- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Could a Lawsuit Over LIC Disclosures Test Alexandria (ARE) Management's Credibility With Investors?

Reviewed by Sasha Jovanovic

- Earlier this week, Levi & Korsinsky, LLP announced it has filed a lawsuit on behalf of investors in Alexandria Real Estate Equities, Inc., alleging the company misrepresented information related to the performance and outlook of its LIC property. The complaint claims that Alexandria's optimistic statements about leasing and occupancy may have presented a misleading picture of its long-term prospects in a key development area.

- This shareholder lawsuit brings attention to the transparency of Alexandria's property disclosures and raises questions about the reliability of its communications to investors.

- We'll examine how the allegations of misrepresentation around the LIC property could influence Alexandria's investment narrative and forecasted growth trajectory.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Alexandria Real Estate Equities Investment Narrative Recap

To be a shareholder in Alexandria Real Estate Equities, one generally has to believe in the long-term, resilient demand for specialized life science real estate within high-barrier-to-entry markets. The recent lawsuit over alleged misrepresentations related to the LIC property doesn’t appear to materially alter the primary short-term catalyst, successfully leasing premium assets in core clusters, but it does bring regulatory and reputational risks to the forefront in the near term.

The company’s most recent Q3 2025 earnings announcement is directly relevant given its discussion of property impairments and lowered guidance, both of which offer context for the lawsuit’s focus on asset valuations and leasing performance. For investors, the combination of legal scrutiny and reduced financial outlook means tracking both disclosures and fundamentals will be critical to understanding potential headwinds or inflection points.

In contrast, while the company’s development pipeline and cluster strategy remain long-term drivers, investors should be aware of...

Read the full narrative on Alexandria Real Estate Equities (it's free!)

Alexandria Real Estate Equities' outlook anticipates $3.2 billion in revenue and $288.1 million in earnings by 2028. This reflects a -0.7% annual revenue decline and an increase in earnings of $309.6 million from the current level of -$21.5 million.

Uncover how Alexandria Real Estate Equities' forecasts yield a $68.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

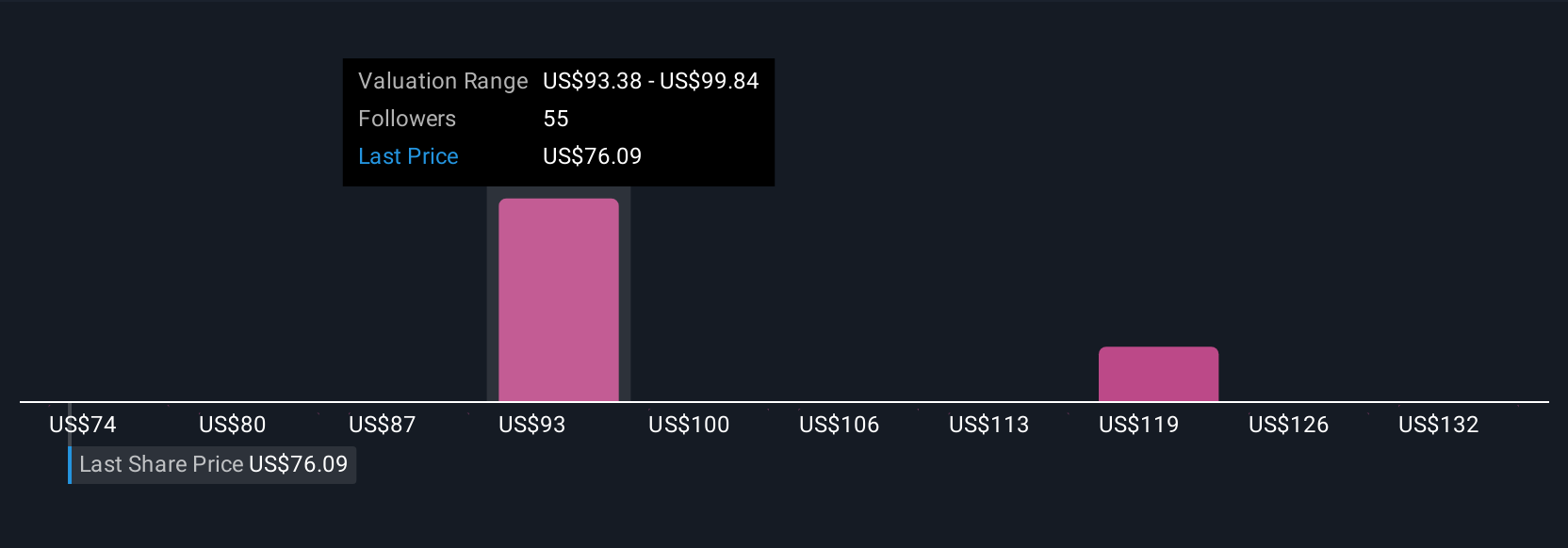

Simply Wall St Community estimates for Alexandria's fair value span from US$68.50 to US$136.20 across nine sources. These diverse individual perspectives highlight the importance of considering transparent disclosure practices, especially as legal and governance risks can shape confidence and future performance expectations.

Explore 9 other fair value estimates on Alexandria Real Estate Equities - why the stock might be worth just $68.50!

Build Your Own Alexandria Real Estate Equities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alexandria Real Estate Equities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexandria Real Estate Equities' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.