- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Is Alexandria Real Estate Equities Due for a Rebound After Its 23% Share Price Drop?

Reviewed by Bailey Pemberton

If you have been eyeing Alexandria Real Estate Equities lately, you are not alone. Many investors are wondering if now is the right moment to buy or hold. Despite a rocky ride over the last few years, there are some intriguing signals beneath the surface that set this stock up for a fresh look. Alexandria’s share price may be down 22.9% over the past year and 38.6% over a five-year period, but these declines might not tell the whole story. The market has been rethinking how it values life science real estate, leading to shifting risk perceptions and, consequently, sharper moves in the stock.

Short-term, the picture has steadied out: a modest decline of just 0.5% over the last seven days and a recent 3.4% gain for the past month suggest that sentiment could be turning a corner. While longer-term returns remain firmly in the red, some clever investors see these depressed prices as a potential springboard for future upside if fundamentals hold up.

One of the most compelling reasons to pay attention to Alexandria right now is its current valuation score. Out of six valuation tests, Alexandria came up undervalued in five, giving it an impressive value score of 5. In other words, this stock is checking nearly every box when it comes to value investing criteria.

So, how are these different valuation approaches stacking up and is the crowd missing something? Let’s break down what the individual methods are showing about Alexandria’s worth. Be sure to stick around, because we will also explore a more insightful approach for judging value by the end of this article.

Why Alexandria Real Estate Equities is lagging behind its peers

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

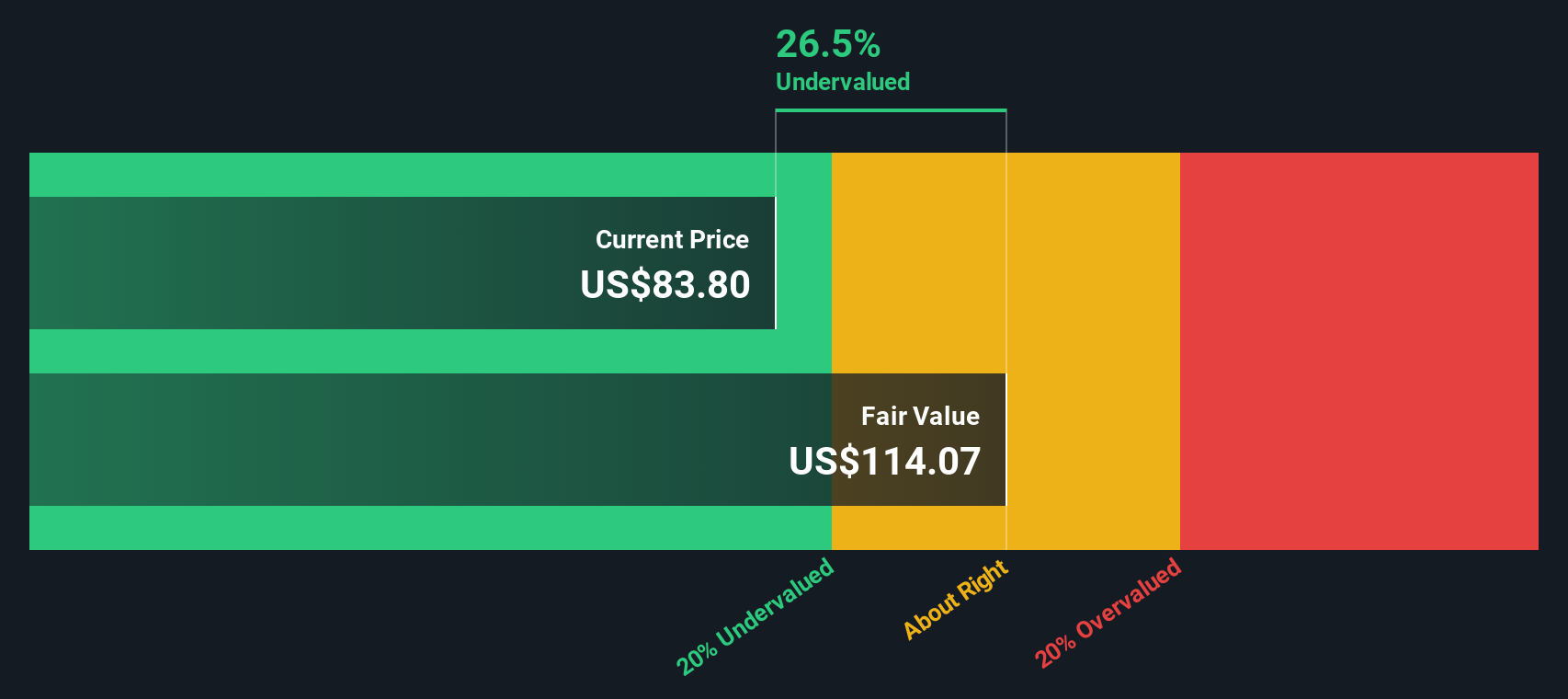

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting the cash it is expected to generate in the future and discounting that back to today’s value. In Alexandria’s case, this model uses adjusted funds from operations to forecast future cash flows and determine what the company is really worth right now.

Currently, Alexandria’s last twelve months’ free cash flow stands at $1.63 billion. Analyst estimates extend several years into the future, expecting annual free cash flow to gradually rise and reach about $1.23 billion by 2028. While only five years of direct analyst coverage exist, projections beyond that are extrapolated to predict cash flow nearly a decade out. The model factors in these rising yearly figures and brings them back to present dollars using an appropriate discount rate.

According to this approach, Alexandria’s estimated fair value per share is $113.74. This puts the stock at roughly 26.4% below its intrinsic value based on these future cash flows, suggesting the current market price may not accurately reflect the company’s earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 26.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alexandria Real Estate Equities Price vs Sales

For companies like Alexandria Real Estate Equities that have variable earnings or where profitability is nuanced, the Price-to-Sales (P/S) ratio is often the preferred valuation metric. This ratio is especially useful in industries such as real estate investment trusts, where revenues are steady and significant, but profits can fluctuate due to non-cash accounting or large, lumpy expenses.

The typical “fair” P/S ratio for a company takes growth expectations and risk into account. A higher expected growth rate or lower risk justifies a richer P/S multiple, while slower growth or higher risk usually results in a lower one. Using this lens helps investors gauge whether the market is valuing future potential correctly.

Currently, Alexandria trades at a P/S ratio of 4.67x. For context, the Health Care REITs industry sports an average P/S of 6.24x, and key peers average around 5.99x. However, a simple peer comparison can be misleading, as it does not factor in the unique characteristics of Alexandria’s business.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric estimates the suitable multiple for Alexandria by accounting for its earnings growth, industry trends, profit margins, risks, and market cap. Alexandria’s Fair Ratio is 5.81x, slightly higher than its current P/S. This suggests that, accounting for the company’s specifics, the stock may be undervalued on this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

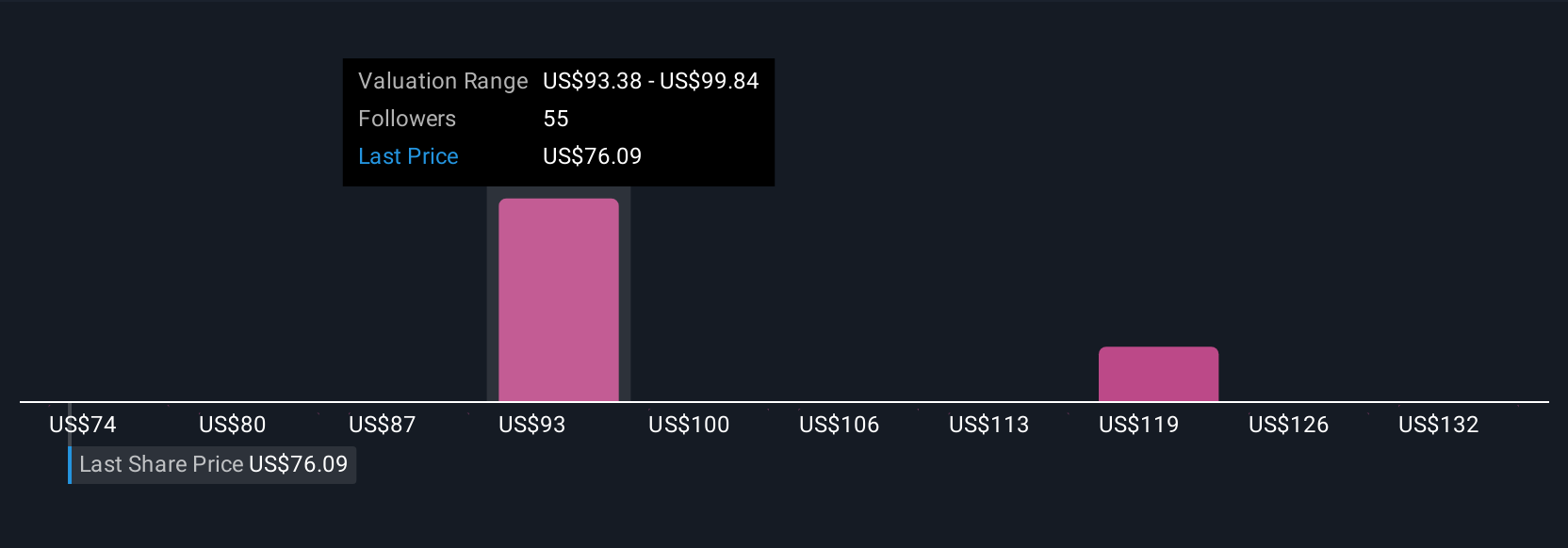

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple but powerful tool that allows you to connect your story or perspective on Alexandria Real Estate Equities directly with the numbers, such as your own assumptions about future revenues, earnings, and margins, to create your personal fair value estimate.

Instead of just relying on traditional metrics, Narratives take what you believe about a company and turn it into a financial forecast, which can then be compared with today’s share price. This means your investment decisions are shaped not just by raw data, but by the story and reasoning behind it, reflecting how you think the business will play out.

On Simply Wall St's Community page, millions of investors are using Narratives to make smarter, more confident buy or sell decisions by comparing Fair Value to the current Price. Narratives update automatically as new information like news or earnings is released, so your view always reflects the latest data.

For Alexandria, one investor might build a bullish narrative based on rising healthcare demand and price the shares at $144, while another might take a cautious stance on market headwinds and see a fair value closer to $71.

Do you think there's more to the story for Alexandria Real Estate Equities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives