- United States

- /

- Residential REITs

- /

- NYSE:AVB

Can AvalonBay’s Strategy Drive a Rebound After a 12.9% Drop in 2025?

Reviewed by Bailey Pemberton

If you’re trying to decide what to do with AvalonBay Communities stock, you’re definitely not alone. For those weighing their options, here’s what stands out: sure, the stock has seen some recent bumps, up 2.5% in the last week and down 2.8% for the past month, but longer-term holders have still seen a hefty 64.4% return over five years. That speaks volumes about both its resilience and its potential for rebound.

What’s driving these swings? AvalonBay has been in the news for a few key reasons, including growing demand for upscale apartment communities in major metro areas and broader shifts in how people approach renting versus buying. As the housing market evolves, company announcements about expanding property portfolios or strategic investments have kept AVB in the spotlight. The market seems to have taken notice, with a mix of optimism and caution as reflected in recent price moves, especially after a tough start this year, with shares down 12.9% year to date. While some investors may worry about risks reflected in the 14.9% dip over the past twelve months, others see solid fundamentals and a leadership position in real estate that could set the stage for strong returns.

From a pure numbers perspective, AvalonBay has a valuation score of 4 out of 6. That means the company is considered undervalued on four major measures, out of six checks. But what really goes into that score? The next section breaks down exactly how these valuation methods stack up, and we’ll also explore a smarter, all-in way to size up AvalonBay’s real worth at the end.

Why AvalonBay Communities is lagging behind its peers

Approach 1: AvalonBay Communities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For AvalonBay Communities, the DCF method uses Adjusted Funds From Operations as the basis. This metric is especially relevant for real estate companies because it accounts for essential recurring income minus ongoing capital expenses.

At present, AvalonBay’s Free Cash Flow stands at $1.56 billion. Analysts project steady growth over the next five years, reaching approximately $1.89 billion by the end of 2029. Beyond this period, projections extend out to ten years. Simply Wall St extrapolates further cash flow increases based on reasonable growth rate assumptions. These projections are all expressed in US dollars to ensure clarity and consistency.

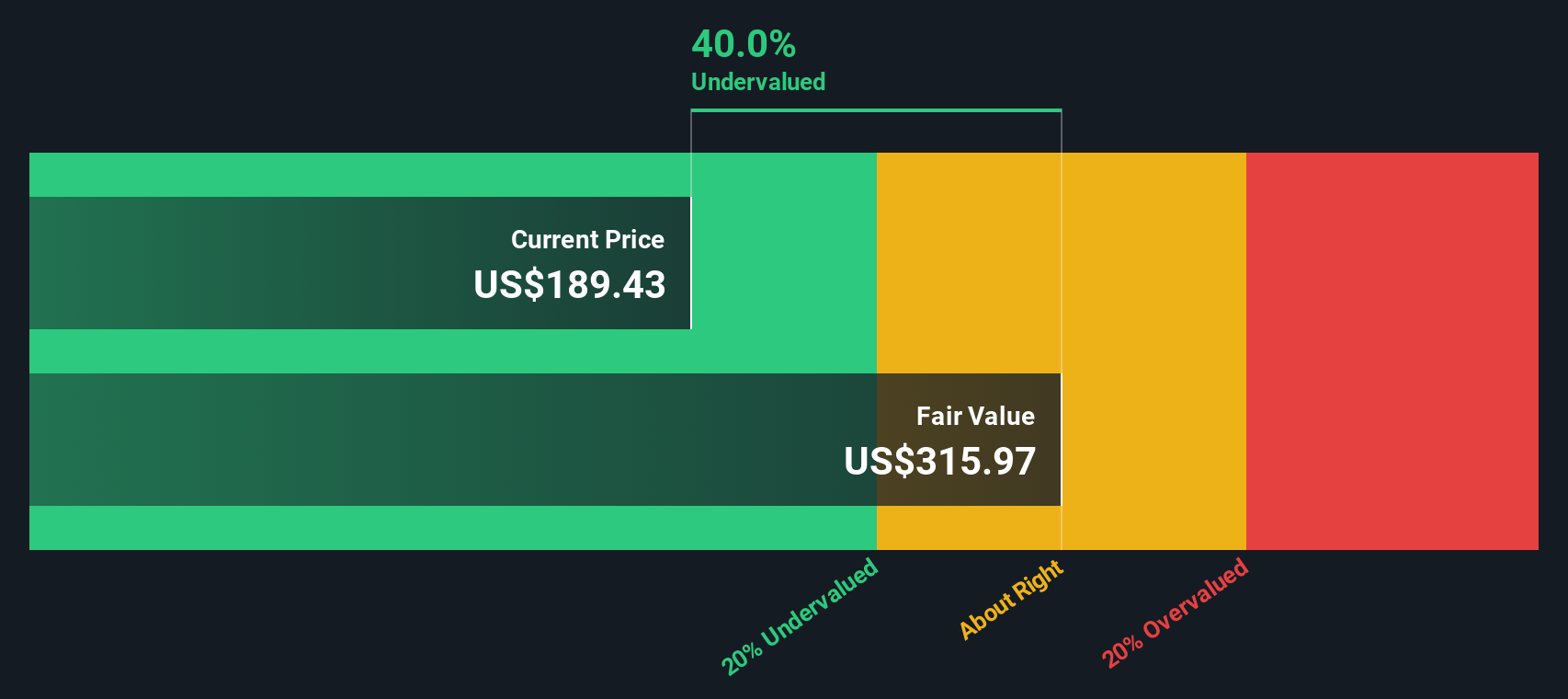

The DCF analysis calculates a fair value for AvalonBay shares of $315.81, which is about 40.1% higher than the current trading price. This suggests a significant margin of undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AvalonBay Communities is undervalued by 40.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AvalonBay Communities Price vs Earnings

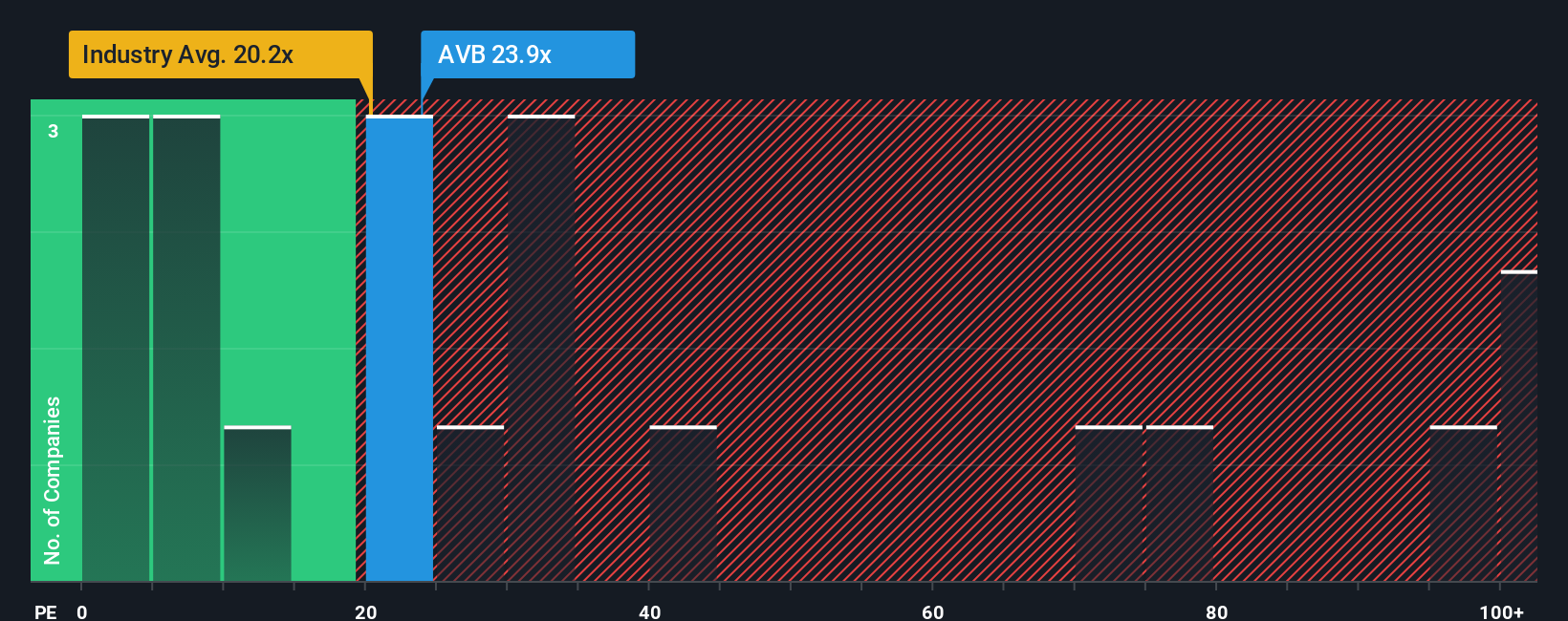

The Price-to-Earnings (PE) ratio is widely favored for assessing profitable companies like AvalonBay Communities because it directly links the current share price to the company's reported earnings. For investors, a lower PE can signal undervaluation, while a higher PE might reflect future growth expectations or areas of elevated risk.

Looking at the numbers, AvalonBay’s current PE ratio sits at 23.22x. That is higher than the Residential REITs industry average of 20.72x, but well below the peer group average of 41.88x. Benchmarks like the industry average and peer average help set the context, but they do not consider a company’s unique qualities or outlook. This is where the Simply Wall St Fair Ratio comes in, as it calculates what AvalonBay’s PE should reasonably be by factoring in the company’s earnings growth, profit margins, size, and risk profile within its industry. For AvalonBay, the Fair Ratio is 28.84x.

Unlike a basic benchmark, the Fair Ratio adjusts for real company fundamentals and industry dynamics, making it a more reliable reference point for long-term investors. Comparing this to AvalonBay’s actual PE of 23.22x shows that the stock is trading at a meaningful discount. The current valuation looks attractive relative to its earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AvalonBay Communities Narrative

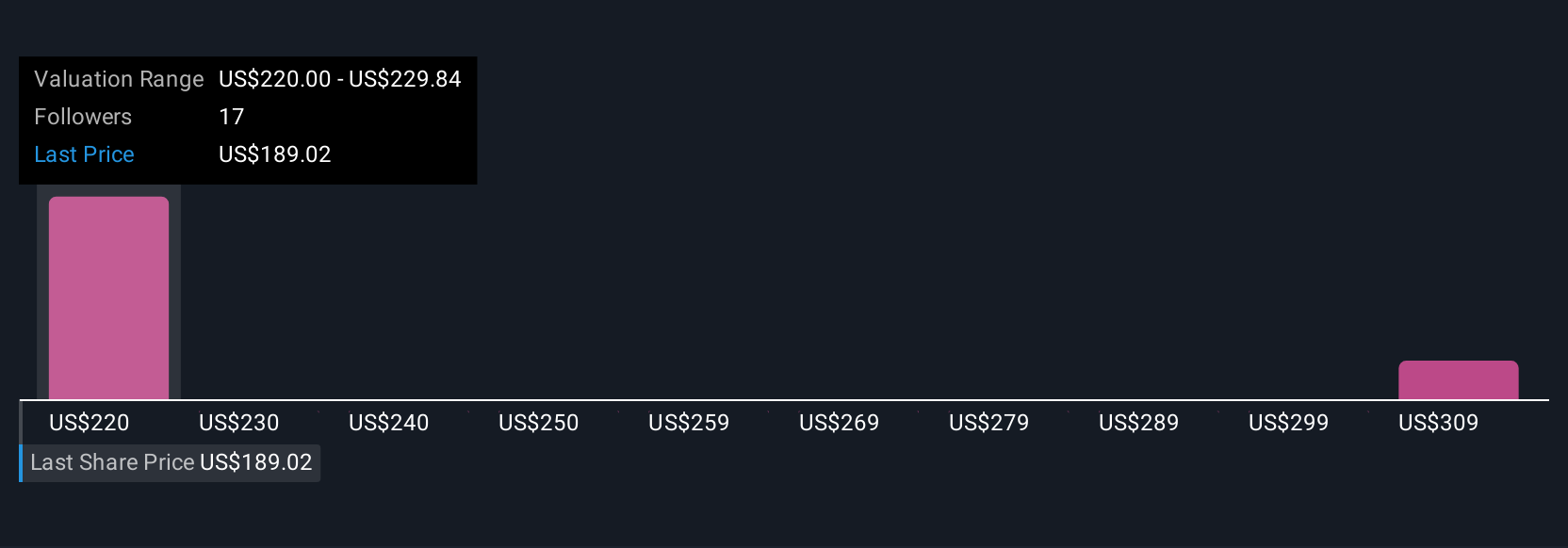

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story and thesis about a company, the reasons behind your expectations for its future revenue, profit margins, growth, and ultimately, its Fair Value estimate. Narratives link your perspective on what drives a business to a concrete financial forecast and then to a calculated Fair Value, helping you move from gut feeling to structured investing.

Narratives are designed to be simple and accessible, available right on the Community page of Simply Wall St where millions of investors share their views. By building or selecting a Narrative, you get to compare your personalized Fair Value for AvalonBay Communities directly against the current share price. This makes it much easier to decide when to buy or sell based on your own assumptions, not just consensus forecasts.

What makes Narratives even more powerful is that they update automatically as new information, such as the latest earnings or breaking news, becomes available. For example, some investors are optimistic, believing AvalonBay’s strong development pipeline and high demand will justify a target closer to $249 per share. Others take a more cautious view, estimating just $199 per share due to market risks and margin pressures.

Do you think there's more to the story for AvalonBay Communities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVB

AvalonBay Communities

A member of the S&P 500, is an equity REIT that develops, redevelops, acquires and manages apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives