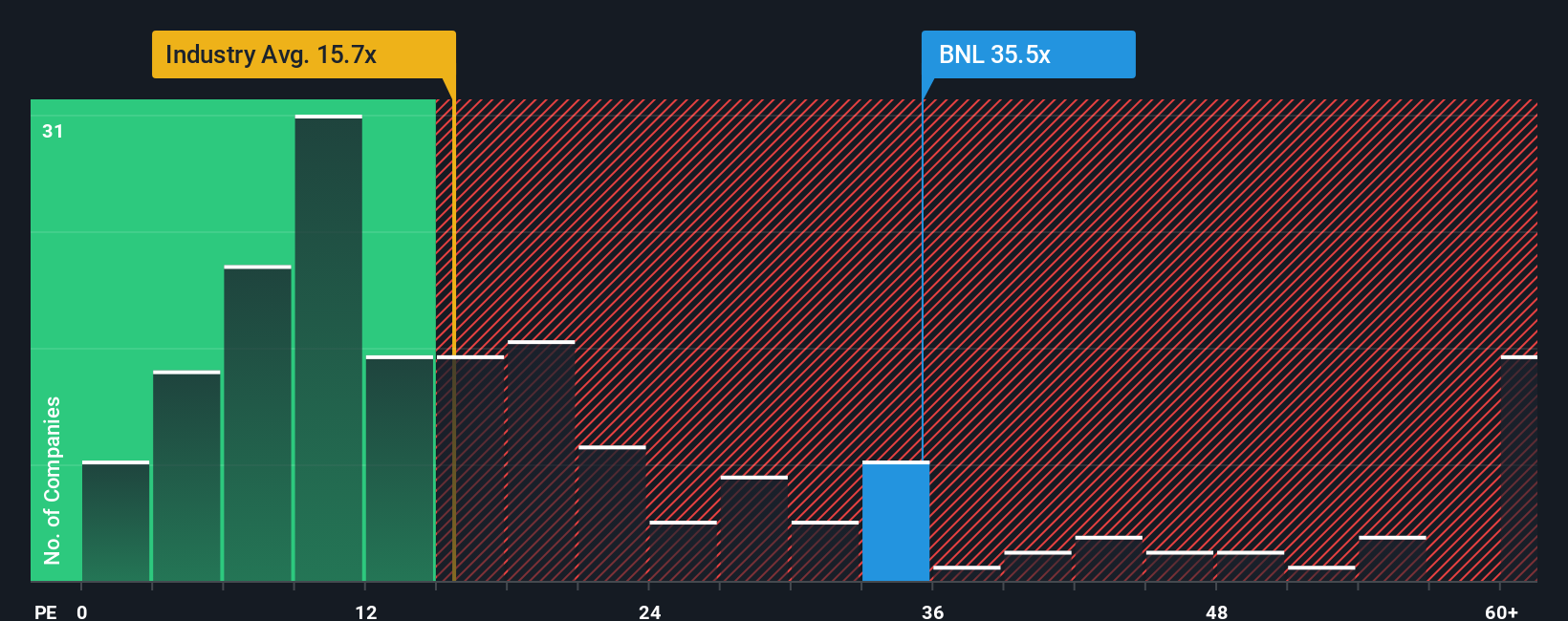

Another Perspective: Market Ratios Tell a Different Story

By comparison, the current price-to-earnings ratio of 38.7x is well above both the global REITs industry average of 15.2x and the peer average of 22.6x. Even when measured against a fair ratio benchmark of 35.5x, Broadstone Net Lease still trades at a premium. This steep valuation raises questions about whether investors are paying too much for future growth or if there is genuine upside left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadstone Net Lease Narrative

If this story doesn't quite match your perspective or you enjoy uncovering your own insights, you can shape a personalized narrative in just a few minutes by using Do it your way

A great starting point for your Broadstone Net Lease research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Let smart strategies work for you and get ahead before the competition snaps up tomorrow’s best opportunities. Missing out now could mean missing the next big winner.

- Capture strong yields and consistent payouts by tapping into these 16 dividend stocks with yields > 3% offering over 3 percent annual returns that income-focused investors don’t want to overlook.

- Seize the chance to profit from artificial intelligence breakthroughs by getting the inside track with these 25 AI penny stocks reshaping industries and powering tomorrow’s growth leaders.

- Spot undervalued gems primed for a turnaround by checking out these 864 undervalued stocks based on cash flows, giving you a front-row seat to the next wave of cash flow-driven growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadstone Net Lease might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNL

Broadstone Net Lease

BNL is an industrial-focused, diversified net lease REIT that invests in primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives