- United States

- /

- Residential REITs

- /

- NYSE:AVB

Can AvalonBay’s (AVB) Rising Costs Reshape Its Approach to Sustainable Income Growth?

Reviewed by Simply Wall St

- AvalonBay Communities recently announced mixed second-quarter results, with same-store residential revenue rising 3% but expenses outpacing income, resulting in only modest year-over-year net operating income growth.

- While core funds from operations per share exceeded analyst expectations, total revenues slightly underperformed, highlighting an ongoing challenge between revenue generation and cost control in the current market environment.

- We’ll explore how these rising expenses and modest income growth are influencing AvalonBay’s investment thesis and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AvalonBay Communities Investment Narrative Recap

To be a shareholder in AvalonBay Communities, you need conviction that long-term apartment demand and barriers to new supply will support steady rent growth, despite economic and regulatory uncertainties in key coastal markets. The latest quarterly results, while revealing higher expenses and only modest net operating income gains, do not materially disrupt the most important catalyst, resilient rental demand driven by housing undersupply, or shift the biggest risk, which remains exposure to shifting job growth and local policy headwinds.

Among recent announcements, management’s decision to revise full-year earnings guidance downward following the Q2 update is most relevant. This adjustment highlights the company’s response to ongoing cost pressures and muted income growth, reinforcing how near-term headwinds could persist even with positive fundamental demand drivers.

Yet, with costs outpacing revenues in some regions, one risk investors should not overlook is the...

Read the full narrative on AvalonBay Communities (it's free!)

AvalonBay Communities is projected to reach $3.5 billion in revenue and $914.8 million in earnings by 2028. This outlook is built on an expected annual revenue growth rate of 5.5%, but earnings are forecast to decrease by about $285 million from current earnings of $1.2 billion.

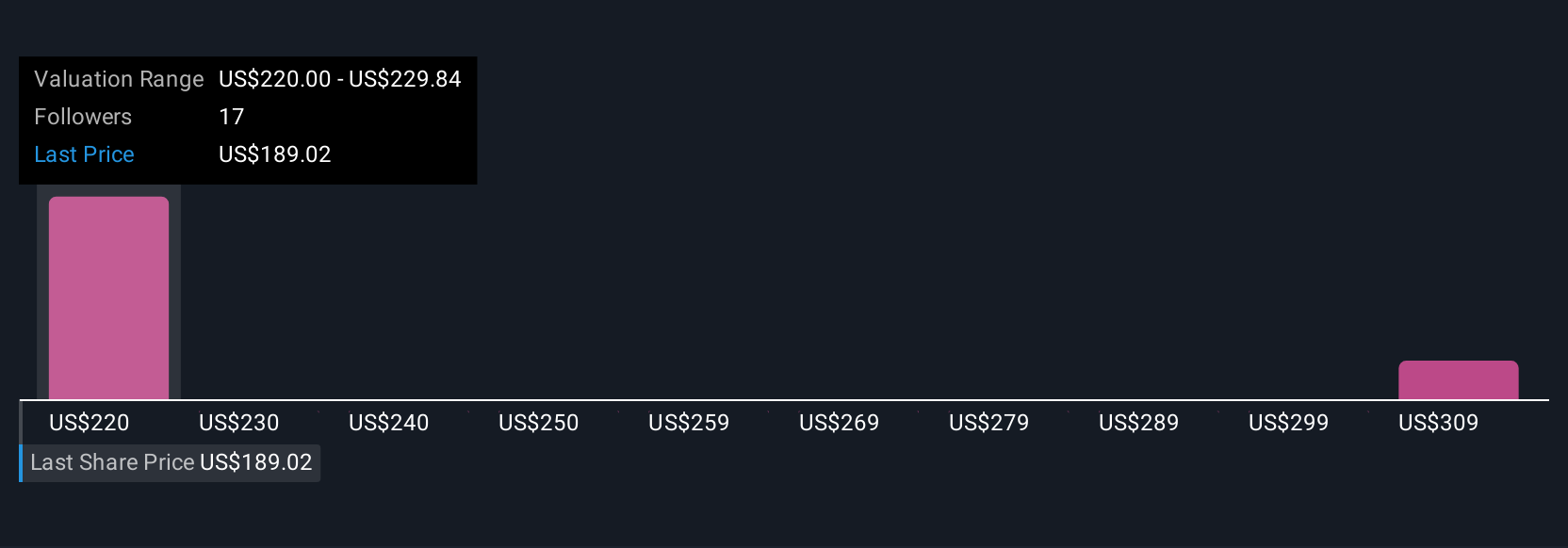

Uncover how AvalonBay Communities' forecasts yield a $220.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate AvalonBay’s fair value between US$220 and US$318, with broad variation at the upper end. Persistent regulatory risks affecting costs and margins could weigh on returns, so it pays to compare several perspectives on the company’s future direction.

Explore 3 other fair value estimates on AvalonBay Communities - why the stock might be worth just $220.00!

Build Your Own AvalonBay Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AvalonBay Communities research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AvalonBay Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AvalonBay Communities' overall financial health at a glance.

No Opportunity In AvalonBay Communities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVB

AvalonBay Communities

A member of the S&P 500, is an equity REIT that develops, redevelops, acquires and manages apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives