- United States

- /

- Retail REITs

- /

- NYSE:BFS

Evaluating Saul Centers After Property Acquisition News and Recent Share Price Rebound

Reviewed by Bailey Pemberton

- Curious whether Saul Centers is a hidden bargain or fairly priced at today's levels? You're in the right place to dig into the numbers behind the market buzz.

- The stock recently bounced 2.2% over the past week and has edged up 1.1% in the past month, even as its year-to-date performance remains down at -18.6%.

- Investors have shown renewed interest in Saul Centers following property acquisition news and fresh partnerships that have brought attention to its long-term development plans. These headline moves offer important context for the shifting sentiment around the company's value.

- When we run Saul Centers through our valuation checks, it stacks up with a score of 4 out of 6 for undervaluation. This is a solid score, but there is more to valuation than just the numbers, as you'll see when we dig even deeper by the end of the article.

Find out why Saul Centers's -18.4% return over the last year is lagging behind its peers.

Approach 1: Saul Centers Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those numbers back to their present value using today’s dollars. In Saul Centers' case, analysts have extrapolated adjusted funds from operations, meaning their focus is on actual cash the business can generate and use for shareholders each year.

Currently, Saul Centers generates approximately $106.83 million in free cash flow. Analyst estimates cover growth for the next five years, but for this DCF, Simply Wall St has projected the company's free cash flow out to 2035. Over this ten-year period, free cash flow is expected to gradually rise each year, reaching about $143.37 million by 2035. These figures are all calculated in US dollars.

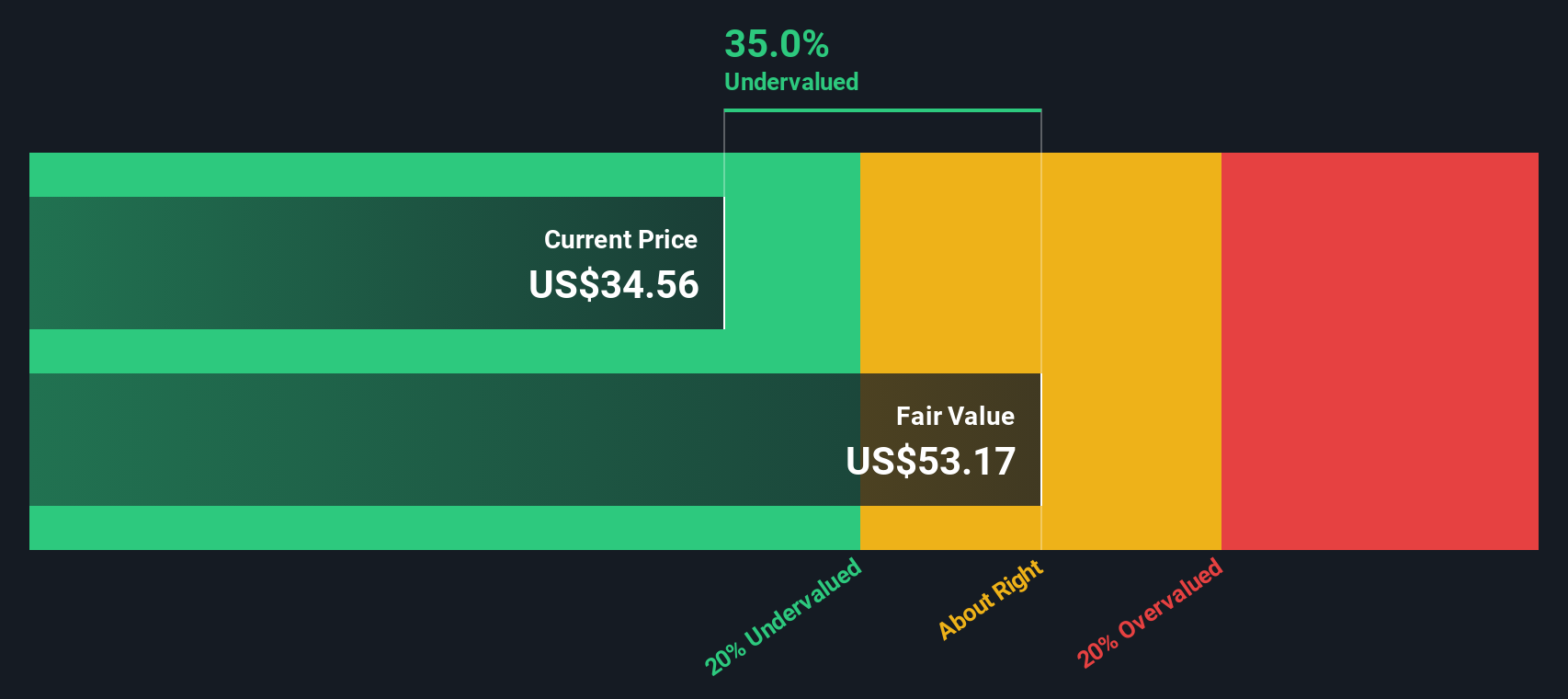

Based on these projections and using the two-stage free cash flow to equity model, the estimated intrinsic value per share sits at $47.83. With the stock trading nearly 35% lower than this computed fair value, the DCF suggests Saul Centers shares are currently undervalued in the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Saul Centers is undervalued by 34.9%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Saul Centers Price vs Earnings

For profitable companies like Saul Centers, the Price-to-Earnings (PE) ratio is a go-to metric for valuation. It measures how much investors are willing to pay today for a dollar of current earnings. A “fair” PE is not universal, since growth prospects and risk levels can push that number higher or lower. A higher expected growth rate or lower perceived risk tends to justify a higher PE ratio.

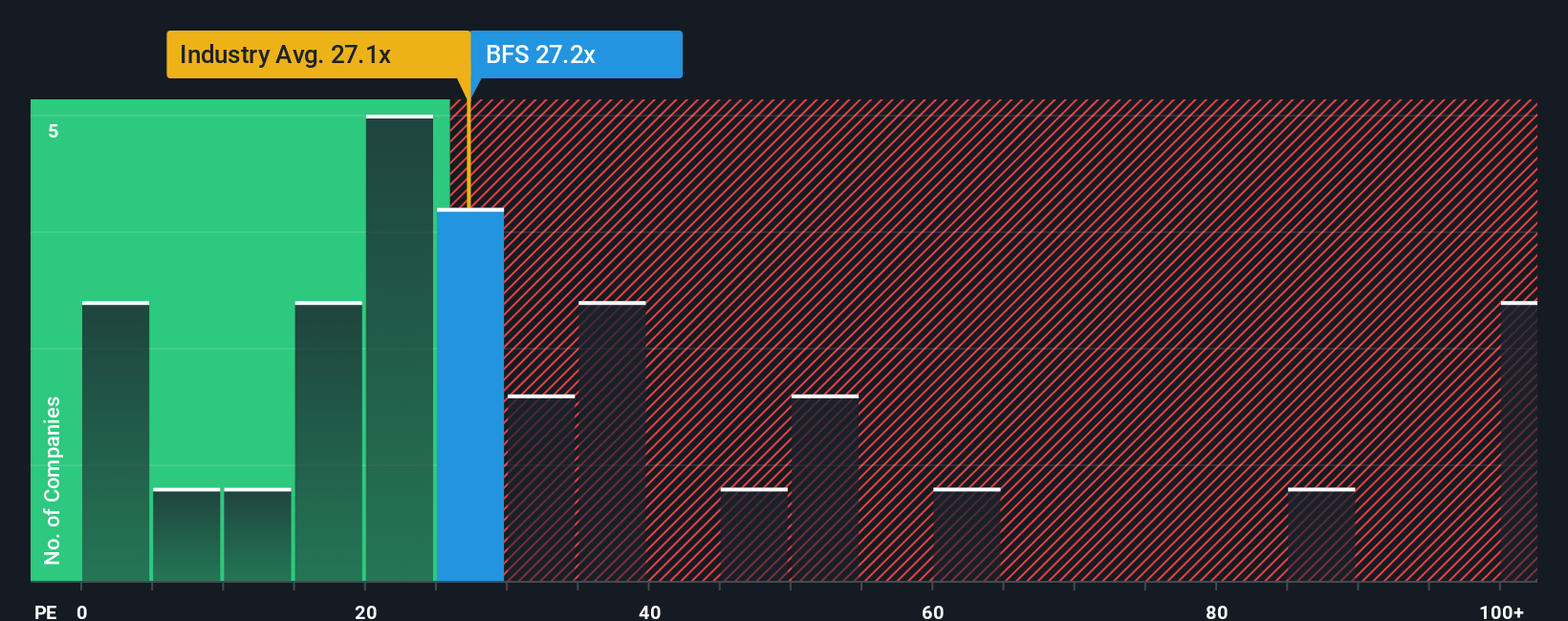

Currently, Saul Centers trades at a PE ratio of 27.2x. This is slightly above the average for the Retail REITs industry, which sits at 27.1x, and significantly below the average of its listed peers at 49.9x. This suggests the stock is valued similarly to the broader industry but more conservatively than direct competitors.

Simply Wall St’s Fair Ratio incorporates not just how Saul Centers compares to the industry, but also factors in company-specific elements like earnings growth, profit margins, market cap, and risk profile. This tailored approach means the Fair Ratio provides a more accurate yardstick for fair value than simple peer or industry averages. For Saul Centers, the Fair Ratio comes in at 38.5x, which is notably higher than its current PE.

Since Saul Centers’ actual PE of 27.2x is well below the Fair Ratio of 38.5x, this approach suggests the stock may be undervalued based on its individual characteristics as well as sector context.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Saul Centers Narrative

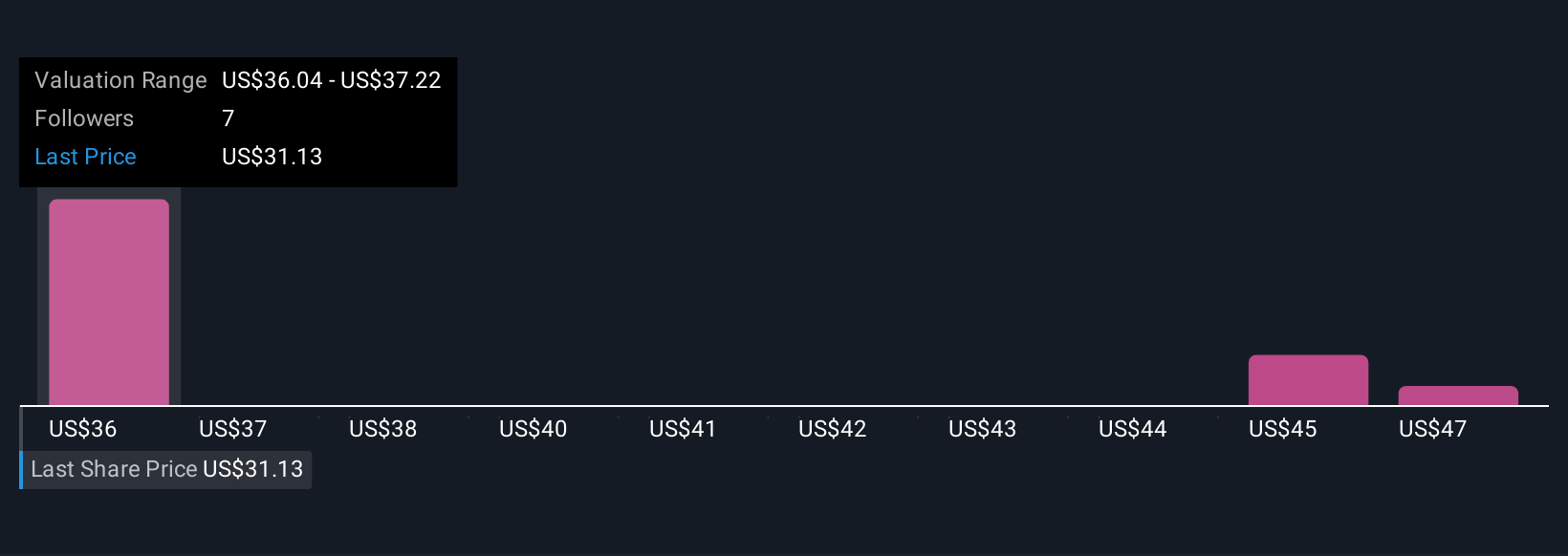

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your own story about a company, connecting your views on its future revenue, earnings, and margins to a personal estimate of fair value. Narratives let investors clearly link the story they believe in to concrete financial forecasts and ultimately to an actionable fair value.

On Simply Wall St’s platform, used by millions of investors, Narratives are found on the Community page as an easy and interactive tool. They help you decide when to buy or sell Saul Centers by visually comparing your Fair Value with the current share price based on your assumptions. Plus, Narratives are automatically updated when new developments or news stories emerge, keeping your outlook relevant and timely.

For example, one investor might predict Saul Centers’ fair value as high as $58 based on robust redevelopment plans, while another could see it as low as $35, focusing on industry risks and slower earnings growth. With Narratives, you can compare these perspectives and choose the one that fits your own story best.

Do you think there's more to the story for Saul Centers? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFS

Saul Centers

A self-managed, self-administered equity REIT headquartered in Bethesda, Maryland, which currently operates and manages a real estate portfolio of 62 properties, which includes (a) 50 community and neighborhood shopping centers and eight mixed-use properties with approximately 10.2 million square feet of leasable area and (b) four non-operating land and development properties.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success