- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Is Alexandria Real Estate Equities Attractive After Recent 20% Price Drop?

Reviewed by Bailey Pemberton

If you’ve ever wondered whether it’s time to buy, hold, or sidestep Alexandria Real Estate Equities, you’re not alone. Investors everywhere have been watching its stock price swing lately, and the conversation around this company is getting louder. In the past week, shares ticked up by 2.0%, a modest shift that comes after a much steeper 9.5% drop in the last month and a year-to-date slide of over 20%. Looking further back, the five-year chart shows a stark 37.7% decline. This suggests to investors that this isn’t just about temporary volatility; something deeper is at play.

What’s fueling these moves? In recent months, attention has turned to Alexandria’s strategic development pipeline and its ability to adapt properties for life sciences tenants, a promising growth sector. This optimism has been tempered by marketwide anxiety about the future of commercial real estate and rising costs, all of which has shaped perceptions of the company’s risk and potential rewards.

With the recent news swirling, valuation has become the big question. Is Alexandria Real Estate Equities too cheap to ignore, or does its battered price reflect deeper concerns? According to our analysis, the company scores a 5 out of 6 on key undervaluation checks, suggesting a compelling investment case in several respects. However, before you rush to any decision, let’s break down these valuation metrics. Later in the article, we'll explore an even more insightful way to value this stock than conventional measures alone.

Why Alexandria Real Estate Equities is lagging behind its peers

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows, then discounting those future dollars back to their present value. For Alexandria Real Estate Equities, the DCF approach relies on adjusted funds from operations, which is a crucial measure in real estate investment trusts.

Currently, Alexandria’s Free Cash Flow stands at $1.63 Billion. Analyst estimates predict that free cash flow will trend fairly stable over the next few years, with Simply Wall St extrapolating out to 2035. By 2028, free cash flow is projected to be around $1.22 Billion, and the ten-year outlook suggests a gentle increase year over year. This cautious optimism is tempered by the broader risks in commercial real estate, but the model reflects steady operational performance over time.

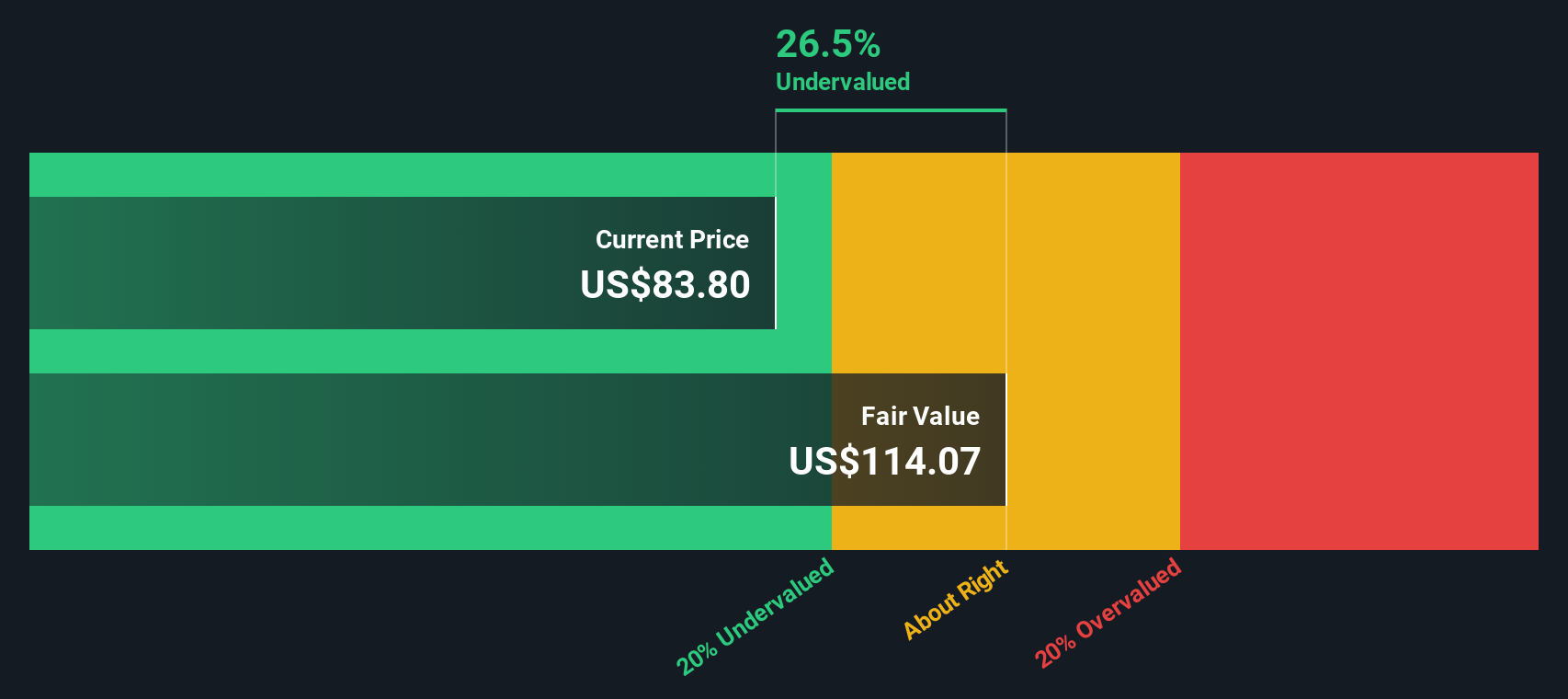

The DCF analysis calculates an intrinsic value of $110.04 per share. Based on the current share price, this implies the stock is trading at a 29.3% discount to its fair value, which signals significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 29.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alexandria Real Estate Equities Price vs Sales

The price-to-sales (P/S) ratio is a particularly relevant metric for companies like Alexandria Real Estate Equities that generate stable, recurring revenue streams, even when profits can be lumpy due to real estate cycles or accounting quirks. Using P/S helps investors gauge how much the market is paying for each dollar of the company's sales. This is especially useful in sectors where earnings may be temporarily suppressed but underlying assets and tenant revenues remain strong.

Growth expectations and risk play a crucial role in what constitutes a “normal” or “fair” P/S ratio. Higher growth prospects and greater stability usually support higher multiples, while greater risks or slow growth will drag those multiples down. With Alexandria, it is important to assess both its growth runway in the life sciences property sector and its exposure to the broader challenges facing commercial real estate.

Alexandria’s current P/S ratio stands at 4.34x. This is notably lower than both the average for Health Care REITs in the industry (6.24x) and the peer group average (5.81x). However, instead of just relying on comparisons to these benchmarks, we also consider Simply Wall St’s proprietary “Fair Ratio,” which is calculated to be 5.67x. The Fair Ratio factors in real company-specific drivers like growth, risk, margins, industry, and market cap, giving a more nuanced target multiple than plain peer or sector averages can offer.

Comparing Alexandria’s actual P/S of 4.34x with its Fair Ratio of 5.67x, the stock appears to be undervalued based on this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

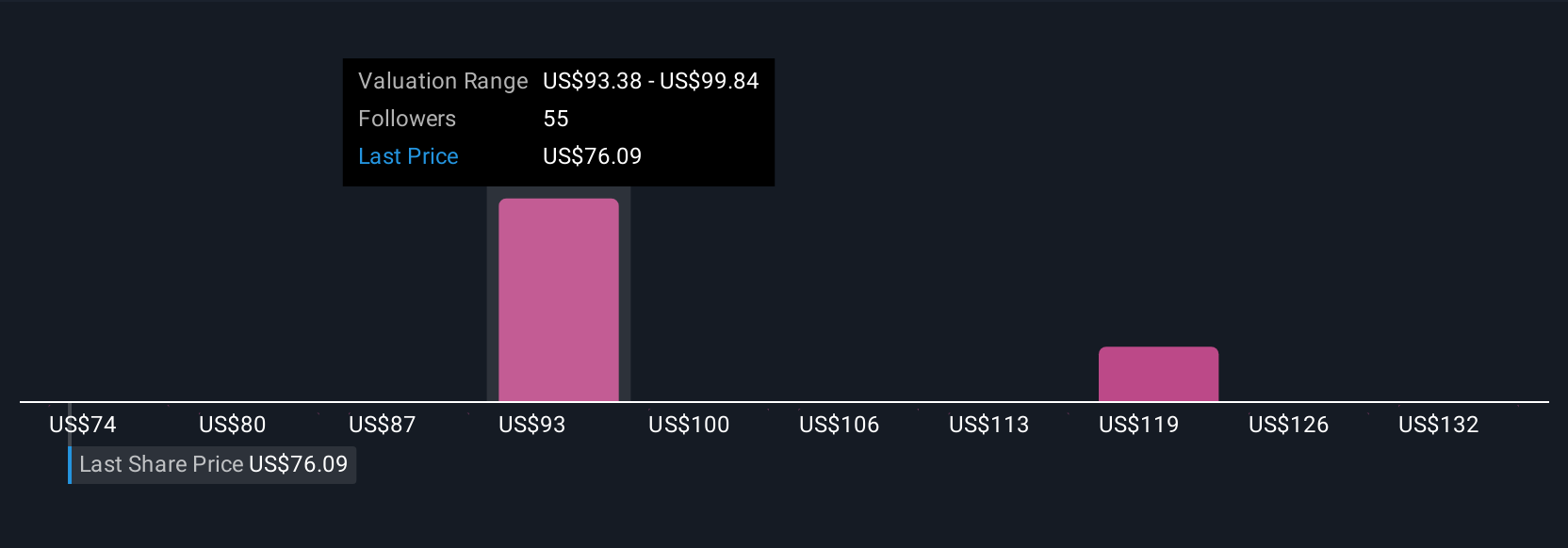

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you lay out your unique story about a company, describing what you believe about its business, future revenue, earnings, and margins. This approach then directly links these assumptions to a financial forecast and an estimated fair value. Available on Simply Wall St’s Community page and used by millions of investors, Narratives make investing more insightful by helping you clearly connect your outlook with the numbers.

With Narratives, you can compare your own fair value estimate to the current stock price to help you decide if it’s time to buy, hold, or sell. Unlike static models, Narratives update instantly as new information or news is released, keeping your view current and responsive. For example, with Alexandria Real Estate Equities, one investor might highlight strong demand and assign a bullish fair value of $144, while another might focus on industry headwinds and see a fair value of just $71. By building and sharing your own Narrative, you can confidently make investment decisions that match your beliefs and keep pace with the market.

Do you think there's more to the story for Alexandria Real Estate Equities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives